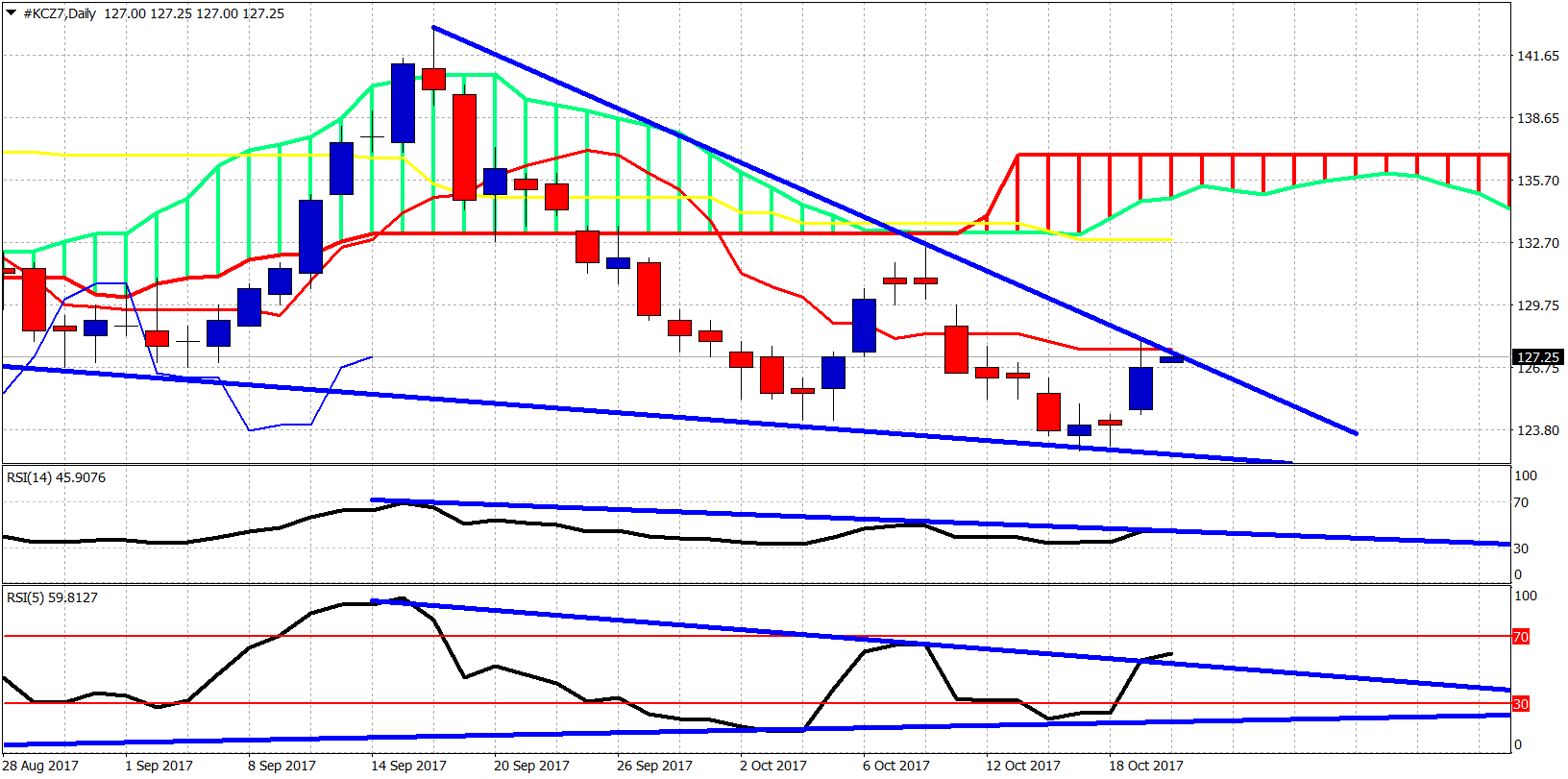

Good day to all and happy Friday. Today we enjoy our Coffee (KC bullish) as we were expecting prices to bottom and turn around from 122-123 upwards.

As mentioned in twitter (above), price followed the path expected and bounced according to the bullish setup we pointed out in my post in InsideFutures.com.

Below 123.75 it was time for Coffee to bounce. Coffee must break above the triangle/wedge pattern and if it does, I will be expecting it to reach the kijun-sen (yellow line indicator) around 132.50$. A more optimistic target will be the underside of the Kumo at 135.

With Coffee, there is also some talk about Sugar, as both go together in real life, but not in the markets (at least the short-term).

Sugar (SB) has been trading mostly sideways for the last few days but why? Because if you look at the larger picture I believe that Sugar is making a triangle pattern in a wave 4 position. This implies that the chances favor a downward breakdown for wave 5 towards 13 and lower.

Support is at 13.90-13.70$. Resistance is at 14.30-14.50$.

Concluding, I’m bullish short-term Coffee and bearish medium-term Sugar. Let’s see how these play out.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.