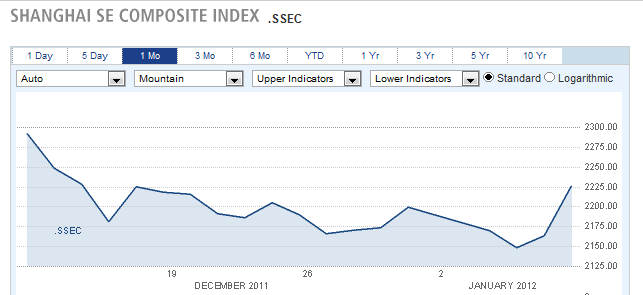

Asian markets traded mostly lower, despite a report from China which showed inflation fell to 4.1%, its lowest level in 15 months. The Shanghai Composite eased fractionally, settling at 2275. Hong Kong’s Hang Send slid .3%, rhe Nikkei lost .7%, and the ASX 200 edged down .2%. Bucking the downtrend, South Korea’s Kospi rallied 1%,

In Europe, the ECB held rates steady, and ECB chairman, Mario Draghi, said there are signs the region is stabilizing. The FTSE and CAC40 declined .2%, while the DAX rose .4%. Auctions in short-term debt in Spain and Italy were wildly successful, but their ability to sell longer term debt may prove more challenging.

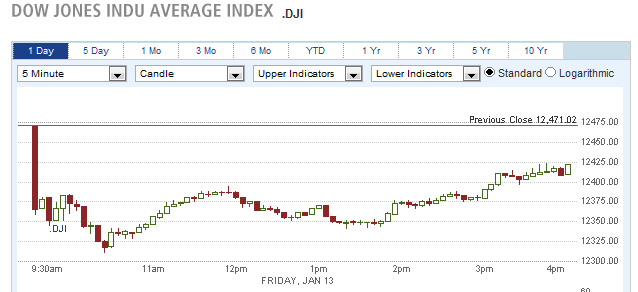

US stocks posted modest gains, despite weak economic data. The Dow inched up 22 points to 12471, the Nasdaq advanced .5%, and the S&P 500 rose .2%.

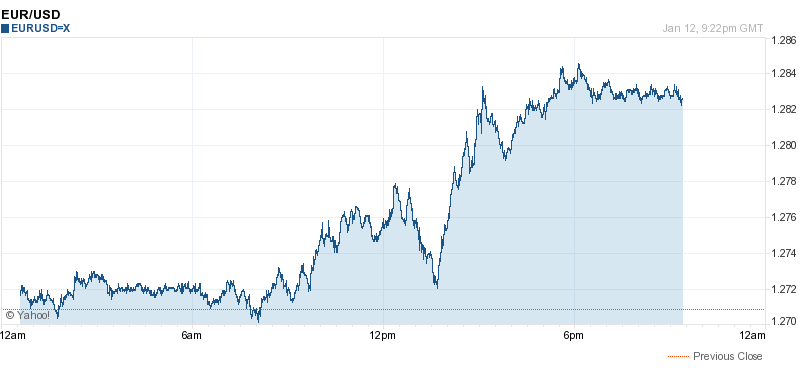

Currencies

The Euro rallied .9% to 1.2826, and the Swiss Franc gained 1.1% to 1.0595, as the successful bond auctions in Europe relieved some anxiety. The Pound and Candian Dollar both rose .1%, and the Australian Dollar settled up .3% at 1.0340. EUR/USD" title="EUR/USD" width="804" height="373">

EUR/USD" title="EUR/USD" width="804" height="373">

Economic Outlook

Weekly unemployment claims jumped by 24K to 399K, hitting their highest level in 6 weeks.

Retail sales rose a mere .1% last month, a sharp drop from November’s .4% rise.

S&P Due to Downgrade Several European Countries

Equities

The week closed on an up note in Asia, as the region’s markets traded mostly higher. The Nikkei rallied 1.4% to 8500, the Kospi gained .6%, and the ASX 200 rose .4%. In greater China, the Hang Seng edged up .6%, while the Shanghai Composite fell 1.3%, following the release of a report which revealed a drop in China’s foreign exchange reserves.

News that S&P was due to downgrade the credit rating of several European countries pressured the region’s markets. The FTSE lost .5%, the DAX dropped .6%, while the CAC40 edged down .1%. It is expected that France and Austria will be downgraded by one notch, while Spain and Portugal will drop 2 notches. Adding to the debt pain, a breakdown in negotiations between Greece and holders of its debt could spell major troubles for the Euro zone.

US stocks fell moderately as well. The Dow lost 49 points to 12422, while the Nasdaq, and S&P 500 shed .5%.

Dow Mostly Recovers from Steep Morning Slide

JPMorgan reported earnings that fell short on revenue, sending the shares down 2.5%. The negative news weighed on banking shares, sending Citigroup down 2.7%, and Morgan Stanley down 3.1%.

Currencies

The heavy dose of negative European news hit the single currency hard. The Euro fell as low as 1.2626, before recovering slightly, closing down 1.1% to 1.2680. The Yen, Pound, and Australian Dollar all declined a mere .1%, which the Canadian Dollar dropped .4% to 1.0230. The Swiss Franc eased .2% to 1.0506.

Economic Outlook

Consumer sentiment data from the University of Michigan rose to 74 from 69.9, beating estimates for 71.2. The trade deficit grew to $47.8 billion, a significant increase from last month’s $43.3 billion deficit, hitting its highest level in 5 months.

European Markets Shrug Off S&P Downgrades

Equities

Over the weekend, S&P downgraded the debt ratings of 9 out of 17 euro zone countries, sending Asian markets lower on Monday. The Nikkei sank 1.4% to 8378, as the Euro-Yen (EURJPY) fell to 97.22, its lowest level in more than a decade, hurting exporters. In Korea, the Kospi shed .9%, and Australia’s ASX 200 dropped 1.2%. The Hang Seng slid 1% to 19012, while the Shanghai Composite tumbled 1.7%, largely erasing last week’s gains.

Shanghai Composite Slides 1.7%

In contrast, European markets climbed, despite the wave of credit downgrades. The DAX rallied 1.3%, the CAC40 climbed .9%, and the FTSE rose .4%. Late Monday, S&P downgraded the European Stability Fund’s credit rating by one notch, which may make it harder for the fund to obtain cheap funding.

Currencies

Global currencies traded in relatively narrow ranges, thanks to the US holiday. The Canadian Dollar gained .5% to 1.1081, ahead of the Bank of Canada’s rate decision on Tuesday. The Swiss Franc slipped .3% to 1.0478, the Australian Dollar eased .2% to 1.0306, and the Euro edged down .1% to 1.2664. The Yen rose .2% to 76.78.

Economic Outlook

Tuesday’s sole economic report is the Empire State manufacturing survey. Analysts are expecting the index to rise to 10.8 from last month’s 9.5 reading.

Chinese GDP Better than Expected, Lifting Markets

Equities

GDP data from China showed the economy grew at 8.9% in the last quarter, better than forecast. The news sent the Shanghai Composite soaring 4.2%, despite the fact that the figure was lower than last quarter’s 9.1% growth. Across the region, stocks rallied, particularly in neighboring Hong Kong, where the Hang Seng jumped 3.2% to 19638. The Nikkei advanced 1.1% to 8466, the Kospi climbed 1.8%, and the ASX rose by 1.7%.

The upbeat sentiment continued in Europe, as the DAX rallied 1.8%, the CAC40 gained 1.4%, and the FTSE rose .7%. Automakers posted a 2.8% gain, as fear of a Chinese hard landing abated.

US stocks posted smaller gains. The Dow tacked on 60 points to 12482, the Nasdaq advanced .6%, and the S&P 500 gained .4%.

Currencies

A successful bond auction in Spain helped boost European currencies. The Swiss Franc rallied .8% to 1.0533, the Euro gained .6% to 1.2734, and the Pound inched up .1% to 1.5332. The Canadian Dollar edged up .3% after the Bank of Canada kept rates steady at 1%. In the Pacific region, the Australian Dollar climbed .7% to 1.0379, and the Yen closed down fractionally at 76.82.

Economic Outlook

The Empire State manufacturing index blew past expectations, rising to 13.5 from last month’s 9.5 reading, its highest level since April.

Housing Market Sentiment Soars to 4.5 Year High

Equities

Asian markets traded mixed on Wednesday, as doubts over Greece’s debt burden clashed with Tuesday’s cheer. The Nikkei climbed 1% to 8551, lifted by a sharp 6.6% rally in Elpida Memory on news the company is seeking a deal with Micron Technology. The Hang Seng rose .3%, to 19687, while the Kospi and ASX 200 settled little changed. The Shanghai Composite fell 1.4% to 2264, following Tuesday’s powerful 4.2% rally, the largest single-day gain in more than 2 years.

European shares traded mixed as well. The FTSE rose .2%, the DAX gained .3%, while the CAC40 eased .2%. Societe Generale shares surged 6% as Greece resumed debt negotiations, on hopes the bank’s losses due to exposure to Greek debt will be less than feared.

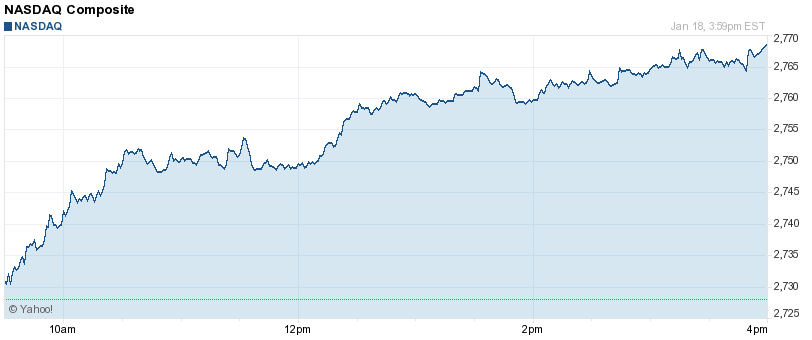

Upbeat data and rumors of a possible Greek-debt deal later in the week sent US stocks higher. The Nasdaq led the advance, climbing 1.5%. The Dow rose 97 points to 12576, and the S&P 500 gained 1.1% to 1308.

Nasdaq Rallies 1.5%,

Goldman Sachs surged 6.8% after beating earnings estimates, while Bank of NY Mellon sank 4.6% after reporting weak earnings.

Currencies

The Euro surged 1.6% as hopes for a solution to Greek’s debt woes lifted the single currency. The Australian Dollar rallied 1.2% to 1.0430, the Swiss Franc advance 1% to 1.0654, and the Pound climbed .8% to 1.5441. The Canadian Dollar posted a smaller .4% gain to 1.0112, and the Yen inched up fractionally to 76.99.

Economic Outlook

The NAHB housing market index jumped to 25 from last month’s reading of 21, blowing past analyst estimates of a rise to 22. Industrial production rose by .4%, slightly less than forecast, and PPI slipped .1%, following last month’s .3% gain.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Successful Debt Auctions in Spain and Italy Lift Euro

Published 02/02/2012, 04:26 AM

Updated 05/14/2017, 06:45 AM

Successful Debt Auctions in Spain and Italy Lift Euro

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.