The greenback exerts powerful influence on the precious metals – that has been the case yesterday, and it unsurprisingly continues to be so also today. So, what message is the USDX sending out now?

USD Index in Spotlight

We’ll open up with a quote from yesterday’s Alert:

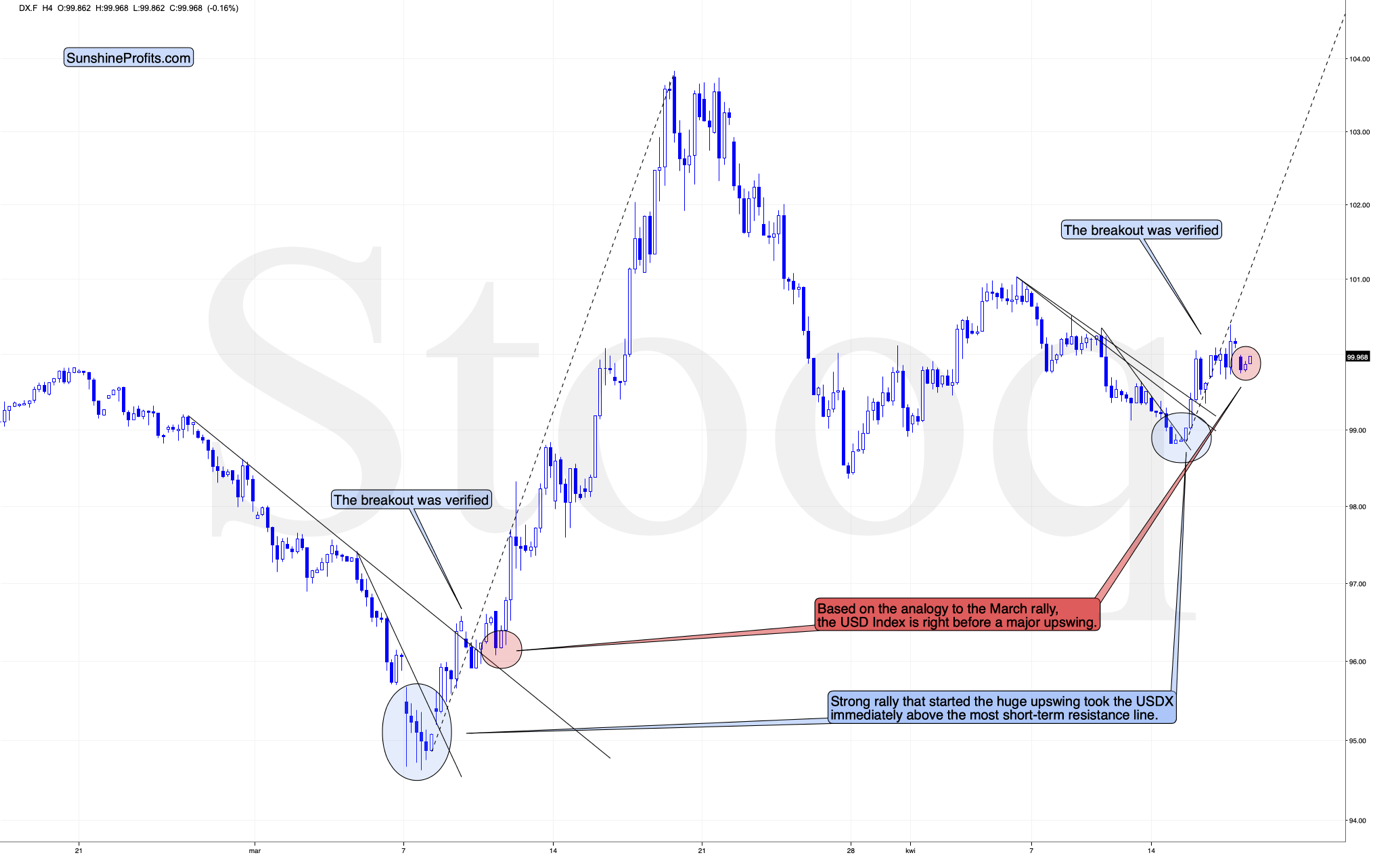

Looking at the 4-hour candlestick chart, we see that the USD Index just formed a reversal and is now testing the previous lows. There were very few 4-hour reversals in the recent days, but when we saw them, big and fast rallies followed. The early-March bottom is particularly similar to the current situation as the USD Index is – just like back then – after a visible decline, and the 4h reversal was followed by a re-test of the intraday low.

What happened next?

The USD Index moved below the intraday low of the reversal and then soared back up – exactly as it did in early March. And just like what it did back then, the USDX rallied immediately after the bottom and it did so in a sharp manner, especially right after breaking above the most short-term declining resistance line. At the same time, the USD Index invalidated the small breakdown below the April 1 st low.

Once the USD Index soars above the upper declining resistance line (currently at about 99.6) it will be relatively clear that the short-term bottom is already in and another big upswing has just begun. That line will be the final short-term confirmation, though. The most important line is the one that the USX is testing right now. It’s the one based on the April 6 and April 8 tops. Once the USDX breaks above it, the short-term odds will be on the bulls’ side and it will be clearly visible for many traders, not only for those who pay attention to the price pattern analogies and are able to detect the bottoms earlier (such as us). It could be the case that when you read this, the breakout above this line is already confirmed.

And what happened in the following hours?

The USD Index has indeed broken above all declining resistance lines. And it gets better – the USDX didn’t just break below those lines. It then pulled back, verified the previous resistance lines as support and then moved higher once again. That’s the perfect breakout, which makes the outlook clearly bullish, and very similar to what happened around March 10.

The back and forth movement that we’ve seen in the last several hours – below the previous highs, but also above the recent lows – makes today similar to what we saw on March 12 – right before the powerful run-up. After we created the above chart, the USDX moved above 100 once again, which seems to be confirming the similarity. Still, we wouldn’t rule out another final short-term pullback before the true rally is seen. In practice, it means that we

might see the big run-up today – but even if we won’t see it today, we’ll very likely see it (probably early) next week.

The implications for the precious metals market are very bearish.

Silver Breaks Down

Silver just broke below the rising support line, and has been verifying this breakdown for the past few hours. That’s perfectly normal and it doesn’t make the situation bullish. Conversely, each passing hour without invalidation of the breakdown is another point for the bears. Back in March, similar consolidation after the breakdown was the final pause before the big declines.

Is the history repeating itself here?

This seems quite likely, especially given that the similarity that we’re describing, took place on March 12 – exactly the same day when the USD Index was performing similarly to its today’s performance. History repeating itself to a considerable degree is one of the foundations of the technical analysis, and the key factor behind key precious metals trading tips.

Moreover, let’s keep in mind that silver is already after a confirmed breakdown below the rising support line. The implications are strongly bearish.