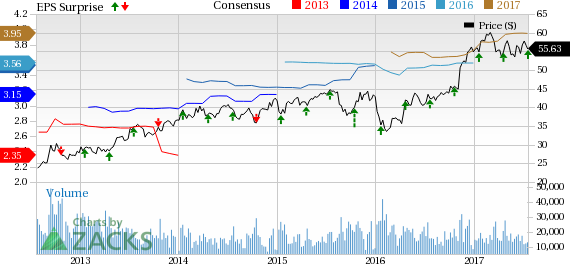

SunTrust Banks, Inc.'s (NYSE:STI) second-quarter 2017 earnings of $1.03 per share outpaced the Zacks Consensus Estimate of 98 cents. Also, the figure was up 10% year over year.

Better-than-expected results were primarily driven by an increase in net interest income, partially offset by higher expenses. Also, modest loan growth acted as a tailwind. A decline in provision for credit losses was another positive for the company.

Net income available to common shareholders was $505 million, up 6% year over year.

Net Interest Income Growth Offsets Higher Costs

Total revenue (FTE basis) for the quarter grew 2% from the prior-year quarter to $2.27 billion.

Net interest income (FTE basis) increased 9% year over year to $1.44 billion. The rise was attributable to growth in average earning assets and higher net interest margin (NIM).

On a year-over-year basis, NIM was up 15 basis points (bps) to 3.14%, reflecting higher earning asset yields, favorable impact of continued positive mix shift in the loan portfolio and lower premium amortization in the securities portfolio.

Non-interest income was $827 million, down 8% from the prior-year quarter. The fall was largely due to lower net securities gains, mortgage production related income and other non-interest income.

Non-interest expenses were up 3% from the year-ago quarter to $1.39 billion. The rise was mainly due to an increase in most expense categories, other than operating losses and other non-interest expense.

Credit Quality Improved

Total non-performing assets were $821 million as of Jun 30, 2017, down 18% from prior-year quarter. Non-performing loans fell 15 bps year over year to 0.52% of total loans held for investment.

Further, provision for credit losses declined 38% from the year-ago quarter to $90 million. Also, the rate of net charge-offs decreased 19 bps year over year to 0.20% of total average loans held for investment.

Strong Balance Sheet

As of Jun 30, 2017, SunTrust had total assets of $207.2 billion while shareholders’ equity was $24.5 billion, representing nearly 12% of total assets.

As of Jun 30, 2017, loans were marginally up on a sequential basis to $144.3 billion. However, total consumer and commercial deposits declined nearly 2% from the prior quarter to $158.3 billion.

SunTrust’s estimated common equity Tier 1 ratio under Basel III (on a fully phased-in basis) was 9.52% as of Jun 30, 2017.

Share Repurchase

During the reported quarter, SunTrust bought back shares worth $240 million.

Our Viewpoint

SunTrust remains well positioned for growth given its favorable deposit mix and enhanced credit quality. Easing margin pressure (given the improvement in interest rates) and initiatives to enhance efficiency should support the company’s revenues.

However, the company’s significant exposure to commercial and residential loan portfolios remains a major near-term concern. Any deterioration in the real estate prices will pose a problem.

SunTrust currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Regional Banks

BB&T Corporation’s (NYSE:BBT) second-quarter 2017 adjusted earnings of 78 cents per share surpassed the Zacks Consensus Estimate by a penny. Better-than-expected results were driven by an increase in revenues and lower expenses. However, provision for credit losses increased, which was a headwind.

Comerica Inc.’s (NYSE:CMA) second-quarter 2017 adjusted earnings per share of $1.15 surpassed the Zacks Consensus Estimate of $1.07. Better-than-expected results reflect higher revenues and lower expenses. Moreover, lower provisions and better credit quality were the tailwinds.

Riding on higher revenues, The PNC Financial Services Group, Inc. (NYSE:PNC) reported a positive earnings surprise of 4.5% in second-quarter 2017. Earnings per share of $2.10 easily beat the Zacks Consensus Estimate of $2.01. Continued growth in loans helped the company to generate higher revenues, which were partially offset by an increase in expenses.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

BB&T Corporation (BBT): Free Stock Analysis Report

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

Comerica Incorporated (CMA): Free Stock Analysis Report

SunTrust Banks, Inc. (STI): Free Stock Analysis Report

Original post