Industrial tool maker Illinois Tool Works Inc. (NYSE:ITW) kept its earnings streak alive in third-quarter 2017, pulling off a positive earnings surprise of 3.64%. Results were primarily driven by sales growth, benefits from enterprise initiatives and 2.7% fall in the diluted share count due to the company’s active share buyback activities.

Earnings in the quarter came in at $1.71 per share, above the Zacks Consensus Estimate of $1.65 and roughly 14% above the year-ago tally of $1.50. As noted, the bottom-line results excluded roughly 14 cents benefit accrued from a legal settlement.

Organic and Forex Gains Drove Top-Line Results

The quarter’s revenues totaled $3,615 million, reflecting growth of 4% from the year-ago tally. The improvement was driven by 2% organic gains and 2% positive impact of foreign currency movements.

Also, the top-line result surpassed the Zacks Consensus Estimate of $3.58 billion.

Illinois Tool Works reports its revenues under the segments discussed below:

Test & Measurement and Electronics’ revenues increased 1.8% year over year to $525 million. Revenues from Automotive OEM (Original Equipment Manufacturer) grew 4.1% to $795 million. Food Equipment generated revenues of $549 million, increasing 1.1% year over year.

Welding revenues came in at $378 million, growing 4.8% year over year. Construction Products’ revenues were up 6% to $440 million while revenues of $498 million from Specialty Products reflected growth of 4.6%. Polymers & Fluids’ revenues of $434 million increased 2.6% year over year.

Margin Profile Improves

In the quarter, Illinois Tool Works’ cost of sales increased 3.3% year over year, representing 57.9% of total revenues compared with 58% in the year-ago quarter. Selling, administrative, and research and development expenses, as a percentage of total revenues, came in at 16.3%.

Operating margin improved 130 basis points (bps) year over year to 24.4%, driven by roughly 110 bps contributions from enterprise initiatives. The margin excluded the impact from the legal settlement.

Cash Position Strong, Debt Increases

Exiting the third quarter, Illinois Tool Works had cash and cash equivalents of approximately $2,785 million, up from $2,496 million recorded in the previous quarter. Also, the company generated net cash of $780 million from its operating activities in the quarter, up 25% year over year. Capital expenditure on purchase of plant and equipment totaled $78 million. Adjusted free cash flow was $702 million, reflecting a conversion rate (as a percentage of net income) of 110%.

The company’s long-term debt balance increased 1.1% sequentially to $7,439 million.

Outlook

Illinois Tool Works increased its GAAP earnings guidance to $6.62-$6.72 per share, reflecting 25 cents growth at mid-point.

Organic revenue growth is expected to be 2-3% while operating margin is projected to be 24.5%. Full-year free cash flow is anticipated to be in excess of 100% of net income.

For fourth-quarter 2017, GAAP earnings per share are expected within $1.55-$1.65. Organic revenues are expected to be 2-3%.

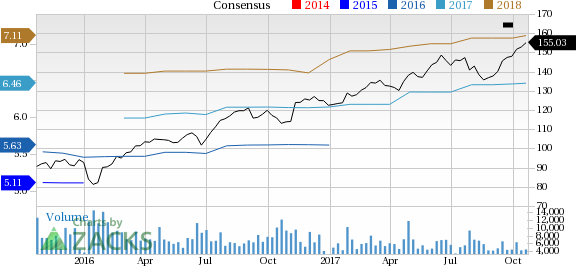

Illinois Tool Works Inc. Price and Consensus

Graco Inc. (GGG): Free Stock Analysis Report

Illinois Tool Works Inc. (ITW): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Original post

Zacks Investment Research