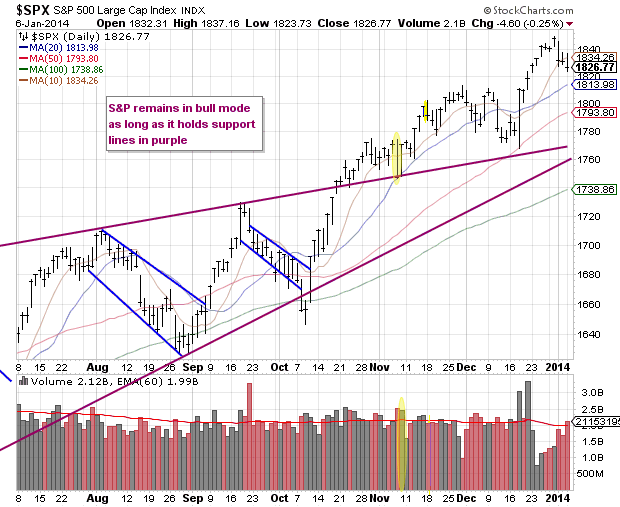

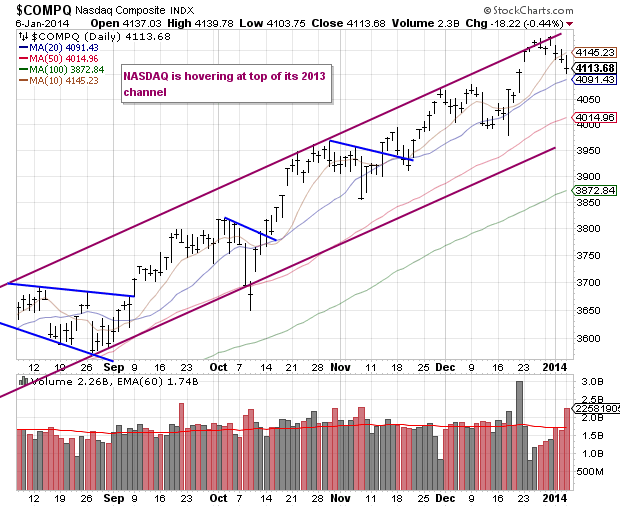

Three consecutive down days in a row to begin the year? What is this sorcery? The past few years we have been used to rocketing out of the gate to kick off a year, but with such a strong rally to end 2013 some profit taking was not unexpected. While there were some episodes of three down days in a row in 2013, four in a row was very rare so it will be interesting to see if the bulls wake up tomorrow. The S&P 500 fell 0.25% and the NASDAQ 0.44%. After the close Janet Yellen was not surprisingly confirmed as the next Federal Reserve head in the Senate.

The Senate has easily approved Janet Yellen's nomination to head the Federal Reserve. Monday's 56-26 vote makes Yellen the first woman to lead the central bank in its centurylong history. Yellen begins her four-year term as chair on Feb. 1. She replaces Ben Bernanke, who has held the job for eight years.

There were 2 economic reports on the day in the U.S. There was also a weaker than expected services data report out of China that pressured world markets a bit.

The Institute for Supply Management's non-manufacturing index came in at 53.0 in December, versus estimates that the index would climb to 54.6 from 53.9 the month before. Any reading over 50 indicates expansion. Further, new orders for U.S. factory goods rebounded in November, increasing 1.8 percent.

Ending 2013 we said that Tuesday that the S&P was very overbought as it was nowhere near even the 10 day moving average - it has now come down in a few days to not only test it but break it a tad; generally in very strong bull moves the 20 day is the one you want to watch for bounces.

The NASDAQ approaches that same 20 day moving average after pulling back from resistance in its year long channel.

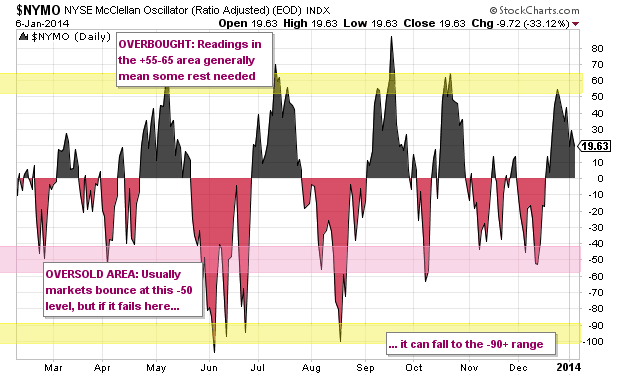

This small bout of selling has helped the market work off extreme overbought conditions; we can see the NYSE McClellan Oscillator back down to a manageable level; sustained readings between +5 to +40 are preferred as it would indicate solid breadth.

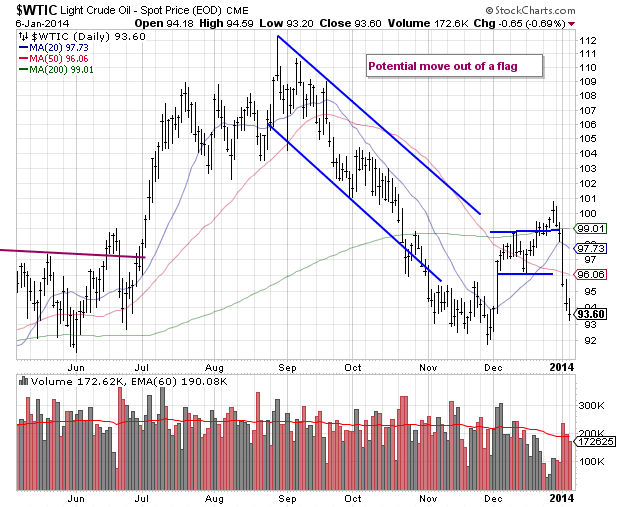

We mentioned the failed breakout in oil last week, this shows why there is no shame in stopping out in a trade. With WTIC, the failed breakout happened when the price fell back below $99ish. Now a few days later this commodity is below $94; a simple stop saves you 5% in a few days.

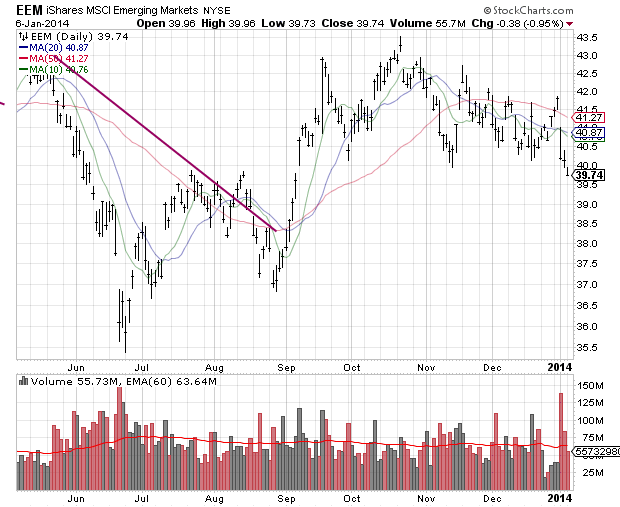

Emerging markets continue to be weak - the currencies of both Thailand and Turkey have been under pressure as the Federal Reserve finally tapered which in theory in positive for the dollar, plus some political unrest in both those nations. When these things happen people tend to lump all emerging markets in a group. Here is the ETF, EEM:

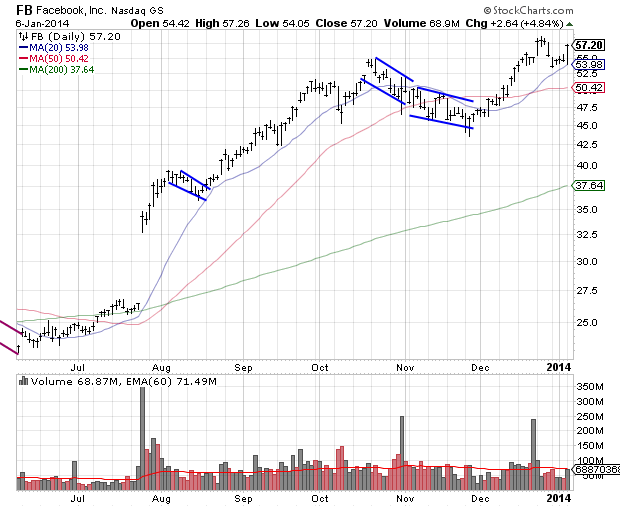

Facebook (FB) had pulled nicely to its 20 day moving average and benefited from a well timed upgrade today. Morgan Stanley said Facebook appears to be “the best way to play social Internet.” It incorporated Instagram revenue into its estimate and raised its 12-month price target on the social network’s stock to $62 from $53.

It's almost that time, earnings season is about to kick off again and with that a lot of individual stock volatility. If you have not read Blain's "5 East Steps to Navigate Earnings Season Better than the Pros", go check it out.

Our friends at Bespoke provide a nice list of the season's most volatile stocks if you are a short term oriented trader who enjoys an adrenaline rush.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

STTG Market Recap: Yellen Confirmed As Fed Chair

Published 01/07/2014, 05:40 AM

Updated 07/09/2023, 06:31 AM

STTG Market Recap: Yellen Confirmed As Fed Chair

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.