By Adam Button

The coronavirus backslide isn't just a US story; Australia grabbed headlines on the weekend because of outbreaks and a number of countries are hitting various records. The US dollar started another week on a sour note and CAD was the weakest after a dismal business survey from the Bank of Canada. (more below). The US services ISM survey jumped to 57.1 from 45.5, showing the biggest 1-month rise on record is the early highlight of the week.

The jump in Australian cases along with flareups in China and Japan shows how difficult COVID-19 will be to contain. On the weekend, US cases rose again but the market has so far brushed it aside. Some of that is because of lower mortality rates but there are also signs of complacency as summer hits.

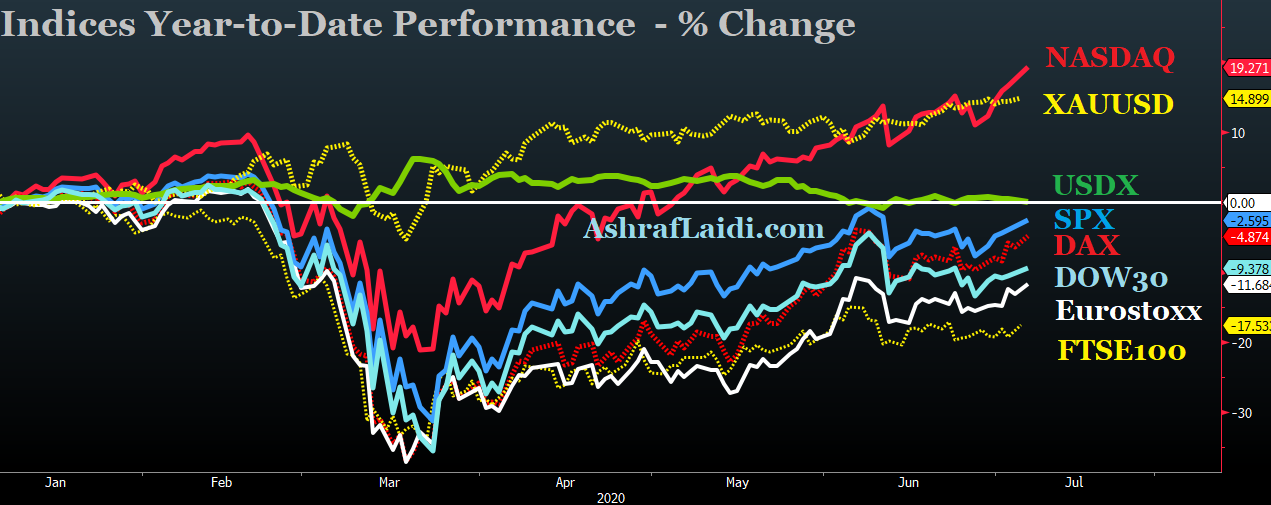

The tug-of-war between easy money and virus fears has turned into a summer stalemate. So far, the economic impacts of the lockdown and a rebound in economic measures on pent-up demand and massive government stimulus was predictable.

The more challenging task is figuring out the expiration of fiscal measures. Time certainly isn't on the economy's side in the pandemic, but no one is quite sure when time will run out. That should bring economic data to the front focus in the weeks ahead.

The Bank of Canada's business outlook tumbled to -35.0 vs from 22.0, highlighting deeply negative conditions across all regions and sectors due to the pandemic and drop in oil prices.