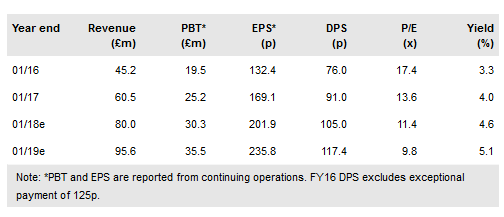

S&U's (LON:SUS) trading update for the period since its half-year end confirmed that it is trading in line with expectations and our estimates are unchanged. Transactions and receivables outstanding continue to grow even though underwriting criteria have been tightened. Impairment rates have edged up further but should stabilise and reverse as the loan book mix evolves.

Motor finance continues growth

Advantage reports that applications for motor finance have been strong and, even though underwriting refinements have meant a slight reduction in the rate of approvals, transaction growth has been maintained and receivables stand at over £240m, up nearly 6% in the period since the end of July or c 24% since the end of January. A new e-signature system that guides customers through terms and conditions and verifies their digital sign-off is being well-received and is contributing to a higher rate of conversion from approvals to transactions (c 10% in recent years). Tighter lending criteria mean the quality metrics on new loans have risen but the legacy effect of the previous move towards higher-risk customers means the impairment rate relative to revenue has ticked up modestly (23.4% vs 22.9% H118). Given the recent announcement from Provident Financial that its non-prime motor finance subsidiary, Moneybarn, is the subject of an FCA investigation relating to customer affordability and treatment of customers in financial difficulty, it is worth mentioning that Advantage was authorised by the FCA in December 2016 and has not been involved in any ongoing FCA discussions since that point. Management stresses its commitment to responsible lending and use of a sophisticated affordability process.

To read the entire report Please click on the pdf File Below: