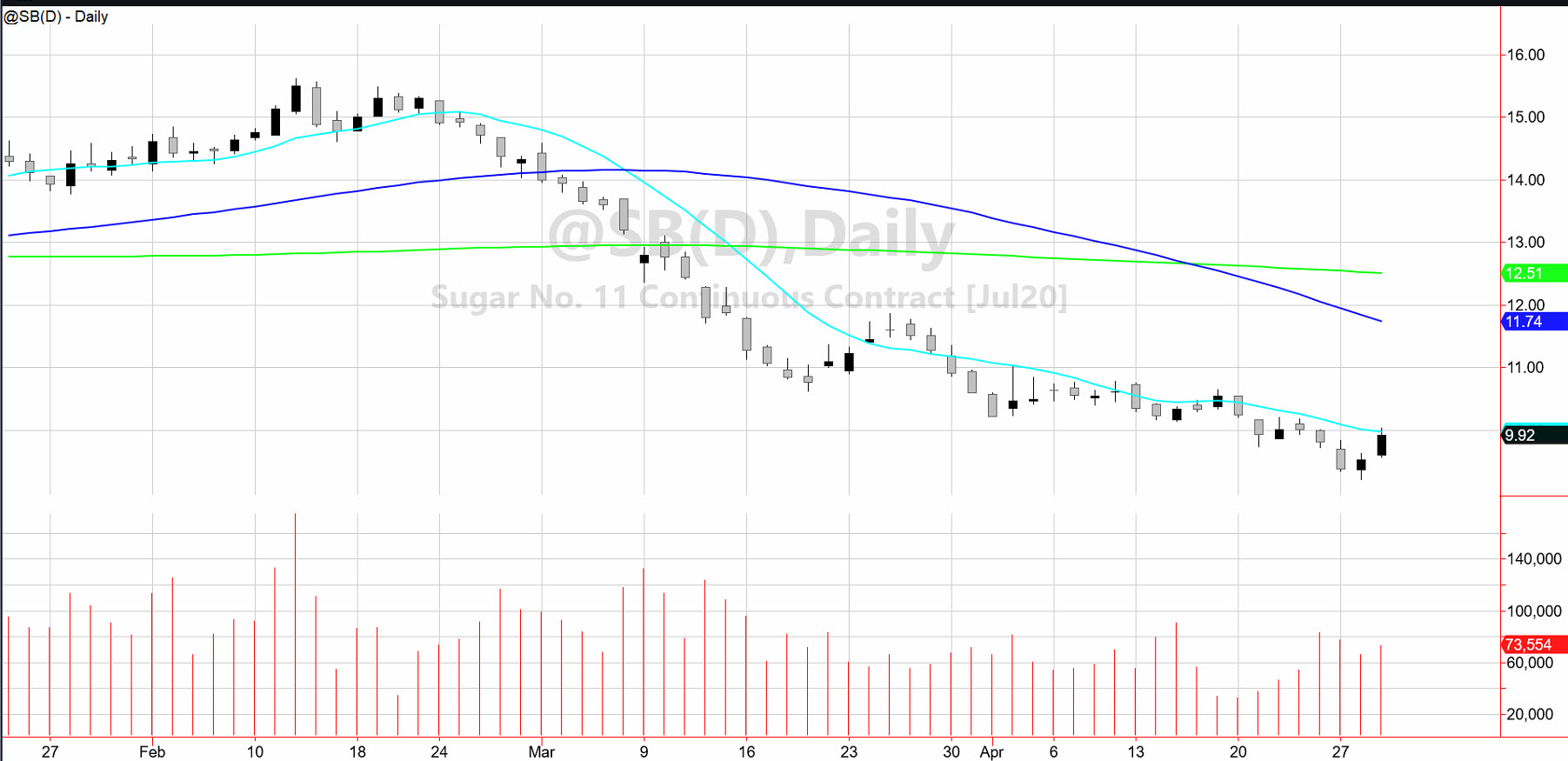

Sugar futures or the sugar continuous contract (can also check out the July contract SBN20) rallied 4.5% today, leaving a potential bottoming pattern. Again.

This is important for 2 reasons.

First, sugar is tied to ethanol, so that could signal that the worst of the oil debacle is over and…

Secondly, sugar is a secret inflationary indicator that could be telling us that deflation expectations have bottomed.

Let us look at both.

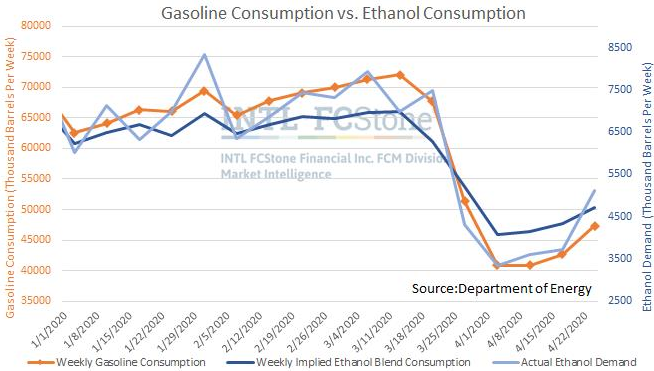

As the pandemic rolls on, gasoline consumption (in red) has expanded.

The dark blue line shows implied ethanol demand, which is also rising.

Note that the lighter blue line is actual ethanol demand, rising at the fastest rate.

As ethanol fermentation uses sugar, that helps explain why sugar might have bottomed.

Sugar as a secret inflationary indicator is a topic I have written and spoken about in the past.

What we could look at right now, is not so much the inflation aspect, rather, the potential bottom of the deflationary metrics.

The Fed has clearly stated that they want to see a rise in inflation. Furthermore, with GDP declining by 4.8% and consumer spending declining by 7.6%, perhaps that too, is the worst of it and like gasoline demand, it’s only up from here.

Regardless, looking at the chart, sugar made a new multiyear low and closed above the highs of the last 2 days. The volume was good.

Now, a move and close over 10.00 (or the 10 day moving average) could offer a low risk buy, especially if like the overall market, hope is truly returning to consumers.

S&P 500 (SPY) 288-290 pivotal support as this enters a new level of resistance between 295-300.

Russell 2000 (IWM) 136.17 last swing high from 3/13/20. It also cleared a channel top so now, if fails 135, can be a potential short-and over 136.17 see 140-141

Dow (DIA) 249 resistance 238 support

Nasdaq (QQQ) 216-217 support 222 resistance

KRE (Regional Banks) Prodigal getting lavish-38.10 support to hold

SMH (Semiconductors) Wonder woman strikes again-135 the must hold

IYT (Transportation) 155 resistance 150 support

IBB (Biotechnology) Inside day. Top of channel which if clears could see new all time high

XRT (Retail) 38.50 is huge resistance with 35.00 support

Junk Bonds (JNK) Unconfirmed recuperation phase-needs to confirm then see 101.00 area

LQD (iShs iBoxx High yield Bonds) 130 pivotal but looks like the consolidation will resolve to the upside