SUPERVALU INC. (NYSE:SVU) is scheduled to report third-quarter fiscal 2018 results on Jan 10, before market opens. This grocery dealer has a mixed record of bottom-line surprises in the trailing four quarters.

Considering this, let’s delve into how things are shaping up for the upcoming announcement.

What to Expect?

The Zacks Consensus Estimate of 48 cents for the fiscal third quarter has been stable in the last 30 days and reflects an increase of about 37% from the year-ago reported figure.

Further, analysts polled by Zacks expect revenues of $4,002 million for the impending quarter, up 33.3% from the year-ago quarter.

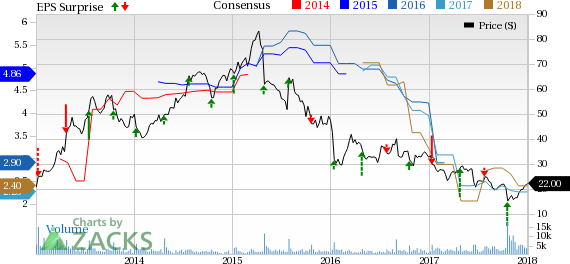

SuperValu Inc. Price, Consensus and EPS Surprise

Factors at Play

Acquisitions & Partnerships: A Vital Growth Driver

Acquisitions have been favoring SUPERVALU’s business growth for a while, particularly in the wholesale business segment. In second-quarter fiscal 2018, the takeover of Unified Grocers in drove wholesale segment sales by 58% year over year. The company also holds supply agreements with retailers like Fresh Market Inc., America’s Food Basket and Marsh Supermarkets. Such agreements are expected to continue bolstering the company’s top line in the forthcoming quarters.

Further, we note that SUPERVALU concluded the acquisition of Associated Grocers in December 2017. Going ahead, the company expects this Florida-based company to be a profitable inclusion to SUPERVALU’s wholesale business, given its strong customer and retailer base as well as presence in key international regions.

Adapting With Evolving Consumer Trends

Organic food products are becoming popular owing to rising health consciousness amongst consumers. Thus, the company has been evaluating prospects in the organic foods arena and has partnered with wholesale merchants to explore opportunities in this category.

Apart from this, SUPERVALU also strives to improve omni-channel capabilities to resonate with the evolving consumer trends. In this respect, the company is on track with upgrading website and mobile applications to enhance consumer shopping experiences. Recently, the company signed a multiyear contract with Instacart to provide integrated store coupons and loyalty rewards at its e-commerce sites. Such efforts will augment SUPERVALU’s top line in the forthcoming quarters.

Weak Retail Businesses: A Major Hurdle

Despite the above-mentioned upsides, SUPERVALU’s sluggish retail business is a concern. Competitive pressures and lower store traffic has been marring the segment’s performance, lately. Evidently, the retail segment has been facing identical store sales decline for the trailing 10 consecutive quarters.

Unfortunately, management continues to anticipate retail business to reel under competitive pressures and price sensitivity. An aggressive promotional environment is also expected to dampen the company’s store sales in the retail segment. Companies such as ConAgra Foods (NYSE:CAG) and Kroger (NYSE:KR) have also been facing stiff competition, thanks to the growing dominance of industry biggies such as Amazon.com (NASDAQ:AMZN) .

Though the company is undertaking robust efforts to improve retail segment’s performance, the aforementioned obstacles are likely to make the road bumpy. Additionally, the company is exposed to the risk of input price volatility.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that SUPERVALU is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although SUPERVALU’s Zacks Rank #3 (Hold) increases the predictive power of ESP, its Earnings ESP of -27.46% makes us less confident about an earnings surprise. You can see the complete list of today’s Zacks #1 Rank stocks here.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Conagra Brands Inc. (CAG): Free Stock Analysis Report

SuperValu Inc. (SVU): Free Stock Analysis Report

Kroger Company (The) (KR): Free Stock Analysis Report

Original post

Zacks Investment Research