Superior Industries International Inc. (NYSE:SUP) intends to offer principal amount of senior notes worth €240 million, with the year of maturity fixed as 2025. The offering is subject to market and customary conditions, along with registration requirements of the Securities Act of 1933.

The Senior Notes will be general unsecured obligations for the company and will be guaranteed with certain exceptions by the Superior Industries’ existing and future domestic subsidiaries. Proceeds from the offering will be used to repay a €240 million bridge loan, which was taken earlier to purchase outstanding shares of UNIWHEELS.

The notes and related guarantees will be offered only to qualified institutional buyers.

Superior Industries acquired UNIWHEELS AG for around $715 million by purchasing 100% of the company’s outstanding shares. Headquartered in Germany, UNIWHEELS is the third largest supplier of aluminum wheels to the European OEM automotive market. The company is also Europe’s leading manufacturer of aluminum wheels for the automotive aftermarket.

Superior Industries reaffirmed its fiscal 2017 outlook for net sales, value-added sales and unit volume growth. The company projects revenues in the range of $730-$750 million, compared to $732.7 million, reported in 2016. It also expects 2017 value-added sales, which are net sales less the value of aluminum passed through to customers, to be in the range of $400-$410 million, compared to $408.7 million, reported in 2016.

The company expects adjusted earnings before income tax depreciation and amortization (EBITDA) to increase to $97-$105 million from $88.5 million in 2016. However, the above outlook does not include the future impact from the acquisition of UNIWHEELS.

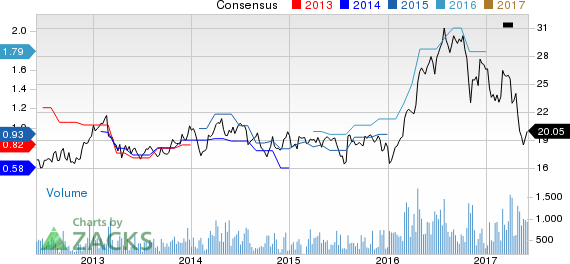

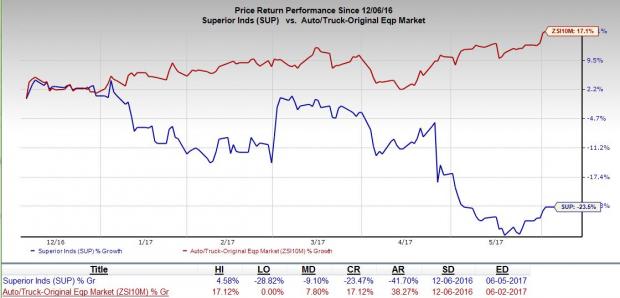

Price Performance

Superior Industries has underperformed the Zacks categorized Auto/Truck-Original Equipment industry in last six months. The company’s share price dipped to 23.5% during this period, compared to industry’s gain of 17.1%.

Zacks Rank & Stocks Picks

Superior Industries currently carries a Zacks Rank #3 (Hold).

Better-ranked companies in the auto space include Dana Inc. (NYSE:DAN) , Allison Transmission Holdings Inc. (NYSE:ALSN) and Ferrari N.V. (NYSE:RACE) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dana has an expected long-term growth rate of 3%.

Ferrari has expected long-term growth rate of 14.1%.

Allison Transmission has an expected long-term growth rate of 11%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Superior Industries International, Inc. (SUP): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Dana Incorporated (DAN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research