The President didn’t help the Growth/FAANG/Momentum crowd this morning with his tweets targeted at Amazon (NASDAQ:AMZN).

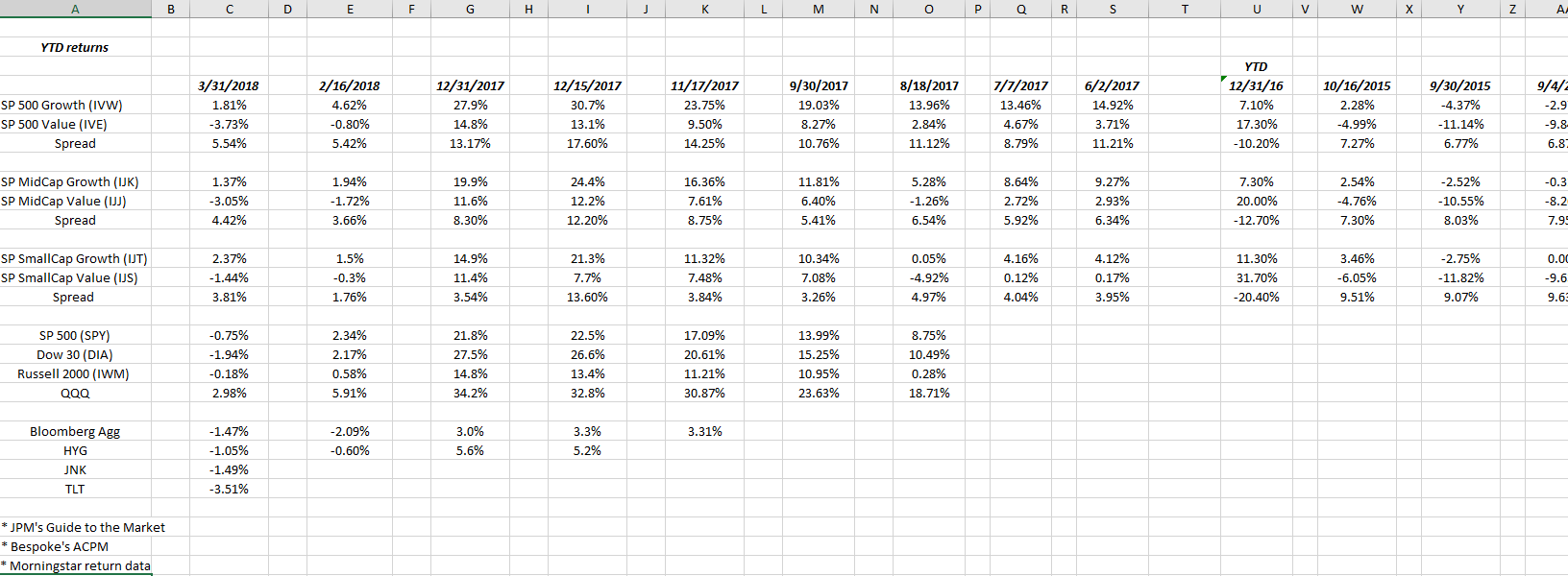

Looking at the above table, as of this weekend, it looks like Growth is maintaining its “alpha” over Value, although large-cap is seeing less of a premium than small-cap.

However, what is somewhat deceptive about that data, is the January ’18 style was very similar to 2017’s out-performance, the worm has started to turn in the last 60 days.

Let’s use two examples, the SP 500 Growth ETF (NYSE:IVW) versus the small-cap value ETF (NYSE:IJS):

Let’s also look at 1-month as well as Q1 ’18 returns:

IVW: SP 500 Growth ETF

- 3-month return: +1.81%

- 1-month return: -2.97%

IJS: SmallCap Value ETF

- 3-month return: -1.44%

- 1-month return: +1.37%

While not perfectly negatively correlated, there does seem to be some negative correlation.

Coming into 2018, some Tech and Q’s were sold and some IJS bought just from a “reversion to the mean” perspective, after tech and large-cap growth were up around 30% in 2017.

As the 2nd quarter starts, look for Tech/Growth/FAANG/Momentum to lose that performance premium and look for both the smaller-caps and Value to start to close the performance gap.

Note for the 12/31/17 column, the performance premium Growth held over Value for the full-year 2017. It was less dramatic in the mid and smallcap, but the premium was there.

The SP 500 is testing its 200-day moving average today. The February 9th, 2018 opening low for the SP 500 was 2.532.69 – that’s your line in the sand.