We continue to have a weird situation between the 2 major indexes as the S&P 500 is clearly in correction mode, but the NASDAQ is doing ok. Generally they move together far more closely, but from a technical perspective we have two completely different reads between them. This was another day of government shutdown and the market is slowly selling off. It has now been just over 2 weeks since the Fed meeting when Bernanke surprised almost everyone with no slowdown of quantitative easing, and it's been almost straight down since for the S&P 500. After a morning selloff on some bad economic data, there was a mid day rally but the shooting in D.C. pressured the market late in the day. The S&P 500 fell 0.90% and the NASDAQ 1.07%. Economic data was weak:

The Institute of Supply Management non-manufacturing survey index fell to 54.4 in September from 58.6 in August. A reading above 50 in the index indicates an expansion in the U.S. service sector. September's reading fell short of the 57.4 consensus expectation in a Reuters poll and even undershot the lowest forecast among the 74 economists surveyed.

Keep in mind with the government shutdown there will be no employment data tomorrow as we normally get.

With the S&P 500 we continue to test this 50 day moving average this week. The NASDAQ on the other hand has only fallen to the 20 day moving average, and has only done that Monday and today had held the 10 day ma.

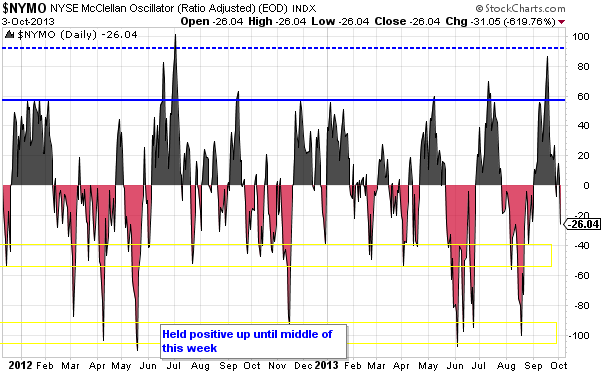

NYSE McClellan has now gone negative this week after staying positive for the first week of the correction; this indicated breadth is weakening.

VIX remains elevated and today made higher highs...not something bulls want to see.

After a breakout earlier this week, the Transports has broken back into its channel.

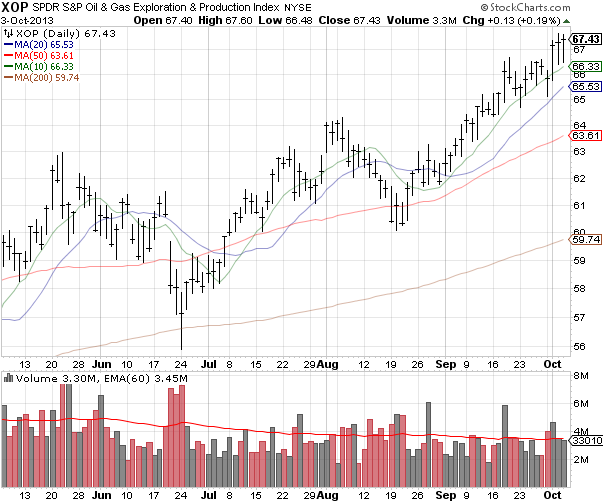

Very few sectors are holding up versus the market as a whole but 2 are the energy exploration stocks and biotech.

Last but not least, Twitter today made its IPO filing and will trade under ticker TWTR. From CNBC:

Twitter made its S-1 filing available to the public Thursday, finally shedding some light on its initial public offering plans.

The company intends to trade under the ticker TWTR and seeks to raise $1 billion, according to the filing. Goldman Sachs is the lead underwriter on the deal.

Twitter has seen rapid growth recently. Last year revenue rose 198 percent, to about $317 million, while its net loss declined 38 percent, to about $79 million, the filing said.

According to the filing, Twitter has more than 215 million monthly active users, 100 million of whom are daily active users.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

STTG Market Recap; S&P In Correction Mode, Market Selling Off

Published 10/03/2013, 03:49 PM

STTG Market Recap; S&P In Correction Mode, Market Selling Off

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.