COVID-19 has caused countless supply and demand disruptions across the globe.

It appears the coronavirus has caused a demand hit to one commodity in particular that not even doctors and governments could despite years of warnings.

With restaurants, sports arenas and cinemas all temporarily closed, sugar demand is set to drop for the first time in 40 years, according to supply chain services firm Czarnikow.

"Consumption out of home is normally more than what you would now substitute and have at home," Czarnikow analyst Ben Seed said.

"If you go to the cinema you would probably quite happily have a liter or maybe more of soda while you watch the film, whereas we just don’t think people would drink a whole liter of soda while watching Netflix (NASDAQ:NFLX)."

Czarnikow predicts sugar consumption will fall 1.2% this season to 169.9 million tons. The U.S. Department of Agriculture also sees sugar stockpiles rising as demand falls. The USDA reduced its estimate of sugar deliveries "based on initial analysis of the effects of pandemic lockdowns on the demand for sugar."

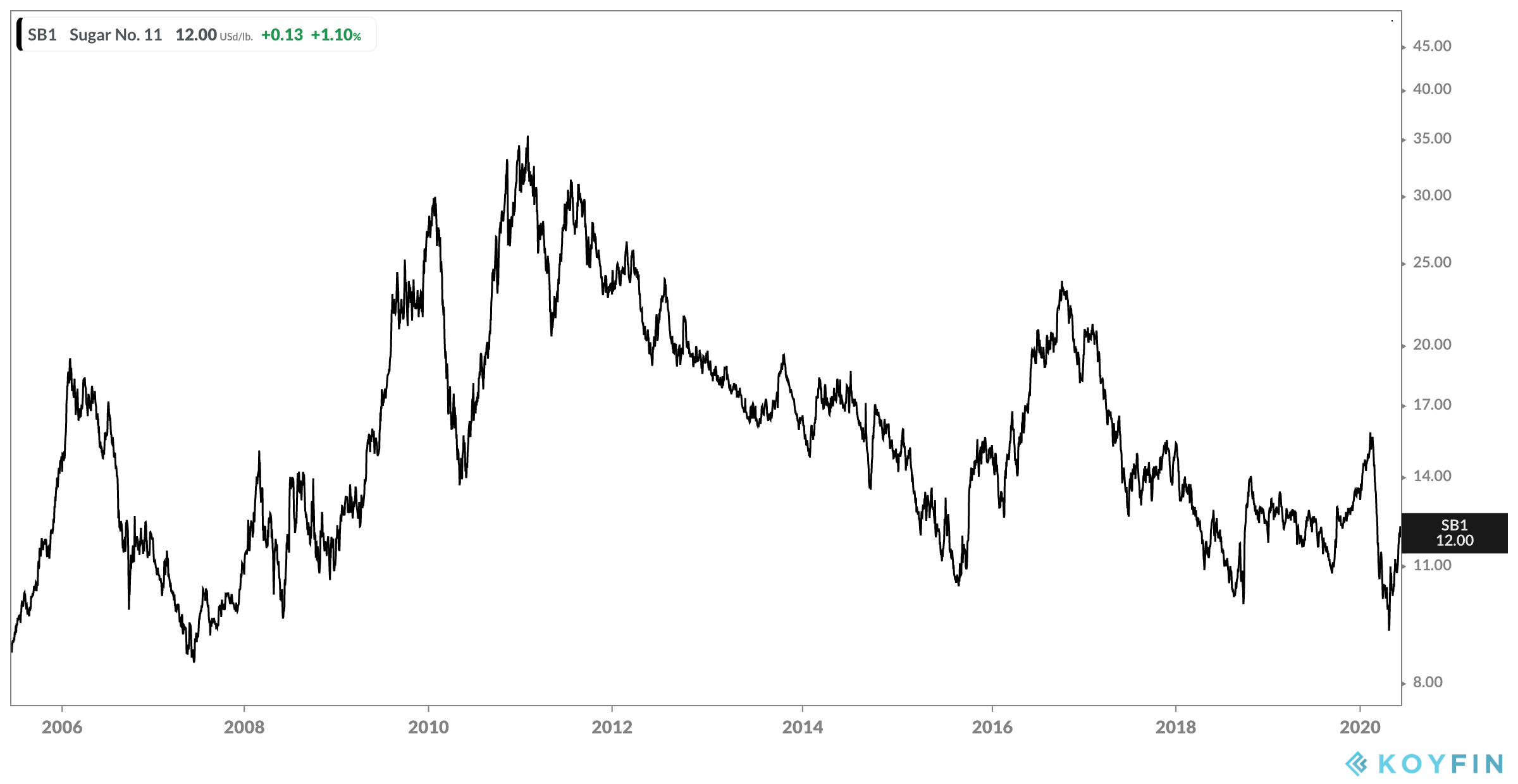

With the drop in demand has come a drop in prices. Raw sugar prices hit a 12-year low in April after falling more than 30% in just three months.

The International Sugar Organization believes the coronavirus has wiped out all of 2020s projected consumption growth. The organization warned bigger losses may follow, while also saying hedge funds switched from net long to net short.

Notable companies that are heavily dependent on sugar such as Coca-Cola (NYSE:KO) and PepsiCo (NASDAQ:PEP) have already seen a hit to demand. Coca-Cola said volume fell 25% in April, while PepsiCo warned second-quarter revenue will take a hit.

"The bigger picture of falling sugar consumption comes from sales data of Coke and Pepsi, which is terrible," said John Stansfield, a trader at Group Sopex who works in the sugar industry.

"But what I fear more is falling global GDP. Unemployed people won’t be going to restaurants and bars. As GDP stalls, so will sugar consumption."

While governments have fought sugar for years over health concerns, it's ironic that the forces of supply and demand as a result of the coronavirus are what finally caused demand to drop.