Over the past century, buying and holding dividend growth stocks has been one of the most reliable ways to build wealth.

But it’s important to be nimble with your investments, to question old assumptions, and to be well-positioned for the future. Buy-and-hold investing means maintaining a low portfolio turnover rate, but doesn’t mean you can’t rotate away from dying industries when the writing is on the wall.

The Coca-Cola Company (NYSE:KO), once one of the bluest of blue chip stocks, faces a far more uncertain future than it has experienced in any time in history. They’re a $200 billion company that essentially sells sugar water, and sugar is the new tobacco.

The Health Effects of Sugar

More and more studies have been piling up over the past decade showing that excessive sugar is playing a key role in skyrocketing global obesity and diabetes rates, and putting severe pressure on healthcare systems around the world.

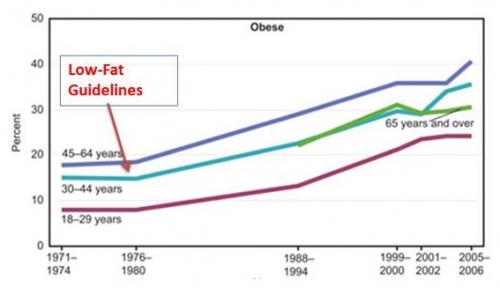

For decades, fat was the target, but telling Americans and the rest of the world to reduce dietary fat (and the subsequent replacement with carbohydrates including sugar) has been correlated with an unprecedented rise of obesity and similar disorders rather than solving any of the problems it was intended to help with.

Source: Healthline, using data from the National Center for Health Statistics

Now, the focus is increasingly being shifted towards sugar, as study after study has supported the notion that sugar is something we need to be far more concerned about than fat.

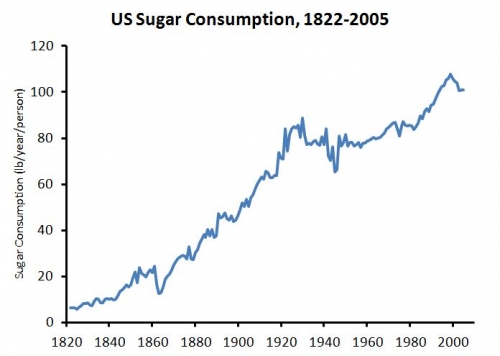

Added sugar has gone from a negligible dietary inclusion to being one of our principle forms of carbohydrate intake:

And here’s a summary by Dr. Peter Attia about a paper published by his colleague Dr. Robert Lustig in Nature back in 2012:

Sugar consumption is linked to the dramatic rise in obesity, diabetes, cancer, heart disease, and Alzheimer’s disease (i.e., the diseases that cluster around metabolic syndrome). Effectively, sugar speeds up our aging process.

The metabolic effect of sugar, and fructose in particular (fructose makes up half of sugar – sucrose is 50% glucose, 50% fructose; HFCS is 45% glucose, 55% fructose), is nearly identical to that of ethanol (drinking alcohol).

As such, sugar should be regulated in a manner commensurate with the damage it causes.

Basically, if you want to increase your energy and live a healthier life, keeping processed food and added dietary sugars to a minimum seems to be critical. And as an investor, it’s good to be aware of the trends facing several popular snack and beverage companies, including the most pure-play one, Coca Cola.

Sugar Taxes

In 2016, the World Health Organization released a report calling for sugar taxes around the world to combat the rising obesity epidemic. They had been calling for similar measures for years, but due to several actual sugar taxes in practice, they now had more specific data showing that sugar taxes do lead to lower sugar consumption rates.

The American Diabetes Association recommends that sugar-sweetened beverages should be avoided to help prevent type 2 diabetes. The American Heart Association recommends limiting added sugar to 6-9 teaspoons per day depending on your gender.

In 2014, Berkeley California became the first city in the United States to pass a sugary drink tax. By taxing sugar-sweetened drinks at a rate of one penny per ounce, it appears that consumption declined by 10%.

More recently, Philadelphia introduced a 1.5 cent per ounce sugary drink tax, and used that revenue to fund educational programs. The result appears to be an even steeper reduction in products sold, to the point of causing layoffs in the industry.

In the past few years alone, France, Ireland, Mexico, and the UK have passed sugar taxes. In the United States, cities such as Berkeley, Philadelphia, Oakland, San Francisco, Seattle, and Boulder have passed taxes on sugary drinks.

Soda companies have lobbied and fought against these measures with tens of millions of dollars at every step, but have generally been unsuccessful at stopping the momentum. Sugar appears to be where tobacco was decades ago, in the early stages of increasing regulation and taxation to reduce the negative health effects it causes on the public. This could expand into school bans, restrictions on advertising, and more numerous and more significant sugar taxes.

Coca Cola recently got a new CEO who has focused on divesting away from bottling companies and focusing on having a smaller, leaner Coca Cola Company with higher returns on capital. This is a smart move as far as I’m concerned.

In addition, the company sees the writing on the wall, and has been expanding into low and no-sugar products:

But it’s a real problem when a multi-billion dollar company is scrambling to reduce and change its core business. Coke with sweet artificial chemicals instead of sugar, reformulated recipes for classic products with less sugar, smaller serving sizes, and a focus on different low-sugar drinks… these are all headwinds against growth rather than new opportunities.

It’s All About Valuations

So does this mean Coca Cola will go bankrupt? Or that, after paying growing dividends for 55 consecutive years will suddenly cease to be a dividend aristocrat?

Of course not. It’s still a cash machine. And many tobacco companies continue to be cash machines to this day.

But it means we have to be rational with the valuations we’re willing to pay up for, and be conservative with our growth expectations. A slow-growth or even a declining company can be a great investment if you buy it at a bargain price.

Right now, consensus analyst EPS estimates for Coca Cola are $1.91 for 2017 and $1.99 for 2018. That means the stock is trading for about 23.7x estimated 2017 earnings and 22.8x estimated 2018 earnings, which is rather high. Investors are paying a substantial premium for the perception of safety.

Performing discounted cash flow analysis is one of the gold standards to determine the fair price for a stock, because it allows us to see what growth rates it would require to justify a stock priced based on our desired rates of return. With its high yield, a good formula for valuing Coca Cola stock is to apply the dividend discount model.

Coca Cola currently pays investors $1.48 per year in dividends, and has been increasing its quarterly dividend by 2 cents per year over the past several years, which most recently has meant a dividend growth rate of 5.7%. If your target rate of return is 8%, and you can optimistically expect the company to grow its dividend by maybe 6% (at best) over the next ten years, and 4% thereafter, then it results in the following valuation:

What this shows is that at the current price in the mid-forties, Coca Cola could be expected to produce roughly 8% annual returns going forward in an optimistic scenario. This leaves no margin of safety, excludes the possibility of rapidly darkening consumer sentiment or regulation of sugary drinks, and assumes even a mild acceleration of dividend growth.

A more conservative assessment would drop the fair value to the low-forties or down into the upper thirties. Coca Cola may not be a “sell” at these prices, but it’s almost certainly not a “buy” either.

Disclosure: The author has no positions in any stocks mentioned.