KVH Industries, Inc. (NASDAQ:KVHI) , which designs, develops, manufactures, and markets mobile connectivity products and services, could be an interesting play for investors. That is because, not only does the stock have decent short-term momentum, but it is seeing solid activity on the earnings estimate revision front as well.

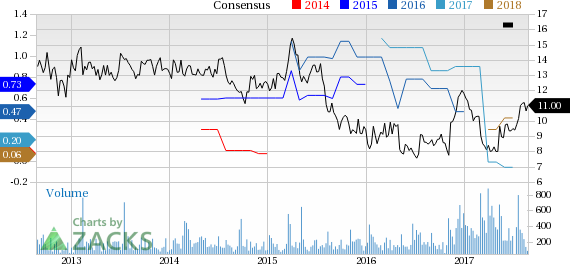

These positive earnings estimate revisions suggest that analysts are becoming more optimistic on KVHI’s earnings for the coming quarter and year. In fact, consensus estimates have moved sharply higher for both of these time frames over the past four weeks, suggesting that KVH Industries could be a solid choice for investors.

Current Quarter Estimates for KVHI

In the past 30 days, one estimate has gone higher for KVH Industries, while none have gone lower in the same time period. The trend has been pretty favorable too, with estimates increasing from a loss of 2 cents a share 30 days ago, to an earnings of 1 cent today.

Current Year Estimates for KVHI

Meanwhile, KVH Industries’ current year figures are also looking quite promising, with two estimates moving higher in the past month, compared to none lower. The consensus estimate trend has also seen a boost for this time frame, increasing from a loss of 6 cents per share 30 days ago to earnings of 20 cents per share today.

KVH Industries, Inc. Price and Consensus

Bottom Line

The stock has also started to move higher lately, adding 7% over the past four weeks, suggesting that investors are starting to take note of this impressive story. So investors may definitely want to consider this Zacks Rank #3 (Hold) stock to profit in the near future. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector.

Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next waves of innovations really take off. See Stocks Now>>

KVH Industries, Inc. (KVHI): Free Stock Analysis Report

Original post