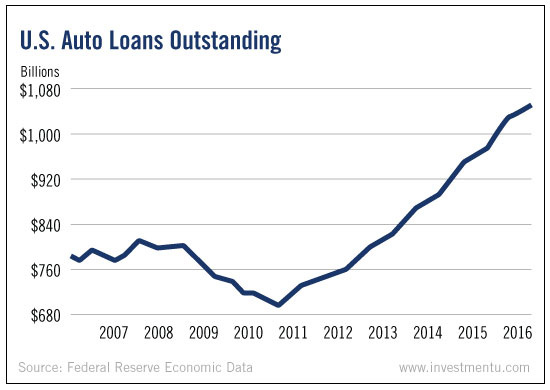

Auto loans have been on a tear lately, soaring from $800 billion in 2008 to more than $1 trillion today. The chart above illustrates their parabolic growth. And thanks to super-low interest rates, auto loans should continue to climb through the rest of 2016.

Now, you might be inclined to view today’s chart as a bullish sign for automakers. But, as I’ll show you, it’s more likely a sign of trouble ahead.

For one thing, interest rates can’t get much lower. And unlike sovereign yields, car loans won’t drop into negative territory. (After all, no logical lender would directly pay you to take its loan.) So, if rates can’t drop, there’s only one way for them to move... up.

When it happens, it will put downward pressure on car loans, especially for a hugely profitable subset of the market.... subprime auto loans.

According to Experian Automotive, subprime loans for Q1 2016 are up almost 11% year over year. Roughly one in five car loans goes to subprime borrowers.

So, risky lending is on the rise. Which is a setup for disaster (and defaults).

In fact, more auto loans are already starting to default. In early 2016, the number of auto loan payments at least 30 days past due climbed to over 2% of total auto loans.

It isn’t a good sign.

To avoid the inevitable fallout, avoid investing in securities that include subprime auto loans - or just auto loans in general.

For example, Credit Acceptance Corporation (NASDAQ:CACC) helps originate and service auto loans. Its revenue is up over the past year, but the company’s share price has dropped. Even founder Donald Foss has been selling his shares.

With only $9 million in cash and more than $2 billion in debt, Credit Acceptance Corp. isn’t well-positioned. Over the next several months, shares are likely to slip further.

Our chart may look bullish to some. But in reality, it’s showing quite a bubble. You’ll want to make sure you’re not around when it pops.