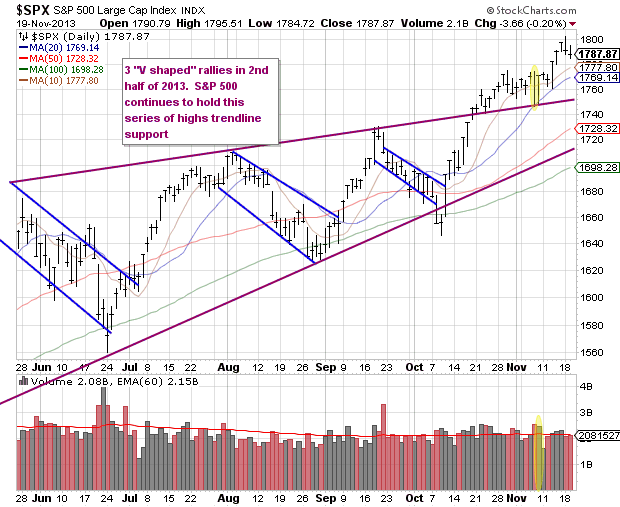

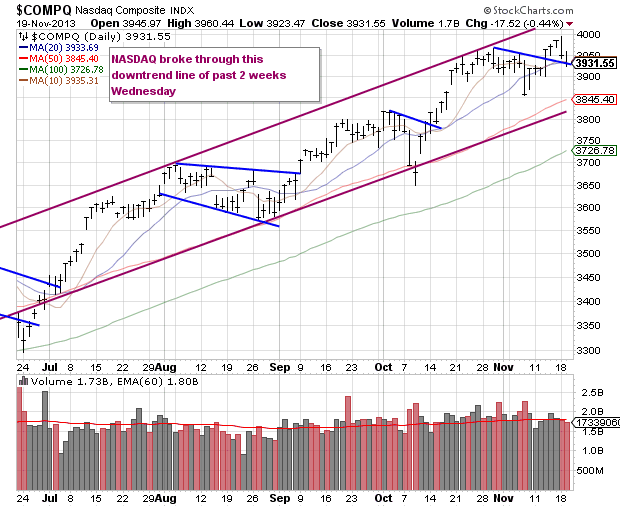

We are getting some mixed signals out of the market right now. While the indexes still are in fine shape, aside from a few days, breadth has not been great of late, and a lot of key momentum stocks have lost some of their mojo after being stars in October. Still on the positive, we are seeing rotations from one group to another. Today the S&P 500 fell 0.20% and the NASDAQ 0.44%. The NASDAQ has shown some relative weakness of late. Chicago Fed President Charles Evans on Tuesday said he was "not in a hurry" to begin tapering.

The S&P 500 continues to hold the trendline formed by connecting a series of highs from the second half of 2013. The NASDAQ pulled back to the trendline from which it broke out from late last week.

Financials have seen some rotation in the past few weeks; Bank of America (BAC) did quite well today despite a market that struggled.

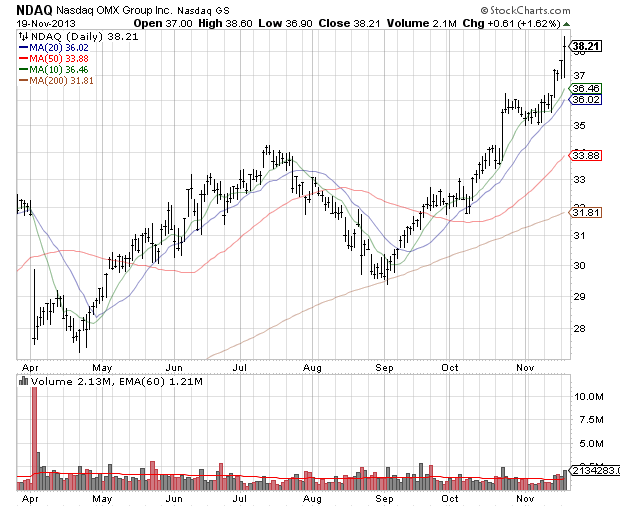

A few of the exchange stocks have also been acting quite well; here is the NASDAQ Group (NDAQ) for example.

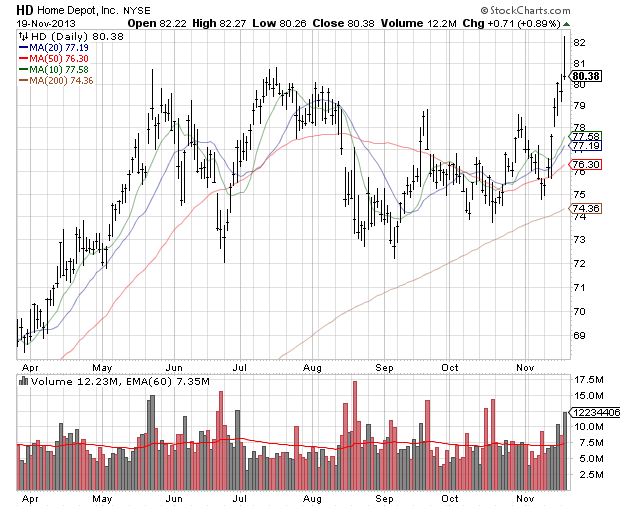

Home Depot (HD) was a big winner in the morning on earnings but reversed relatively sharply in the latter part of the day to reduce those gains.

A recovery in the U.S. housing market helped Home Depot exceed profit and sales estimates for the third quarter, prompting the No. 1 home improvement chain to raise its fiscal-year outlook for the third time this year.

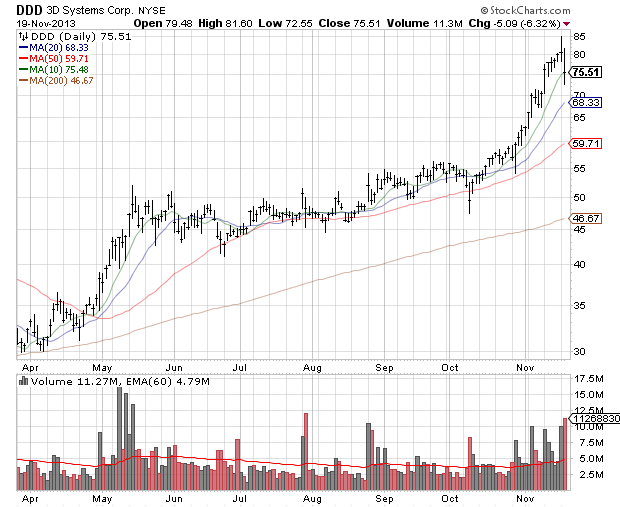

We mentioned 3D Systems (DDD) last week, and said it was a bit overheated; today we had one of those days that shows the danger of chasing overheated stocks.

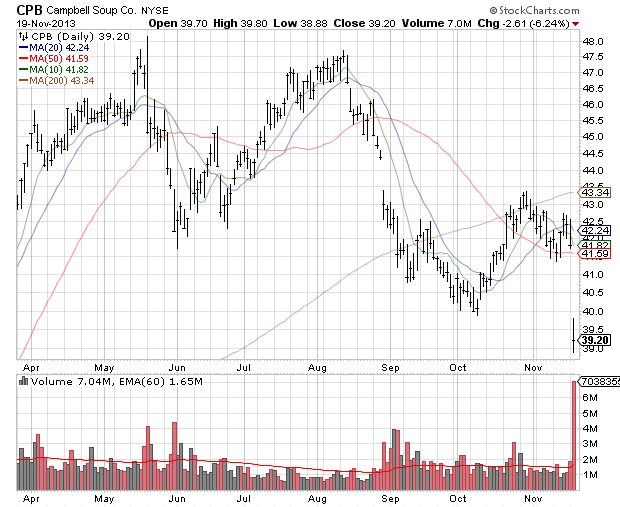

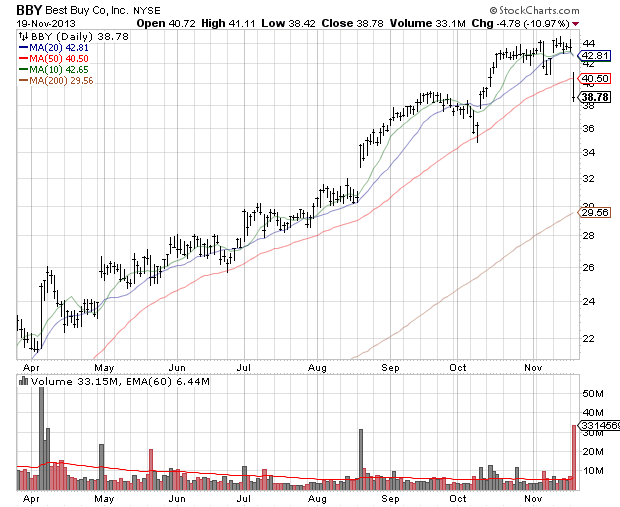

Cautious outlooks from Best Buy (BBY) and Campbell Soup (CPB) hurt both stocks although they were in completely different positions to begin the day. Best Buy had been a big winner in 2013, while Campbell had been severely lagging despite the rotation of late into consumer staples.

Best Buy is cutting prices for the holiday season to thwart fierce competition from Wal-Mart and other discount and online rivals, a move that it warns will hurt margins for the current quarter. Campbell Soup, the world's largest soup maker, also cut its full-year profit forecast after a drop in demand for its soups and drinks resulted in first-quarter earnings that fell far short of analysts' estimates.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

STTG Market Recap: Mixed Signals

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.