Sugar hasn’t been too sweet for those that have been long it for the past 90 days as Sugar ETF (NYSE:SGG) has lost a third of its value. Is sugar about to turn sweet for those long the ETF? Check out where the large decline has SGG at this time.

Let’s be clear about this. SGG is in a downtrend and nothing that has happened recently has changed that. We do focus on potential turnaround zones and this could be one where a counter-trend rally could start. The large decline over the past 90 days has SGG testing a potential support cluster at (1), with one of the potential support lines being the lows of last year.

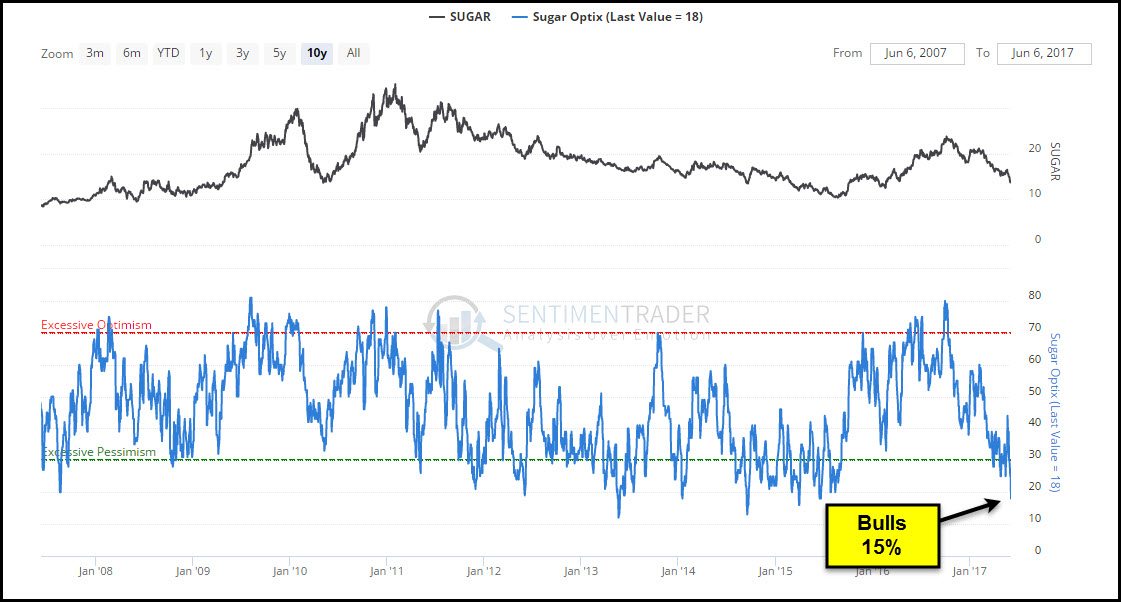

The large and swift decline has been hard on the bulls, who are understandably hard to find. Below looks at Sentiment on Sugar from Sentimentrader.

Are sugar's hard times about to end? We find the test of support and the percent of investors bullish sugar to be a set up where several opportunities could take place.