Moderate delays expected

Due to the knock-on effects of lower gold and silver prices on debt and credit markets (thus affecting project financing), Sumatra Copper & Gold (SUM.AX) has optimised its Tembang mine plan. This generally means higher grade mining during Stage 1 (years one to five) using the Buluh/Belinau resources. However, both of these resources require further drilling and technical work to satisfy financiers. SUM states this will be completed in Q413. We believe the number of discrete deposits at Tembang has always allowed SUM flexibility in scheduling and mining its deposits. Further, with all required mine permits already in place, we believe there is only a moderate risk to project execution. SUM anticipates being able to draw down on its US$35m debt facility during Q413.

H113 – write-down of non-core exploration projects

SUM’s H113 accounts largely reflect its status as a company transitioning from exploration into development. The largest item relates to SUM’s board deciding to write-down US$4.6m (£3.0m) of exploration expenditures relating to non-core projects (Sontang, Jambi, Madina 1&2 and Musi Rawas).

Drilling vindicates decision to mine Buluh first

6.7km of a 9km optimisation diamond drill programme (to replace lower quality RC drill holes) has been completed so far, with completion due by end-October 2013. Results to date have indicated higher grades (ranging from 5.2m at 7.52g/t Au to 2.4m at 21.4g/t Au) at Buluh compared to Asmar (reserve grade 1.3-1.7g/t Au), vindicating SUM’s decision to revise its mine schedule to satisfy its financiers.

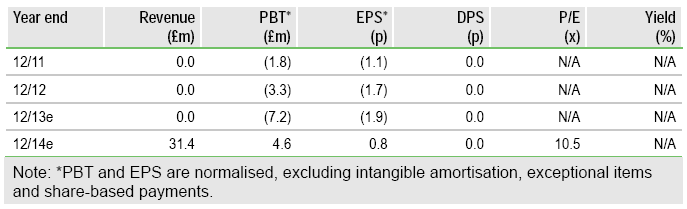

Valuation: Adjusted only for H113 results

Sumatra’s revised Stage 1 Tembang mine plan will bring the Buluh open pit (OP) resource (originally to be mined during Stage 2) forward, ahead of mining the lower-grade Asmar deposit (originally scheduled first in Stage 1). Following the Buluh OP, the Belinau resource will be mined, first OP then underground (UG). After this Asmar will be extracted, mining higher tonnage at slightly lower grades.

SUM is also revising its capital programmes. These revisions will amount to a materially different shape to mining Tembang, so we resist adjusting our last valuation of A$0.30 until the optimisation study is announced. Instead we adjust only for its H113 results. On this basis our valuation reduces to A$0.28 at a 10% discount rate and gold prices of US$1,578/oz (2014) and US$1,676/oz long term. As long as capex remains largely unchanged at c US$67m, the emphasis on increasing grade in the early years of production should affect our valuation positively.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sumatra Copper & Gold: Moderate Delays Expected

Published 10/01/2013, 09:03 AM

Updated 07/09/2023, 06:31 AM

Sumatra Copper & Gold: Moderate Delays Expected

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.