- Fed leaves policy unchanged

- FOMC more confident about inflation reaching target

- Monetary path dependent on fiscal policy

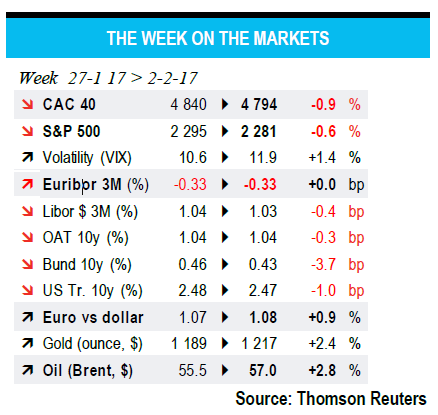

Unveiling the details of its fiscal policy does not look like a top priority for the new US administration. This leaves the Fed in the dark and explains the waitand- see mode. At the latest FOMC meeting, the Fed decided to leave rates unchanged and the rewording of the statement was more about grammar than about sense. While the strengthening in the business sentiment is noted, FOMC members also appear more confident in inflation reaching target in the medium-term.

The target could actually be hit (and broken) in the very near future as the 2016 oil price rebound will feed large base effects in early 2017. Beyond the first half of 2017, however, it gets very difficult to forecast the path the US monetary policy will follow. Under the hypothesis that a large fiscal stimulus is actually implemented, the normalisation of the monetary policy would be sped up. Janet Yellen made it clear back in December that she and her colleagues viewed the output gap as closed, implying that a stimulus would overheat the economy. Absent such a fiscal stimulus, interest rates would be increased more gradually. All these remain dependent on the possible negative consequences on activity from tighter monetary and financial conditions since the November elections. In short, we do not know what the Fed will decide this year. Our only comfort is that we are definitively sure that the Fed itself does not know much more than we do…

by Alexandra ESTIOT