If there is one thing that traders appreciate, it would have to be repetition. The world of technical analysis is built upon repeating cycles and patterns, the primary strategy that provides a clue as to what might transpire in the near-term future. As soon as repetition is recognized, however, you must act quickly. Once the herd takes notice, it is time to move on, since their pounding hooves will dampen even the strongest impulses of the market to repeat itself. Strategies lose their power when everyone tries the same thing.

Ever since the European debt crisis burst upon the scene in its full glory back in May of 2010, the Euro has been on a rollercoaster ride that refuses to quit. The fear of an expanding crisis drives the valuation down, while any hint that a solution might be at hand drives the value back up again. This tragedy, comedy, or whatever descriptor you wish to attach to the situation has been locked in a repeating cycle for three years, reminiscent of that hilarious movie “Groundhog Day”.

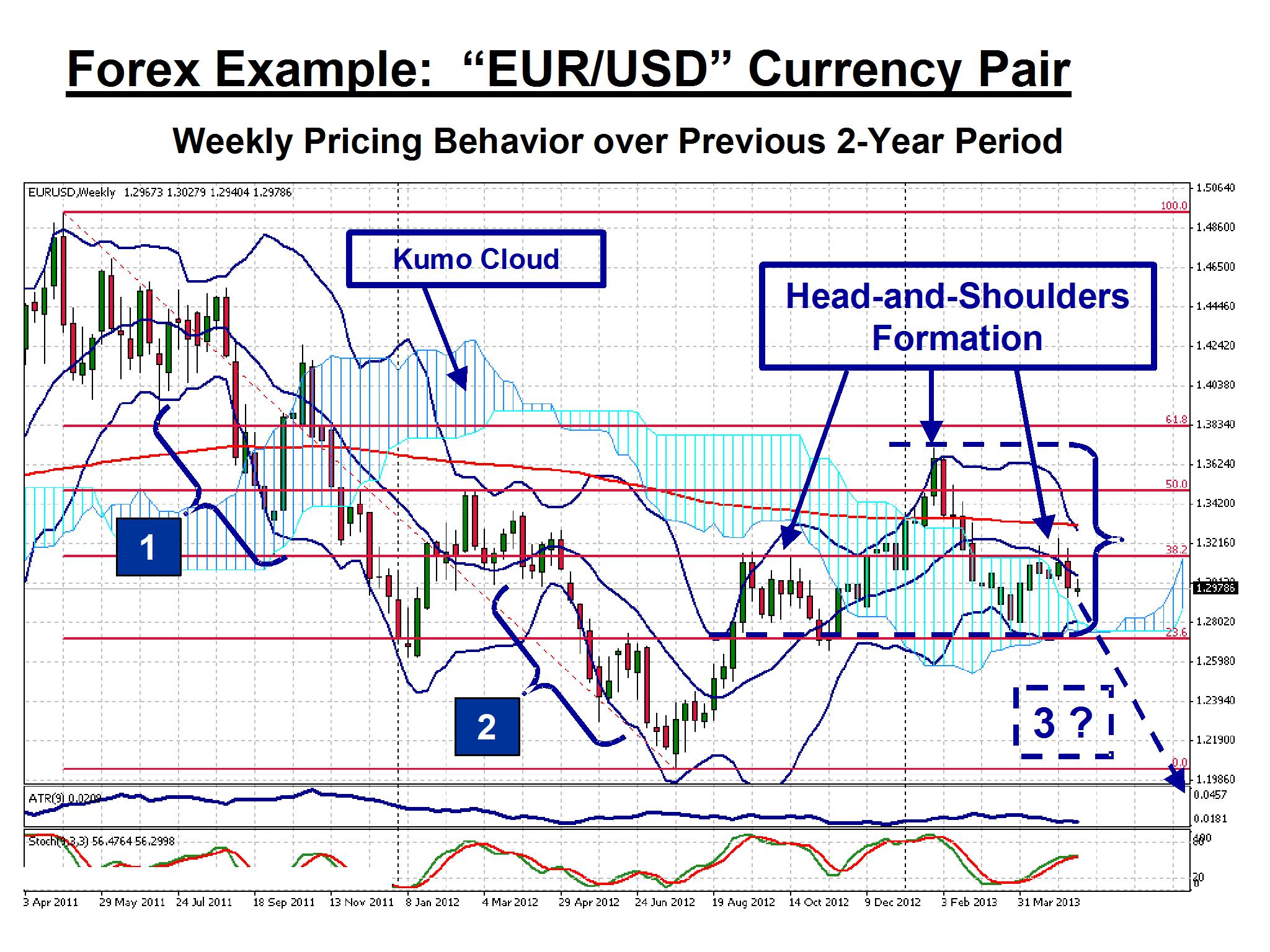

Veteran traders often counsel beginners to avoid the bad habit of trying to pick reversal points in the market. “Make the trend your friend” is the intuitive advice given. In other words, prepare for a reversal or breakout by recognizing the signals, and once the market confirms your interpretation, go for it. For the past few years, the Euro has fallen sharply during the summer months, and this summer portends to be more repetition on the way. Let’s take a detailed look at a weekly chart for the “EUR/USD” currency pair:

Another piece of veteran advice for traders is to step back and review a long timeframe chart to make sense of the long-term trends at play. In this case, we have chosen a weekly chart that includes 2011 to the present day. Fibonacci lines have been added for the major downward move that occurred over the period, with additional annotations to provide further guidance.

The rollercoaster nature of the Euro pricing behavior is apparent. The previous summer drops in 2011 and 2012 are noted by the blue boxes “1” and “2”, and 2013 seems headed in the same direction at this stage. Here are a few more brief observations of a technical nature regarding the Euro’s travails:

- The general trend over the period is in the downward direction, as suggested by the 100-Week EMA (the gradually curving red line in the middle of the chart);

- The Average True Range (ATR) indicator also indicates a downward trend, as volatility has diminished. Officials in Europe have approached each crisis quickly and developed a temporary fix, but the market yearns for a solution that will actually produce sustained GDP growth in the region. The EU has been in recession for the last three quarters of 2012, and data for the first quarter is due out shortly. A negative 0.1% is the current guesstimate;

- Try as it might, the Euro has been unable to mount a charge strong enough to break completely through and move beyond the imposing Kumo Cloud that hovers over the weekly candlesticks;

- A rather prominent Head-and-Shoulders formation has been under development over the past several months. The neckline and head have formed within key Fibonacci levels, while the final shoulder may be classified as still “in process”. The Euro is currently hovering under $1.30, but if the “H&S” holds true, then a breakout down to the $1.18 level is definitely within the realm of possibilities.

What is happening behind the scenes to cause such pricing behavior? The fact that the market perceives that there is no end in sight to the crisis conditions in Europe is the reason for the overall downward trend shape. Greece is only one member state. Spain, Portugal, and Italy may be next, but the recent financial debacle in Cyprus was more Greek related than anything else. Austerity programs have not borne fruit, and the general thinking is that a weaker Euro would be the best cure for current ailments.

A few of the most respected forex hedge fund managers have been predicting parity with the greenback for several years, only to be countered by actions from central banks to prevent the inevitable crash from ever taking place, at least on an immediate basis. The United States and Japan have both been conducting major quantitative easing programs, and foreign exchange reserve managers have bolstered the Euro by shifting funds away from the weakening dollar.

What are traders to make of this situation? Summer seems to be the time for shorting the Euro, if repetition is in the cards. A solid break below the 23.6% neckline may be all the market needs to force the Euro to more expected valuation levels.

Disclaimer: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.