Natural Gas futures seem to be going through growing volatility due to sudden shift in geo-political situations, which have shaken the economic scenario since Monday morning when it became clear that northern Iraq’s oil production and movement had not been disrupted and oil prices declined from earlier highs. The dollar rose against a basket of currencies on Wednesday, on pace for a fifth straight day of gains, taking support from higher U.S. Treasury yields. The U.S. Energy Information Administration said in its weekly report that crude oil inventories fell by 5.73 million barrels in the week ended October 13, 2017.

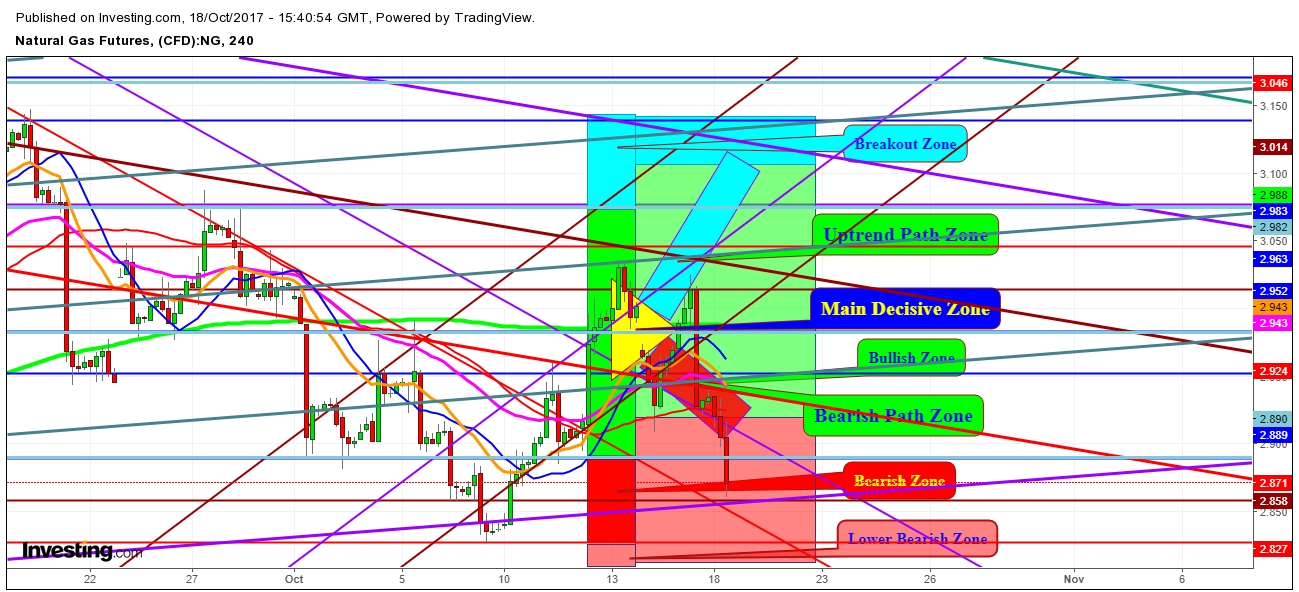

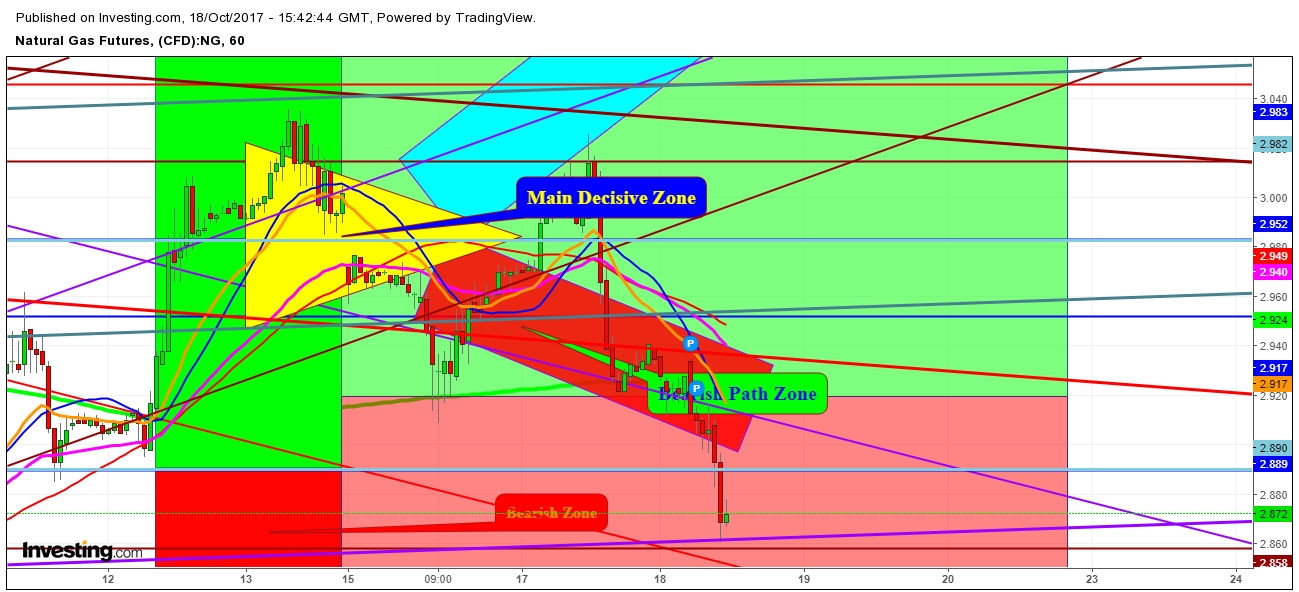

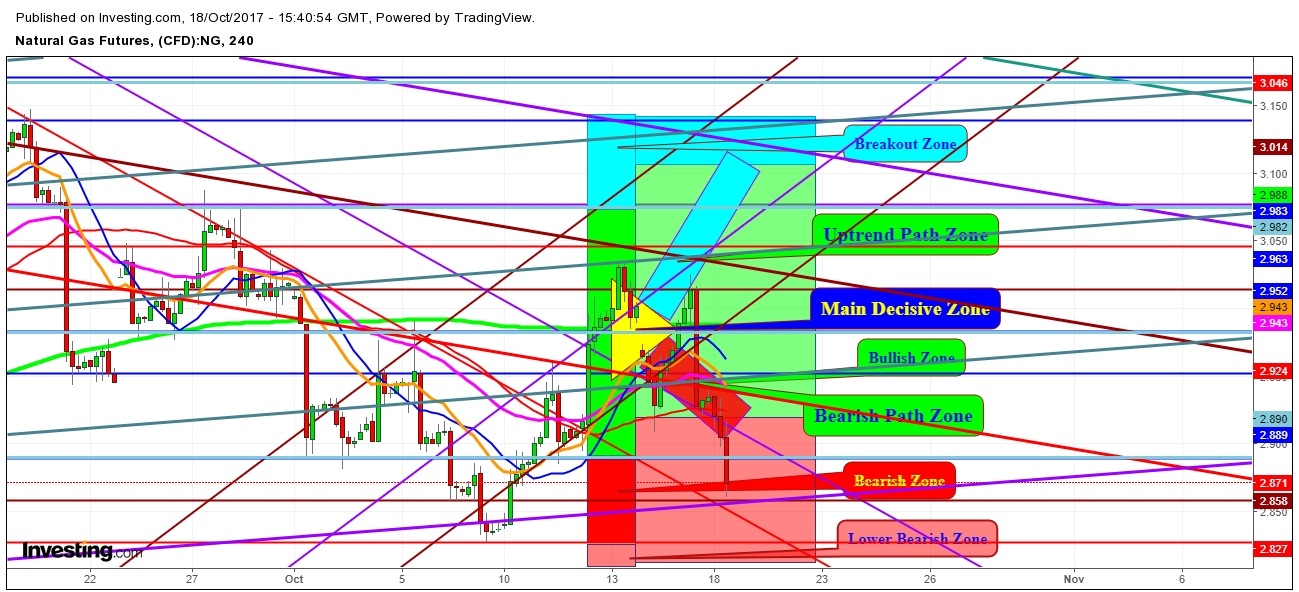

Amid all the economic and geopolitical concerns, I find natural-gas bulls are eager to ride over jumping bears at the current levels – at least until Thursday's Natural Gas Inventories. I see $2.862 as the best platform for natural gas. Based on today's chart, the probabilities of a strong reversal in natural gas futures, which may continue till the weekly closing.

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you are prepared to lose.