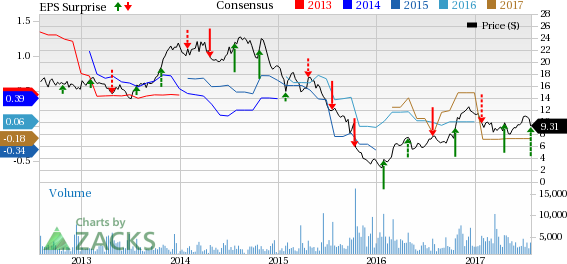

Coke producer, SunCoke Energy (NYSE:SXC) reported loss of 7 cents per share in the second quarter of 2017, narrower than the Zacks Consensus Estimate of a loss of 14 cents.

Revenue

SunCoke Energy’s quarterly revenue was $323.2 million, lagging the Zacks Consensus Estimate of $348 million by 7.1%.

Revenues during the second quarter of 2017 increased $30.5 million compared with the year-ago period, reflecting higher coal prices in the Domestic Coke segment.

Segment Performance

Domestic Coke

Revenues for the quarter amounted to $296.5 million, reflecting an increase of $22.5 million. However, sales volume dropped by 39,000 tons year over year. Therefore, the increase in revenues can be attributed to higher coal prices in the domestic market.

Coal Logistics

Revenues were up $4.9 million year over year to $16.2 million, driven by higher sales volumes at its Convent Marine Terminal and Kanawha River Terminals, LLC.

Corporate and Other

Corporate and other expenses, which include costs related to SunCoke Energy’s legacy coal mining business, were $11 million in second-quarter 2017, reflecting improvement of $1.3 million from last year’s comparable period.

Highlight of the Release

Total costs and expenses in the reported quarter were $314.6 million, up 11.7% from $ 281.8 million in the year-ago quarter.

Operating income was $8.6 million compared with $10.9 million in the year-ago quarter.

Interest expenses in the reported quarter were $15.2 million, higher than $13.4 million registered in the year-ago quarter.

Financial Update

As of Jun 30, the company’s cash and cash equivalents were $ 136.7 million, marginally up from $134.0 million as of Dec 31, 2016.

Long term debt and financing obligation was $ 870.3 million, higher than $849.2 million as of Dec 31, 2016.

In the first half of 2017, cash flow from operating activities was $54.4 million, lower than $121.5 million in the year-ago period.

Capital expenditure in the first half of 2016 was $22.4 million, lower than the $30.2 million in the comparable period.

Guidance

2017 Domestic coke production is expected to be 3.9 million tons.

Capital expenditures for the full year are expected to be around $80 million.

The company reaffirmed 2017 Consolidated Adjusted EBITDA guidance in the range of $220 million to $235 million.

Upcoming Peer Releases

Natural Resource Partners LP (NYSE:NRP) is expected to release second-quarter 2017 earnings on Aug 8. The Zacks Consensus Estimate for the quarter is pegged at $1.38.

Alliance Resource Partners, L.P. (NASDAQ:ARLP) is expected to release second-quarter 2017 earnings on July 31. The Zacks Consensus Estimate for the quarter is pegged at 80 cents.

CNX Coal Resources LP (NYSE:CNXC) is expected to release second-quarter 2017 earnings on July 31. The Zacks Consensus Estimate for the quarter is pegged at 51 cents.

Zacks Rank

SunCoke Energy has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Natural Resource Partners LP (NRP): Free Stock Analysis Report

SunCoke Energy, Inc. (SXC): Free Stock Analysis Report

Alliance Resource Partners, L.P. (ARLP): Free Stock Analysis Report

CNX Coal Resources LP (CNXC): Free Stock Analysis Report

Original post