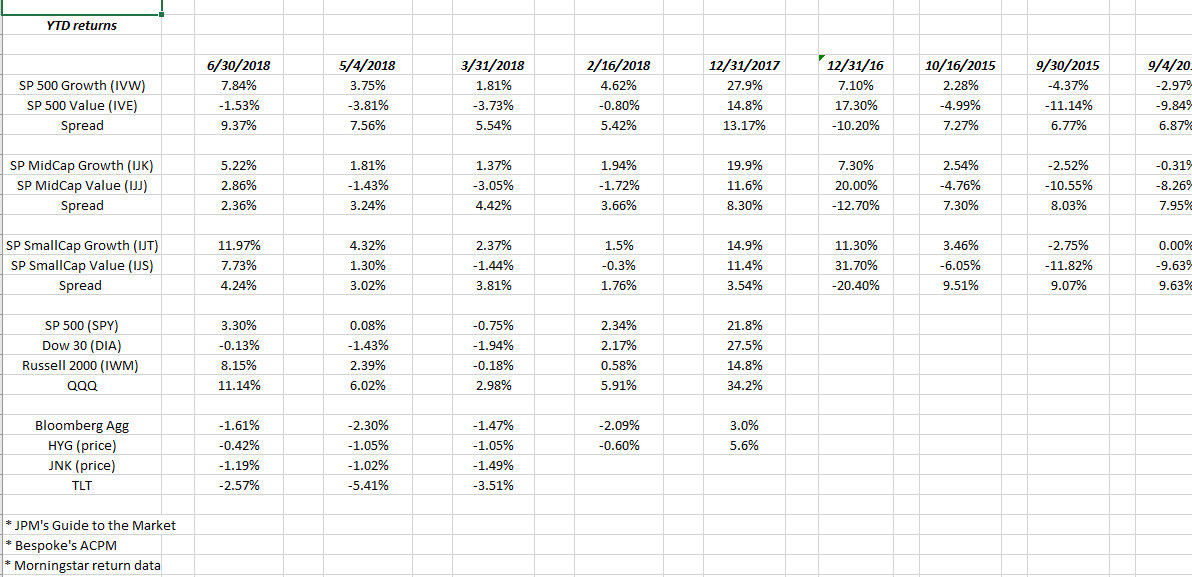

About every 6 weeks, this blog puts out a Style Box update on the various returns difference between small, mid and large-cap value and growth styles.

Looking at the spreadsheet, large-cap value outperformed growth dramatically in 2016, and then Value lagged badly in 2017, with large-cap value still lagging in 2018.

After lagging in the first quarter of 2018, small and mid-cap value have started to generate positive total returns, although still lagging the “growth” style.

As always a chart from Charlie Bilello (the chart is 10 days old) found on Twitter is the chart that tells the story:

Conclusion: the earlier years of the Style Box spreadsheet are incomplete since my updating of the spreadsheet was rather haphazard at the time, but if you look closely at the data, “Value” investing had negative returns in 2015, and then big outperformance in 2016, and now has lagged growth substantially across all market caps from 2017 forward, with small and mid-cap value returns now turning positive in 2018.

Longer periods of data need to be analyzed for better conclusions, but it’s clear large-cap value (IWD) has lagged large-cap growth (IWF) (no doubt due to Tech’s outperformance) and the return disparity has reached almost early 2000-type levels.

JP Morgan’s ETF team came through Chicago recently and held a lunch where Josh Rogers discussed the growing disparity between large-cap growth and large-cap value. Obviously Josh discussed JPM’s JVAL Value Factor ETF and how it is positioned to benefit when Value returns to favor relative to Growth. A number of the JVAL stocks are owned for clients already, so no JVAL has been bought yet.

JVAL will be compared with the Russell 1000 Value ETF (IWD) just to see what we can see.

Large-cap value investing will return to favor once again. Readers should start looking at how they can fit the style factor into their portfolio’s.

Thanks for reading…