Movements of the natural gas and oil prices during the last few weeks indicate a surge in exhaustion and increasing volatility.

The reasons are difficult to point out exactly. This might be the impact of the steep surge in energy prices this year and the central banks trying to control inflation through rapid interest rate hikes.

Since Ukrainian President Volodymyr Zelensky appealed for the restoration of peace at the G20 summit on Nov. 15, natural gas and crude oil prices have started to cool down.

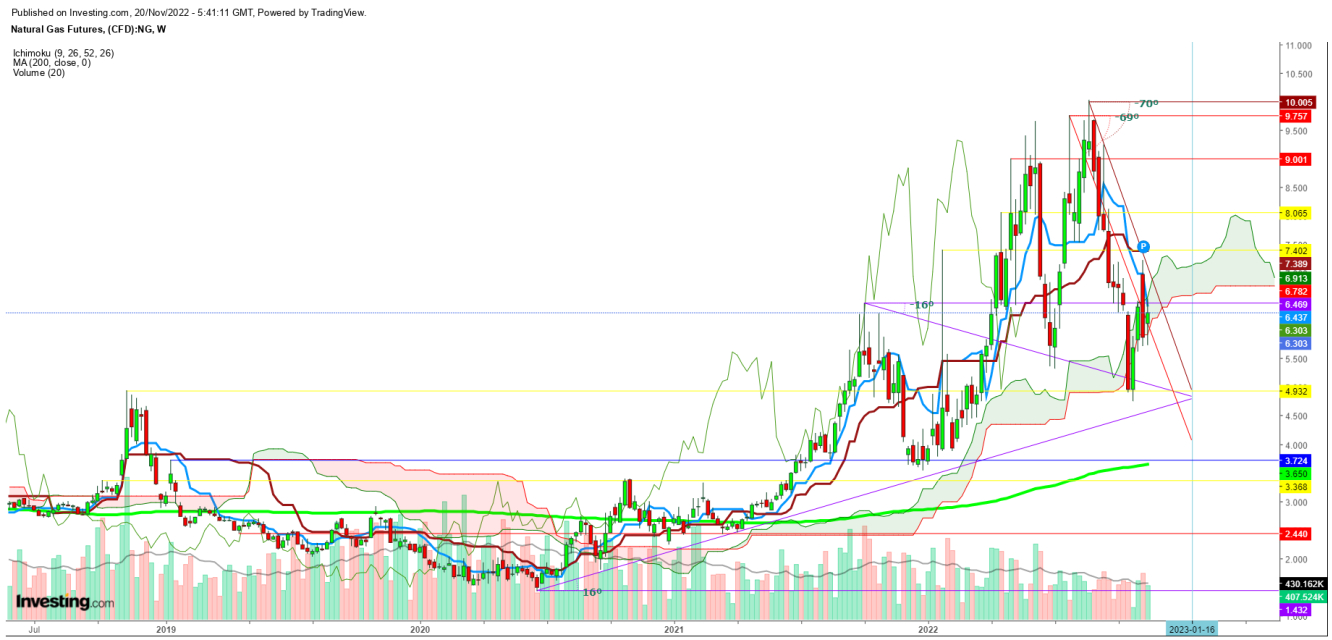

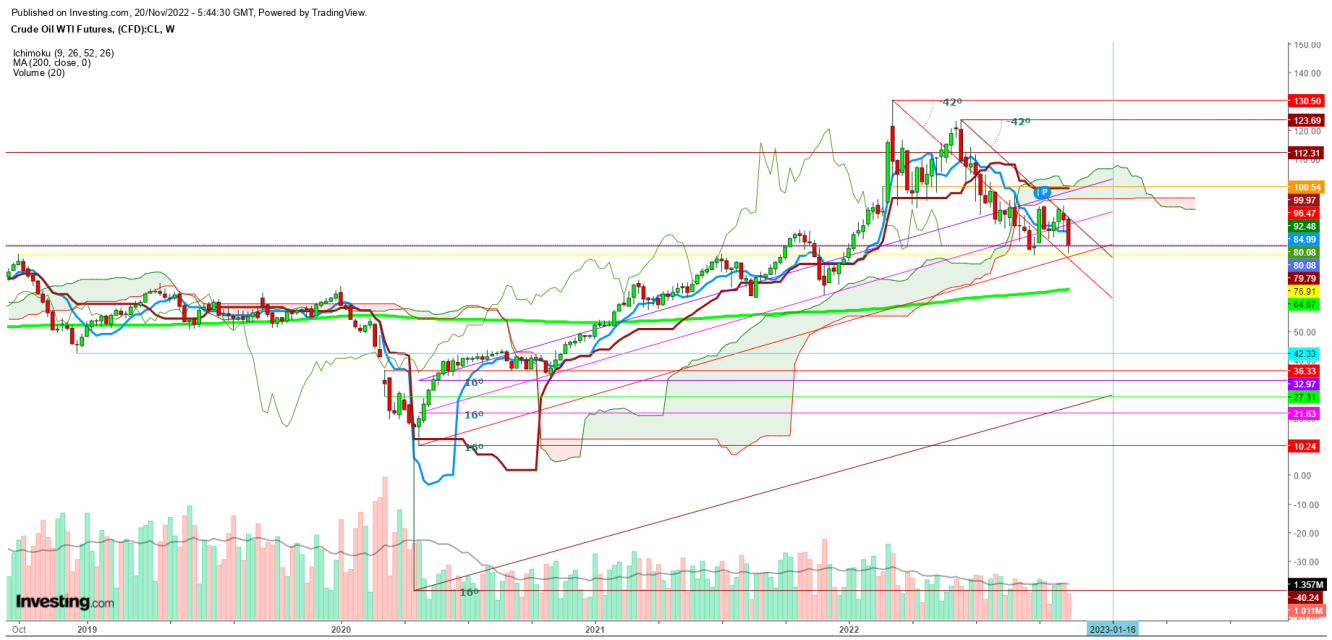

This exhaustion in the natural gas and WTI crude oil futures is visible in the weekly charts. Last week’s candle has found a breakdown below the 9 DMA, indicating the start of a possible decline till the end of the year.

Another recent development this Sunday at the COP27 climate summit was that the member countries agreed to set up a fund to help poor countries being battered by climate disasters but delayed approving a more comprehensive deal outlining global resolve to fight climate change.

This could add one more leg to the current exhaustion in energy prices during the upcoming weeks as the session approved the provision to set up a 'loss and damage' fund to help developing countries bear the immediate costs of climate-fueled events such as storms and floods.

On the other hand, movements of the U.S. dollar index indicate exhaustion during the last three weeks, as the dollar has been on the ropes since mid-October. In the December meeting, the Fed will likely insist that a pause is unlikely to come sooner rather than later, helping to stabilize the dollar.

In the weekly chart, the dollar Index futures indicate that a steep fall could continue as the inflationary pressure will likely ease with easing energy prices.

The upcoming week will define the future of energy prices as the weekly charts of the natural gas, and WTI crude oil futures have felt the impact of the ‘Bearish Crossover’ that is likely to increase exhaustion during the upcoming weeks.

Disclaimer: The author of this analysis does not have any position in Natural Gas and WTI Crude Oil. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.