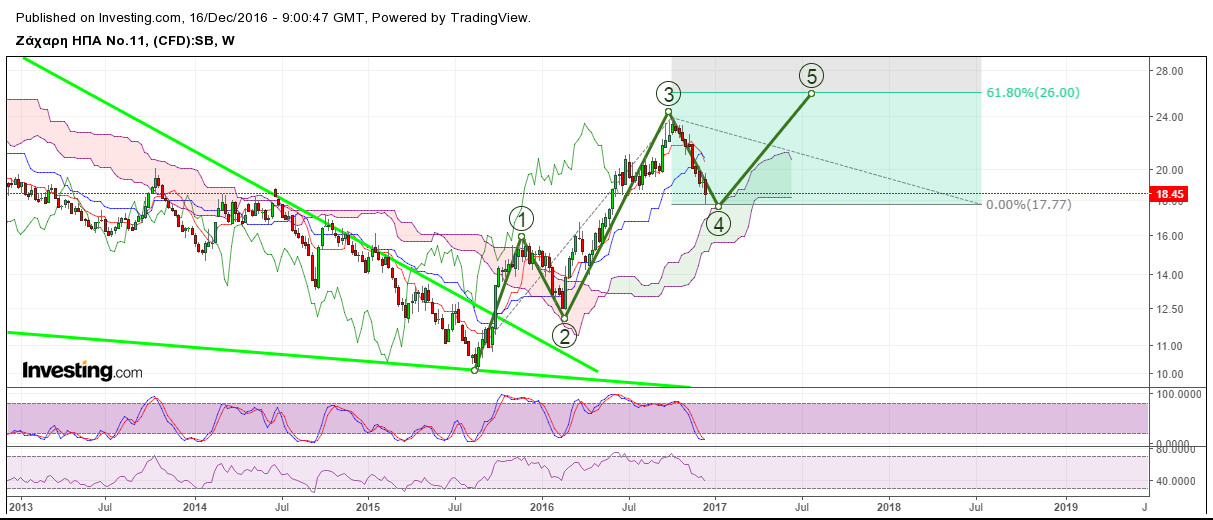

I’m bullish (and long in March contracts) US sugar #11. I believe sugar has most probably finished a wave 4 corrective wave and has already started or is about to start a new upward wave 5 targeting $26 and above.

Sugar has broken above the monthly downward sloping wedge pattern. This can be seen in the 1st chart above. Price is inside a bullish channel. The upward moves are impulsive (almost text-book 5 waves). Declines are corrective and so far wave 4 (what I believe to be) is still above the wave 1 high and above the Ichimoku cloud support. Price has retraced a bit more than the 38% of wave 3 and the projections of wave 5 target the 61.8% of the size of wave 1 to 3 at $26 and higher.

The upper monthly channel boundary is close to $31 which is also a possible target. This scenario will be canceled if price overlaps wave 1 high. I’m already long since $18.50 and will be looking to add on signs of strength.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.