Surmodics, Inc. (NASDAQ:SRDX) reported earnings of 9 cents per share in third-quarter fiscal 2017, much lower than the year-ago figure of 37 cents. The Zacks Consensus Estimate for third-quarter earnings was pegged at a breakeven.

Revenues in the quarter fell 10.9% to $17.8 million. However, revenues surpassed the Zacks Consensus Estimate of $16 million. Excluding hydrophilic royalty catch-up payments, revenues rose 2.5% on a year-over-year basis.

The stock has a Zacks Rank #3 (Hold).

Segment Analysis

Surmodics reports revenues under two segments – Medical Device and In Vitro Diagnostics (IVD).

Medical Device: In the reported quarter, sales declined 18.4% to $12.8 million due to lower hydrophilic royalty revenues. Royalty and license fee revenues at the segment totaled $7.2 million, down by $3.3 million on a year-over-year basis.

Third-quarter operating income at the segment was $1.4 million, significantly lower than $6.7 million in the year-ago quarter. The year-over-year decline is attributable to increased investments related to whole-products strategy and reduced royalty revenues.

IVD: In the quarter under review, sales increased 16.1% to $5 million. The upside came from strong growth and stabilization across BioFX, microarray and antigen product sales.

Third-quarter operating income at the segment was $2.2 million, relatively higher than $1.7 million reported in the year-ago quarter. This resulted in an improved operating margin at the segment (up 570 basis points), courtesy of favorable product mix and solid operating leverage from higher revenues.

Q3 Highlights

SurVeil DCB Pivotal Study: Surmodics received IDE approval from the FDA for its TRANSCEND SurVeil DCB pivotal study. The company is expected to begin enrollment in the platform by the end of fiscal 2017. SurVeil is a paclitaxel drug-coated balloon which is used for the treatment of femoral-popliteal disease. The study is formulated to enroll approximately 446 patients at almost 60 clinical sites in the U.S. and European Union.

For-ex Woes: In the third quarter, the U.S. dollar continued to weaken as compared to the euro and the company suffered loss in its euro-denominated contingent considerations. Surmodics realized a solid $0.6 million in foreign-exchange loss related to the Creagh Medical acquisition.

Margin Details: Product gross margins expanded 200 basis points (bps) to 65% of product sales, as compared with 63% in the prior-year quarter. The year-over-year margin expansion was primarily buoyed by manufacturing leverage and favorable sales mix.

R&D expenses in the third quarter were 44.6% of net revenues, compared to 23.5% in the year-ago quarter. Surmodics expects expenses on R&D to rise on a year-over-year basis, thanks to its whole-product solutions strategy and the new SurVeil drug-coated balloon human clinical trials.

SG&A expenses in the third quarter of fiscal 2017 accounted for 29.4% of net revenues, higher than 22.4% in the year-ago period.

Balance Sheet and Cash Flow: At the end of the third quarter, the company had $43.7 million. Surmodics repurchased 169,868 common shares for $4 million during the reported quarter under the share repurchase program. The company invested $4.9 million in plant and equipment.

Outlook

Surmodics raised its guidance for fiscal 2017 revenues and earnings.

The company expects fiscal 2017 earnings per share in the range of 29 cents to 39 cents, as compared to the prior guidance of 15 cents to 25 cents. Meanwhile, revenues are projected in the range of $70.0 million to $72.0 million, up from the prior range of $65.0 million to $68.0 million.

Revenues at the IVD segment are expected to grow in low single digits. Over the long term, IVD revenue growth is expected in the mid-single digits.

Surmodics anticipates R&D expenses in the band of 40% to 44% of fiscal 2017 revenues.

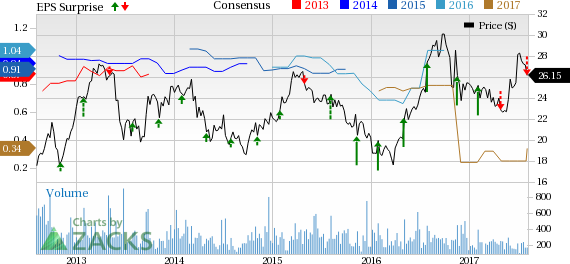

Surmodics, Inc. Price, Consensus and EPS Surprise

Our Take

Surmodics’ third-quarter fiscal 2016 results were impressive, wherein it beat the Zacks Consensus Estimate for earnings and revenues. Furthermore, an upbeat guidance raises investor confidence in the stock. The regulatory approval for SurVeil reflects Surmodics’ solid foothold in developing surface technology for muscular devices, particularly in the drug delivery space. Although Surmodics is striving to expedite its SurVeil drug-coated balloon development program, the drug coated balloon platform is in a nascent stage. On the flipside, the company expects IVD business growth in the mid-single digits, compared to double-digit gains realized in fiscal 2016 owing to anticipated top-line headwinds in the near term. Furthermore, foreign-exchange woes related to the Creagh Medical buyout is a major dampener.

Key Picks

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corporation (NYSE:EW) , Fresenius Medical Care Corporation (NYSE:FMS) and Dextera Surgical Inc. (NASDAQ:DXTR) .

Notably, Edwards Lifesciences and Fresenius Medical sport a Zacks Rank #1 (Strong Buy), while Dextera has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. Notably, the stock has a return of 5.7% over the last three months.

Fresenius Medical yielded a strong return of 10% year to date. The stock has a long-term expected earnings growth rate of 30.5%.

Dextera has a projected sales growth of 54.8% for the current year. The stock promises a long-term expected earnings growth rate of 25%.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Fresenius Medical Care Corporation (FMS): Free Stock Analysis Report

Dextera Surgical Inc. (DXTR): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Surmodics, Inc. (SRDX): Free Stock Analysis Report

Original post

Zacks Investment Research