Normally, I provide the Slope “Fed Spread” only to my beloved Gold and Platinum members each Thursday afternoon. Today I’m going to open up the kimono and make this a public post, partly because I feel bad there’s so much premium content lately, and also to tantalize you with the fact that the Fed Spread is going to get WAYYYYYYYY more interesting following the debt ceiling compromise, and I, for one, plan to hang on to every morsel of data slavishly throughout this summer as my principal source of guidance.

You might want to, ya know, sacrifice a latte or two each month and send Slope your money instead. I daresay it might pay for itself a gazillion times over. Up to you, of course. You and your sense of decency. So let’s move on.

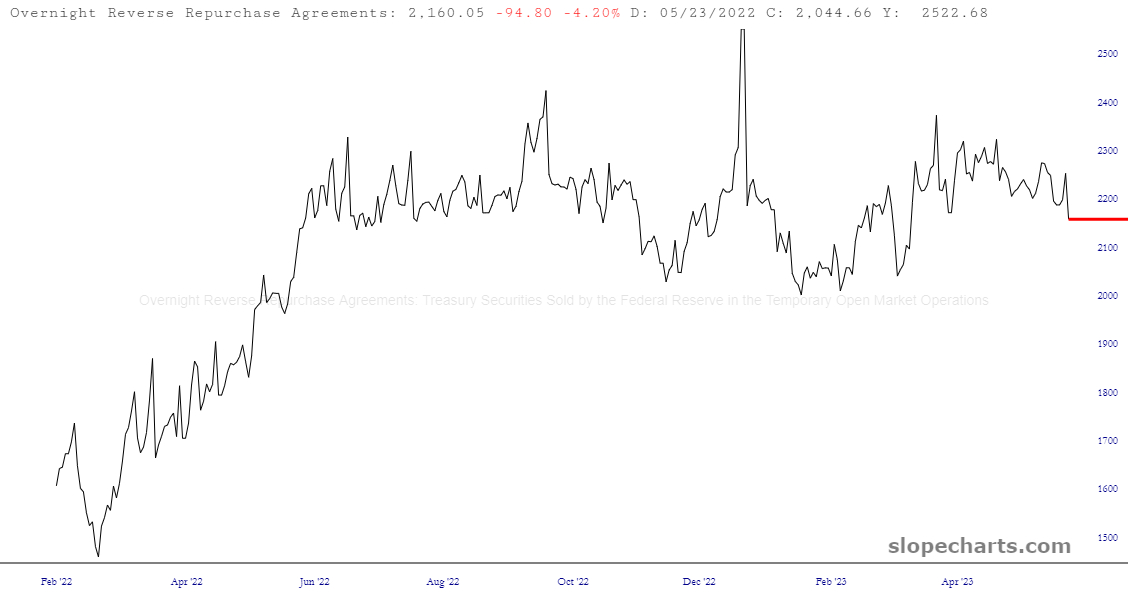

The reverse repo is slipping subtly lower, but is still hovering above $2 trillion every single night. Nothing to see here. I’m sure this is fine.

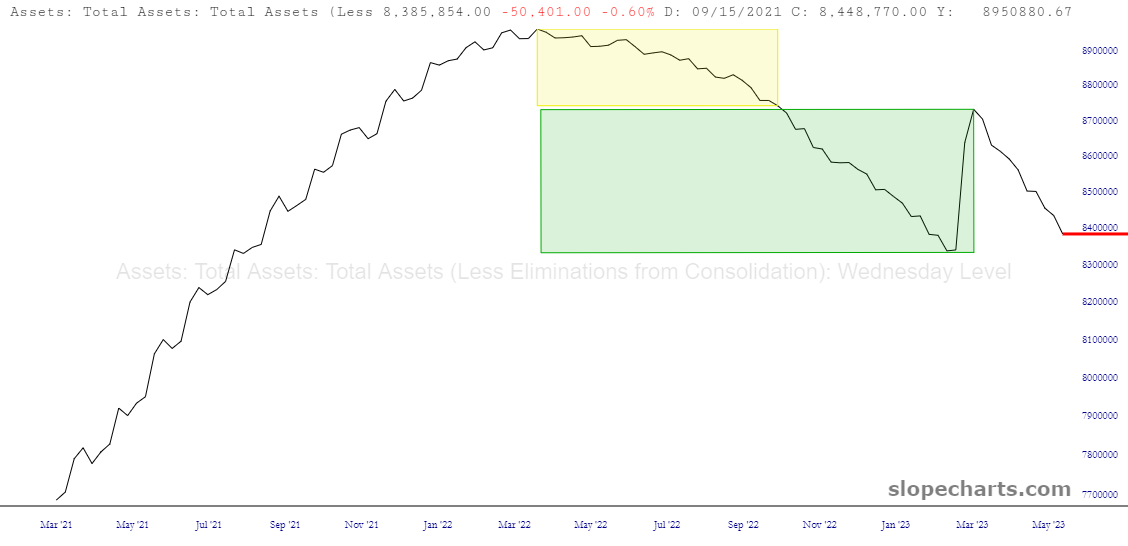

After what I dubbed the Billionaire Bankers’ Bailout in mid-March, which instantly reversed months of QT, we have just about come full circle and are approaching the same “tightening” level as we were at before the crybabies at Silicon Valley Bank mucked everything up.

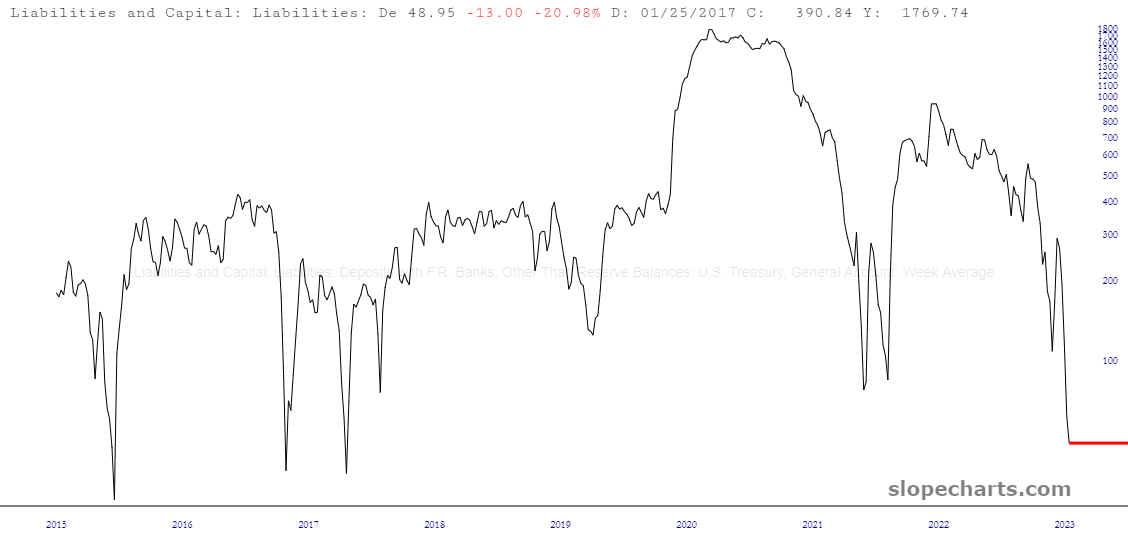

The most interesting chart of all, and the one mainly responsible from keeping the market from crashing As God Intended, is the Treasury balance sheet, which is plummeting toward levels matching the demographic target of Dollar General (NYSE:DG). Thanks to the perma-morons in Washington, this is about to go flying higher, which should pretty much lay the stock market at my feet, where I can get a good aim at it.

Put it through the magical Fed-Spread-o-matic machine, and you get an S&P which should be 350 points lower than it is right now.

As exciting as this is, this is Dullsville compared to what I think is coming this summer. I can hardly wait.