Just nine days until election day, everyone. I’m sure we’ll be glad when it’s all over (more or less), but I think we can all at least agree it’s entertaining for the moment.

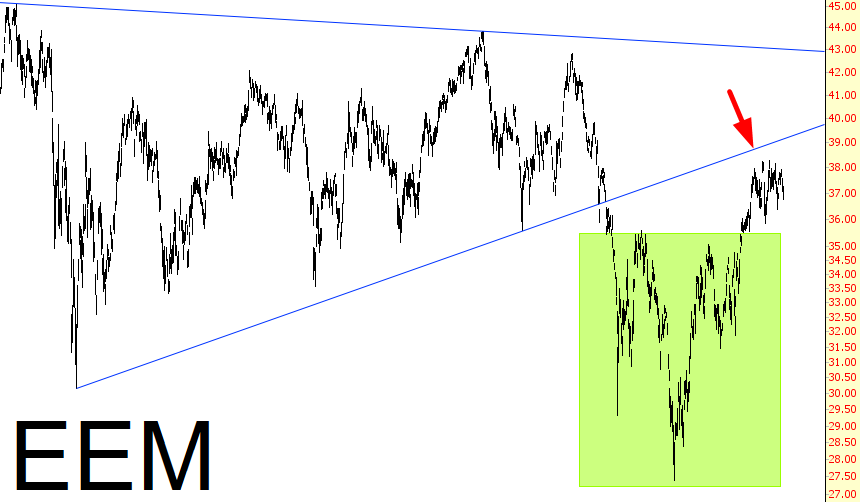

I thought I’d just thumb through a few ETF charts, since the market is still very “stuck” and there’s not a lot of dynamism to point out. This is short and sweet – five charts – so here we go: first is the emerging markets, which had a nice rally off its basing pattern (tinted) but seems to be getting turned away by a much larger trendline (red arrow shows resistance). The pattern for the Chinese ETF, symbol iShares China Large-Cap (NYSE:FXI), is rather similar.

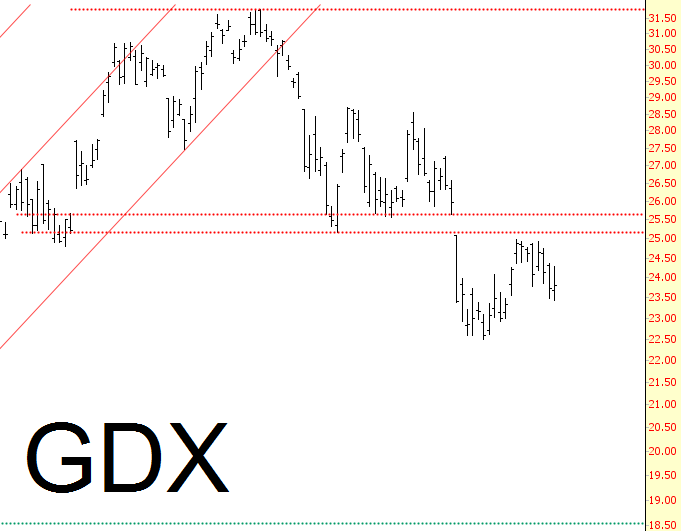

Precious metals miners are a favorite sector of mine these days, and the GDX (NYSE:GDX) and VanEck Vectors Junior Gold Miners (NYSE:GDXJ) patterns have to be two of the cleanest charts in existence today. Gold might battle its way back to about $1300, but I think it’s in trouble, a prospective rally notwithstanding.

I was heartened to see that, at long last, the small caps have exhibited a failed bullish breakout pattern. An identical situation exists with the mid-caps, symbol SPDR S&P MidCap 400 (NYSE:MDY), not shown here.

The much larger ETF SPY (NYSE:SPY) has yet to break its own support. Of course, it broke its 2016 uptrend a while ago (as did just about everything else), but the next bearish goal, a break of the tinted area, remains to be had. On the ES, this corresponds to 2100.25:

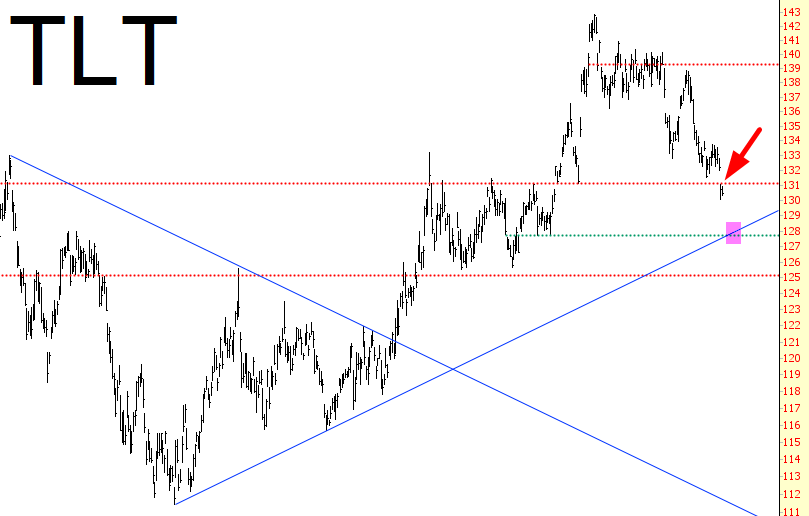

Lastly, bonds are breaking down badly as well. They, too, have a failed bullish breakout now, and should they break the area I’ve tinted below, the Fed’s desperate desire to create inflation and raise interest rates will be fulfilled. But I think “be careful what you wish for” applies.

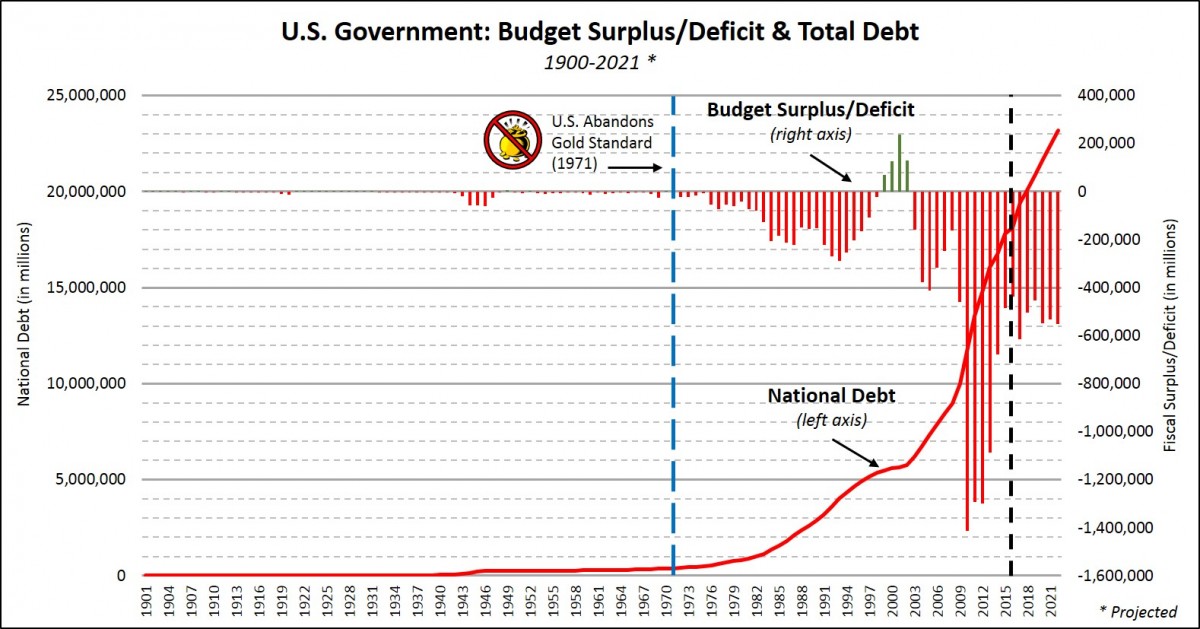

In point of fact, as desperately as the central bankers of the world seem to want to create inflation, I would gently remind you that those same governments are neck-deep in debt unlike the world has ever seen before, and if you want the entire planet to drown in a financial bloodbath, having steadily climbing interest rates would do the trick nicely.