Retail sales came in really strong in May, which could boost risk appetite, but a more dovish Fed should support gold.

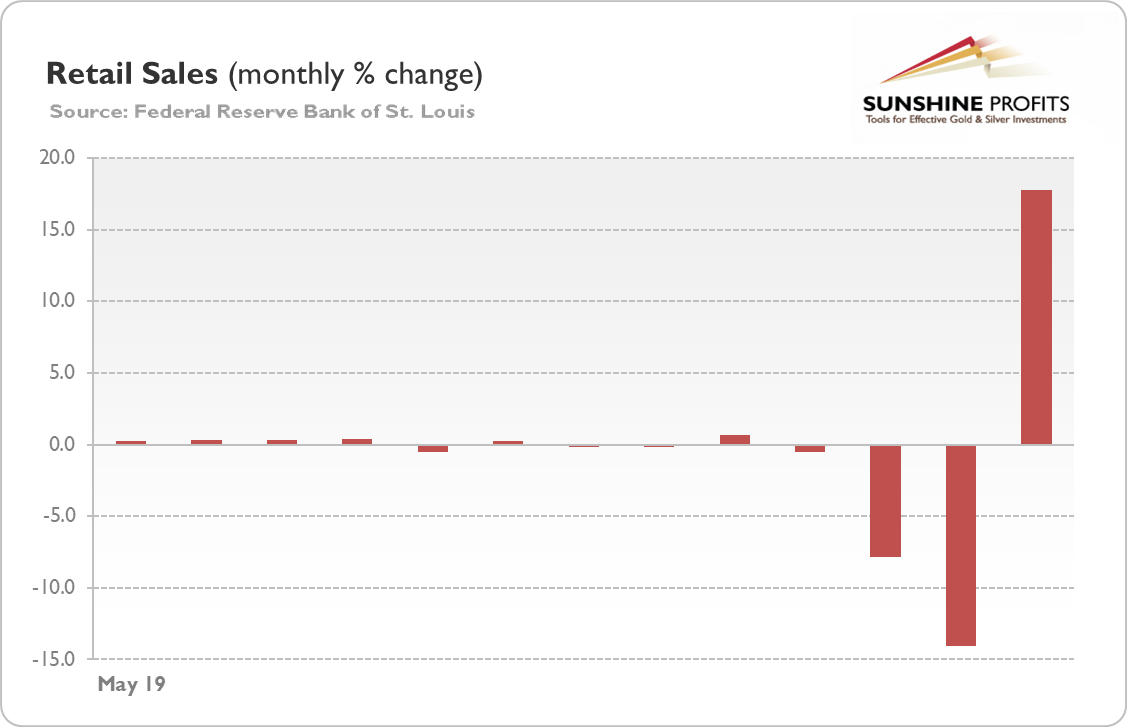

As the chart below shows, retail sales surged 17.7 percent in May, as the US economy started to reopen. The number was a record high and above expectations, triggering optimism in the marketplace.

However, sales were still 6 percent lower than a year ago, which means the coronavirus crisis has not ended yet. But such reports may, nevertheless, increase the risk appetite among investors at the expense of gold and other safe-havens.

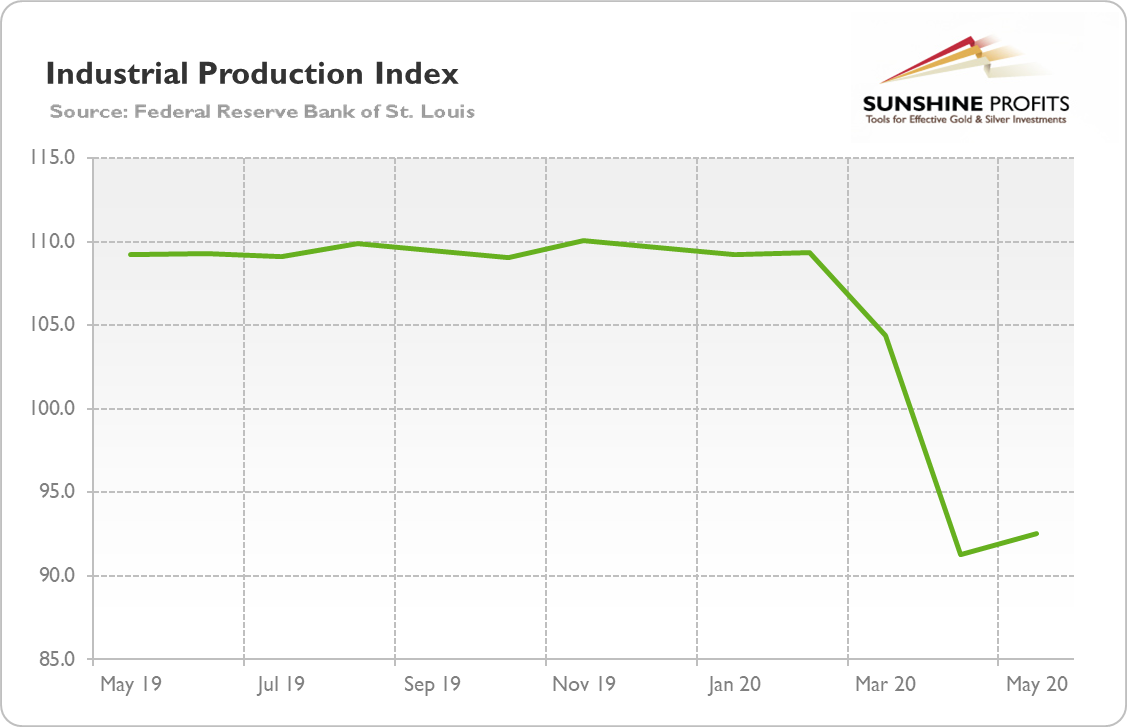

Another sign that the US economy began to revive in May, was the increase in industrial production by 1.4 percent, as many factories resumed operations. However, the number came below expectations, and industrial output is still 15.4 percent below pre-pandemic levels.

Powell's Testimony and Gold

On Tuesday, Fed Chairman Jerome Powell testified before the Senate Banking Committee. His prepared remarks were not much different from those in the press conference after the June FOMC meeting. Powell reiterated his cautious view about the economic outlook and that he does not expect a V-shaped recovery.

The levels of output and employment remain far below their pre-pandemic levels, and significant uncertainty remains about the timing and strength of the recovery. Much of that economic uncertainty comes from a lack of clarity about the path of the disease and the effects of measures to contain it. Until the public is confident that the disease is contained, a full recovery is unlikely. Moreover, the longer the downturn lasts, the greater the potential for longer-term damage from permanent job loss and business closures.

Therefore, according to Powell, investors should not overreact to surprisingly good economic data such as the May nonfarm payrolls or retail sales report. He said that the economy would go through three stages: economic shutdown, the bounce-back as people return to work and the economy "well short" of the pre-pandemic level in February. In other words, we are at the beginning of rebound, and many economic reports may be very positive, but it should not be actually surprising as they are coming off extremely low levels. What is crucial here is how will the economy evolve later.

The new thing Powell said was admission that the latest Fed's dot-plot does not factor in a potential second wave of coronavirus infections later this year, which is rather concerning. When asked by Senator Krysten Sinema whether "Does this projection assume a potential second wave of coronavirus and the accompanying economic impacts?", Powell replied:

"I would think the answer to your question, though, largely will be that ... my colleagues will not principally have assumed that there will be a substantial second wave."

It means that the potential resurgence of coronavirus in the second half of the year would alter the Fed's stance into being even more dovish, which could be positive for gold prices.

Implications for Gold

In his testimony, Powell reemphasized that the Fed will be very accommodative for a long period of time, potentially turning even more dovish if a second wave of infections occurs. The US central bank is not concerned about inflation, but about lack of growth and the high unemployment rate. Although upcoming economic data could be very positive, as it will compare to a very low base, investors should not overreact and remember that there is still long way to recovery.

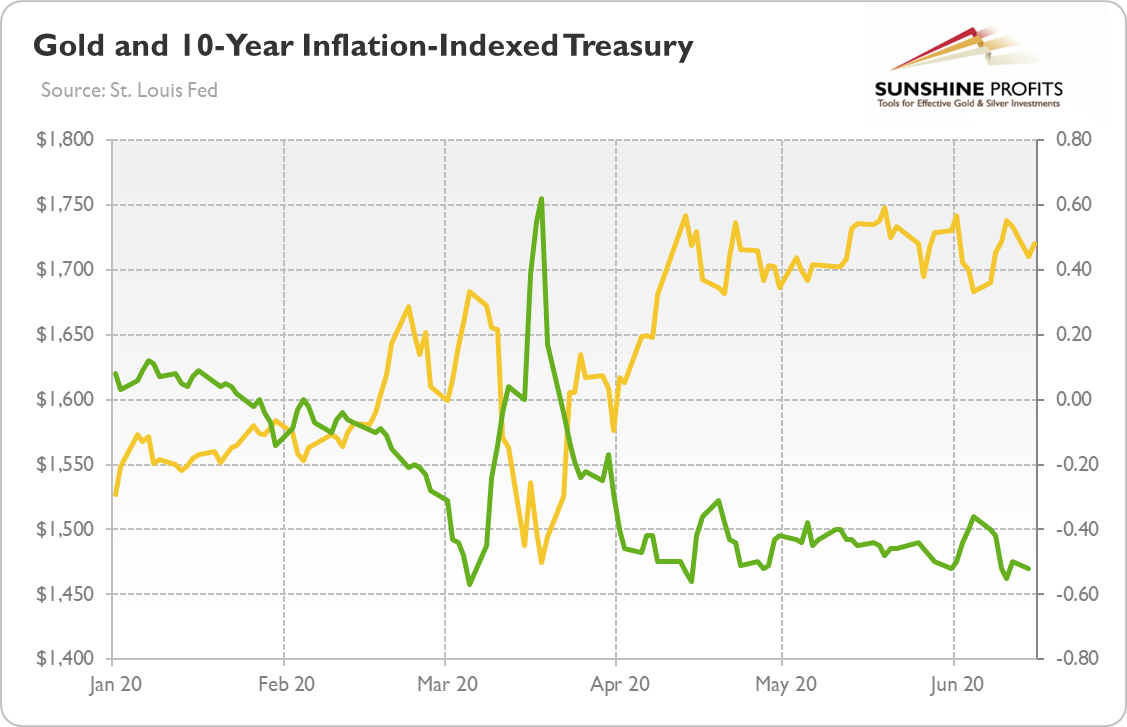

This is what they should do, but don't do. The market is ignoring bad news and focusing on the positives. After all, things turned out to be not so apocalyptic as the initial March assessment suggested. Moreover, interest rates and bond yields are ultra-low, while the Fed stands ready to intervene, which increases market confidence. The optimism among investors is a bad things for gold prices, but negative real interest rates and a very accommodative central bank should prove supportive, as the chart below shows.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.