Investing.com’s stocks of the week

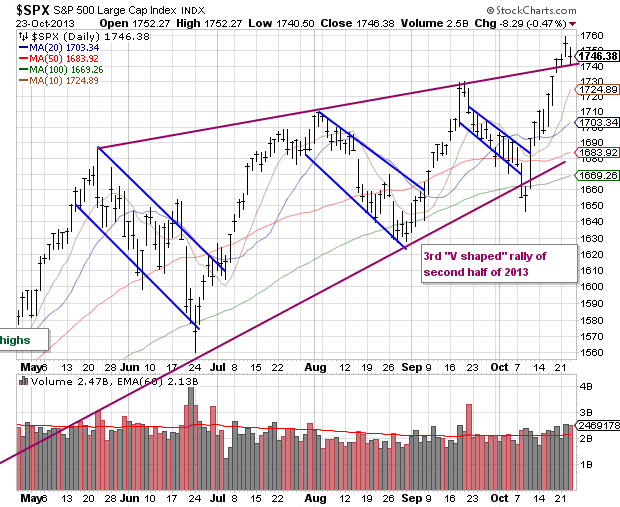

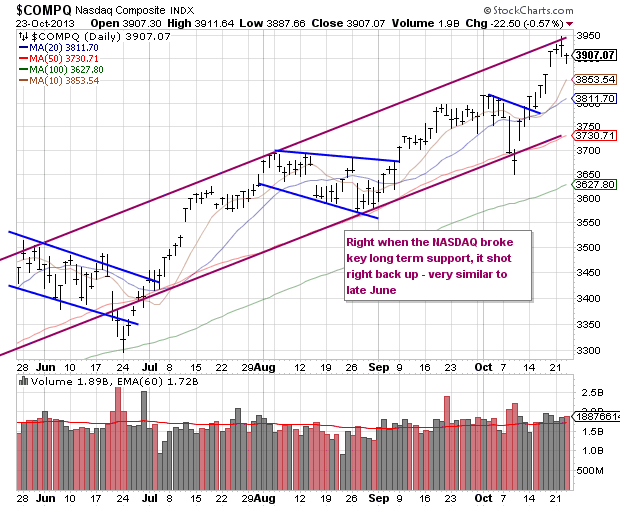

Stocks fell mildly Wednesday. There will be a litany of reasons in other stories you might read, but the reality is this market needs a breather and was extremely overbought after yesterday's session. The S&P 500 fell 0.47% and the NASDAQ 0.57%. Overseas, there was some data showing a lot of bad loans being written off in China which hurt Asian markets but again - when you get to this point of a rally, any excuse will do for there to be some profit taking.

Looking at the index charts, as we showed in a longer term chart yesterday the NASDAQ hit the top end of a channel it had been in all year. So for now, that served as some resistance. The S&P 500 is still above a shorter term channel created by connecting the highs of the past few months.

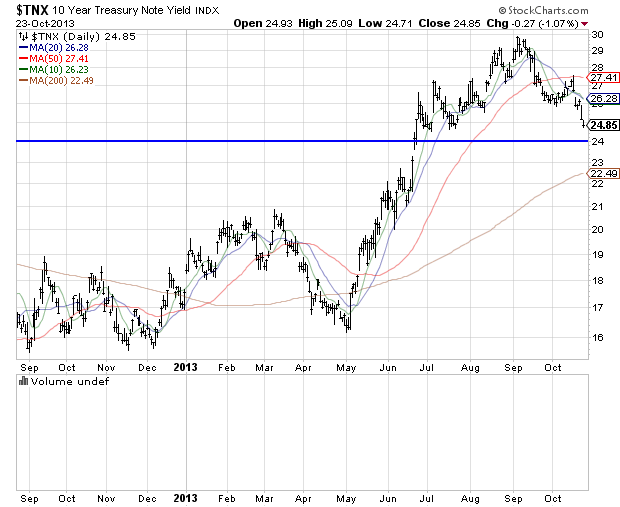

10 year yields also broke down today as the economy is once again seeming to slow and no one believes there will be any Federal Reserve tapering coming anytime soon. This should help yield sensitive sectors such as housing and utilities if it continues.

There were 2 major global companies with very different outcomes from earnings - Boeing (BA) to the positive and Caterpillar (CAT) to the negative. One benefit of technical analysis is it generally (not always) can tell you what people with a lot more information than you know. A stock which has been consistently weak probably is weak for a reason, and vice versa. We have a great example today - Boeing has been a strong stock and the earnings release had a lot of positives; Caterpillar has been range bound most of the year and it had a lot of warts on its earnings report. Caterpillar actually was starting to become a very interesting chart as it broke out of a long consolidation just days before its earnings release but news trumps technicals and bad news broke the chart back down.

Boeing rallied after the jet maker posted quarterly results that easily topped expectations and raised its full-year outlook. The company also lifted its production scheduled for the Dreamliner to 12 units per month from 10 by 2016.

Caterpillar tumbled after the heavy equipment maker missed earnings expectations and slashed its full-year revenue guidance. CEO Doug Olberhelman called this year "difficult," especially in Caterpillar's mining-related business.

Along those lines was Panera Bread (PNRA) which has failed to rally with the market. The stock was below both its 50 AND 200 day moving averages, in a market gone ballistic to the upside. Yesterday after the close they had disappointing data in their earnings report.

Panera Bread Co reported quarterly profit that matched Wall Street's view on Tuesday, but shares fell after sales at established company-owned restaurants grew less than expected because of fewer visits by diners. Sales at company-owned bakery cafes open at least 18 months rose 1.7 percent, compared with analysts' expectations for a 2.7 percent increase, according to Consensus Metrix. Panera also lowered its forecast for fourth-quarter earnings to a range of $1.91 to $1.97 per share, versus $2.05 to $2.11 per share previously.

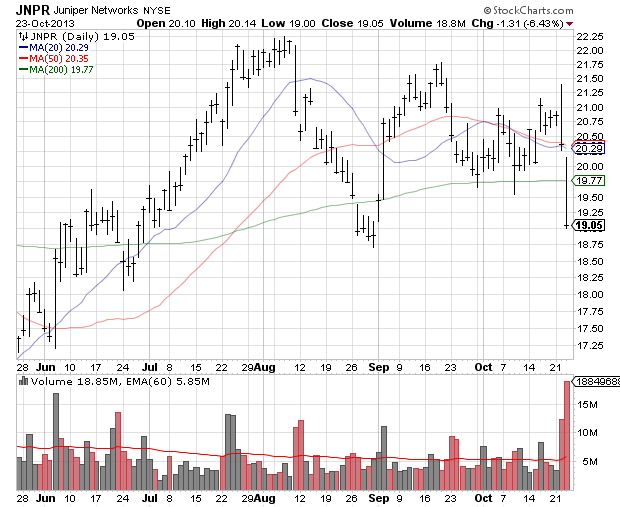

Networking giant Juniper Networks (JNPR) also suffered a similar fate.

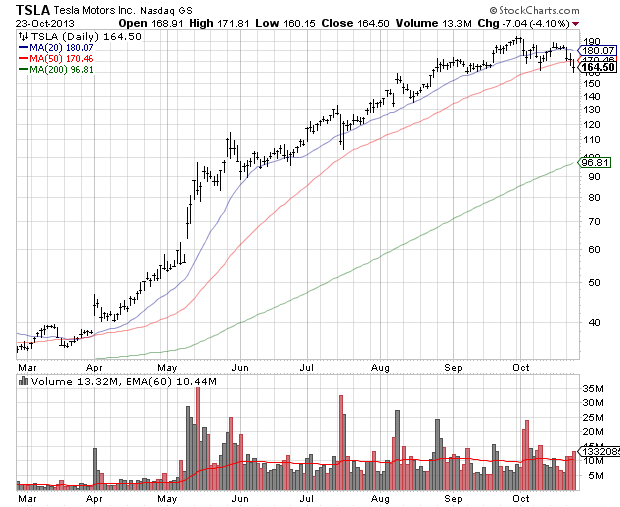

It is also worth noting Tesla (TSLA) which has been the momentum stock of 2013. Today was the first close below the 50 day moving average since March. For intermediate term traders this is usually a place to exit - we shall see if the bulls return to this very controversial name - or if its amazing run is over for now.