Despite the hurdles in Trump’s plans to repeal and replace Obamacare, healthcare is the second best performing sector this year lagging technology. The optimism comes especially from encouraging industry trends and hopes of a favorable policy environment.

The Trump administration plans to focus on easing regulatory hurdles rather than lowering drug prices, and expedite new drug approvals. Additionally, the shift in investors’ sentiment to defensive sectors like healthcare, which generally outperform during periods of low-to-moderate growth and rising geopolitical uncertainty, has led to a rally in healthcare stocks (read: Top Ranked Healthcare ETFs for Long Term Investors).

As such, popular funds – Health Care Select Sector SPDR Fund XLV, Vanguard Health Care ETF (AX:VHT) , iShares U.S. Healthcare ETF IYH and Fidelity MSCI Health Care Index ETF FHLC – have gained at least 18% so far this year. The trend is likely to continue heading into the Q2 earnings season as some big names like Pfizer (NYSE:PFE) , Merck (NYSE:MRK) , Amgen (NASDAQ:AMGN) , AbbVie (NYSE:ABBV) , Gilead Sciences (NASDAQ:GILD) and Bristol-Myers Squibb (NYSE:BMY) are lined up to report this week and in the next. All these stocks collectively account for 26.3% share in XLV, 25.2% in IYH, 22.8% in VHT and 22.5% in FHLC.

Let’s dig deeper into the earnings picture of these companies that would drive the performance of the above-mentioned funds in the coming days:

According to the our methodology, a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) when combined with a positive Earnings ESP increases our chances of predicting an earnings beat, while a Zacks Rank #4 or 5 (Sell rated) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Inside Our Surprise Prediction of These Stocks

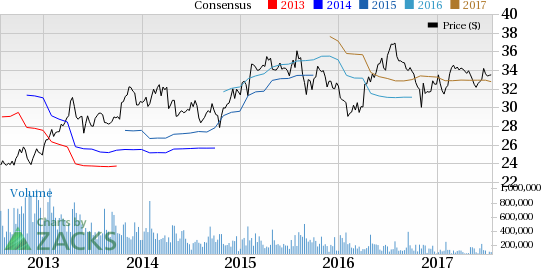

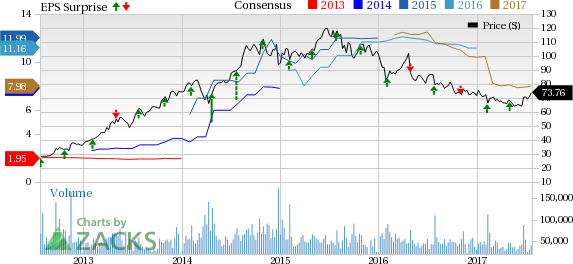

Pfizer has a Zacks Rank #3 and an Earnings ESP of +1.54%, indicating a reasonable chance of beating estimates this quarter. The stock saw no earnings estimate revision for the yet-to-be-reported quarter and delivered negative earnings surprise of 0.35% over the past four quarters. Additionally, it has an impressive Growth and Momentum Style Score of C and F, respectively, though a Value Style Score of B is favorable. Pfizer is scheduled to report earnings on August 1 before the opening bell (read: How to Build a Winning ETF Portfolio for Second-Half 2017).

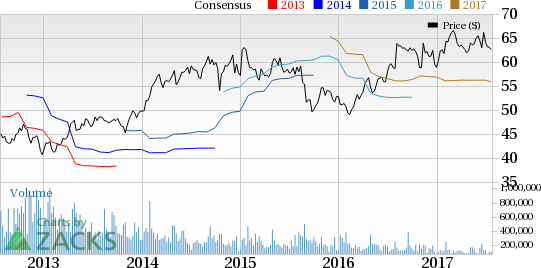

Merck is expected to report results on July 28 before the market opens. It has a Zacks Rank #2 and an Earnings ESP of 0.00%, which makes surprise prediction difficult. The stock witnessed a positive earnings estimate revision of a penny over the past 90 days for the to-be-reported quarter and delivered positive earnings surprises in the last four quarters, with an average beat of 4.36%. Merck has a strong Value and Momentum Style Score of B each and an unfavorable Growth Style Score of D.

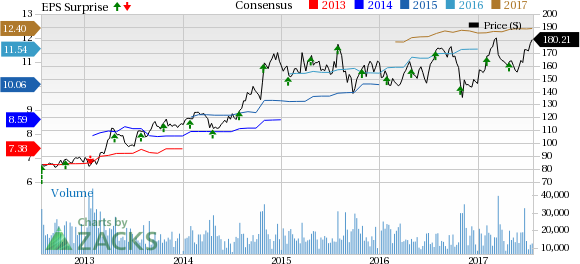

Amgen has a Zacks Rank #3 and an Earnings ESP of -0.32%, indicating less chances of beating estimates this quarter. Though the earnings surprise track over the past four quarters is robust with an average positive surprise of 5.31%, Amgen witnessed negative earnings estimate revision of a couple of cents over the past 90 days for the yet-to-be-reported quarter. The stock has a solid Value and Momentum Style Score of B and A, respectively, but the Growth Style Score of C looks dull. Amgen will report earnings on July 25 after market close.

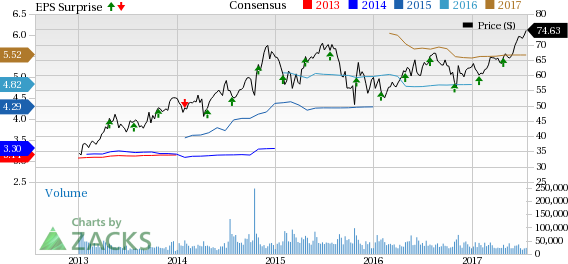

AbbVie has a Zacks Rank #3 and an Earnings ESP of -0.71%, indicating less chance of beating estimates this quarter. The company delivered positive earnings surprises in the last four quarters, with an average beat of 1.65% and saw positive earnings estimate revision by a couple of cents over the past three months for the to-be-reported quarter. The stock has a solid Value Style Score of B while the Growth and Momentum Style Score of C and F, respectively, is unimpressive. The company is scheduled to report on July 28 before the opening bell (read: J&J Brightens Outlook: Healthcare ETFs in Focus).

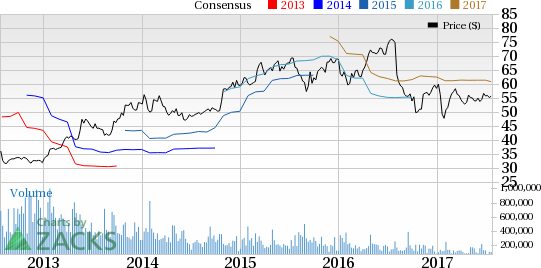

Gilead is expected to release earnings on July 26 after market close. It has a Zacks Rank #3 and an Earnings ESP of +3.32%, indicating reasonable chance of beating estimates. Gilead delivered positive earnings surprises in three of the last four quarters, with an average beat of 3.52% but saw no earnings estimate revision over the past three months for the to-be-reported quarter. Though it has a solid Value and Momentum Style Score of A and B, respectively, the Growth Style Score of F looks ugly.

Bristol-Myers will likely report earnings on July 27 before the opening bell. It has a Zacks Rank #3 and an Earnings ESP of 0.00%, which makes surprise prediction difficult. The stock delivered positive earnings surprises in three of the past four quarters with an average beat of 8.39% and witnessed positive earnings estimate revision of three cents for the to-be-reported quarter. It has an unfavorable Value, Growth and Momentum Style Score of C, C, and F respectively (see: all the Healthcare ETFs here).

Summing Up

Though the healthcare sector is expected to post an earnings decline of 0.1% in the second quarter and has a dismal Zacks Rank in the bottom 31%, some surprises may well be in the cards, suggesting upside for healthcare ETFs. In particular, XLV, VHT and IYH have a Zacks ETF Rank #1 while FHLC has a Zacks ETF Rank #3.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Pfizer, Inc. (PFE): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

SPDR-HLTH CR (XLV): ETF Research Reports

VIPERS-HLTH CR (VHT): ETF Research Reports

ISHARS-US HLTHC (IYH): ETF Research Reports

FID-H CARE (FHLC): ETF Research Reports

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post