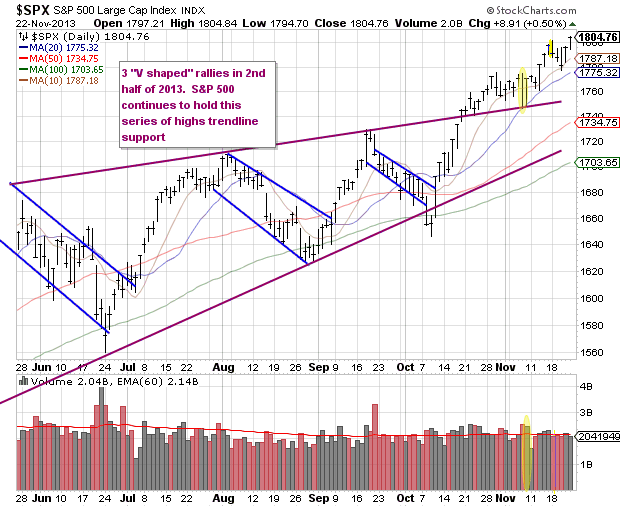

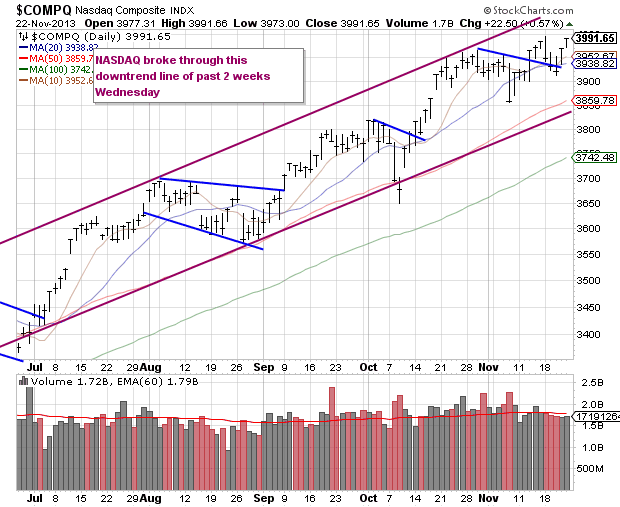

The market continues to be a playground for the bulls. After a 3 day detour downward, we saw the S&P 500 end at highs for the year Friday. This is the seventh consecutive week of gains, which is quite a rare feat (longest run in 3 years); since the politicians kicked the can down the road on the budget / debt, we've essentially been on a 1 way ride. The S&P 500 added 0.50% and the NASDAQ 0.57%.

We have now completely negated the second bearish outside reversal day in as many weeks. So it appears in a QE market this marker is not something to trust.

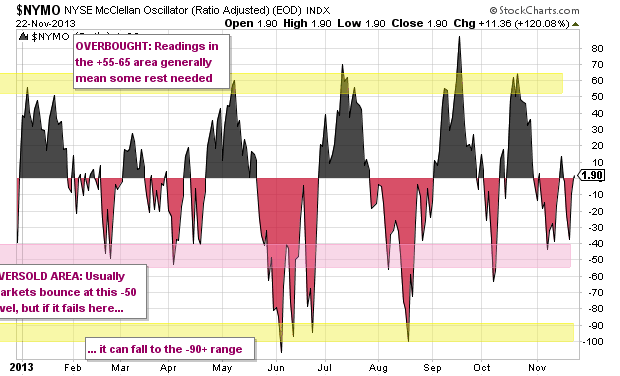

Today's move pushed the NYSE McClellan Oscillator back to positive; at the close Wednesday this was very near the oversold band we have in pink.

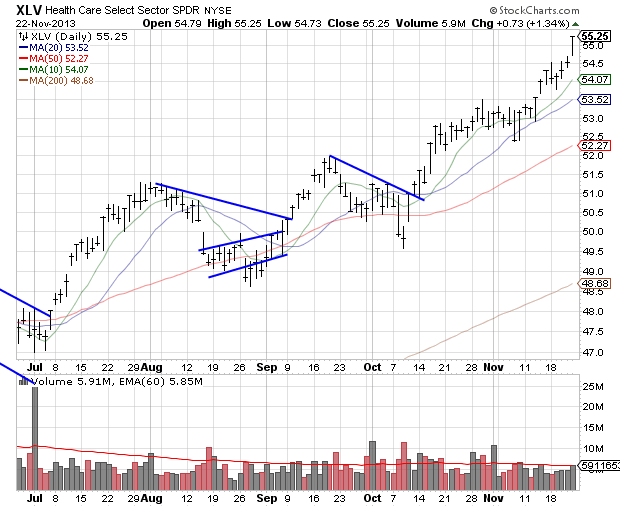

Let us see what sectors also hit new highs; we have healthcare...

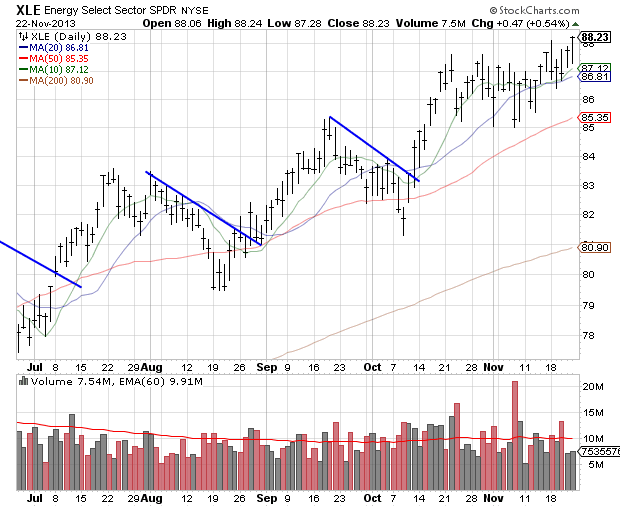

Energy

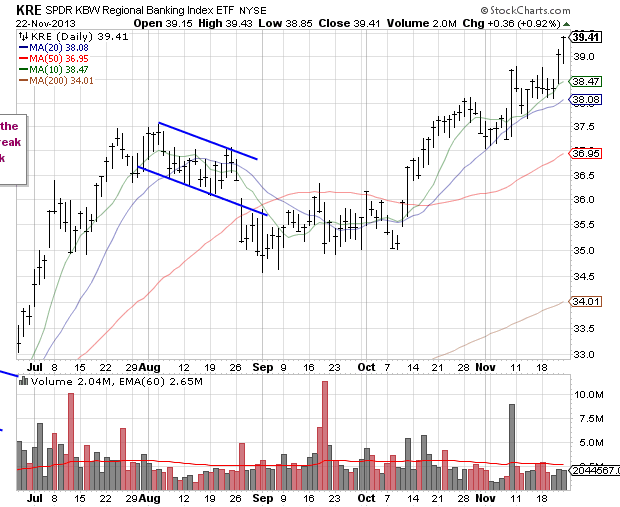

Regional Banks

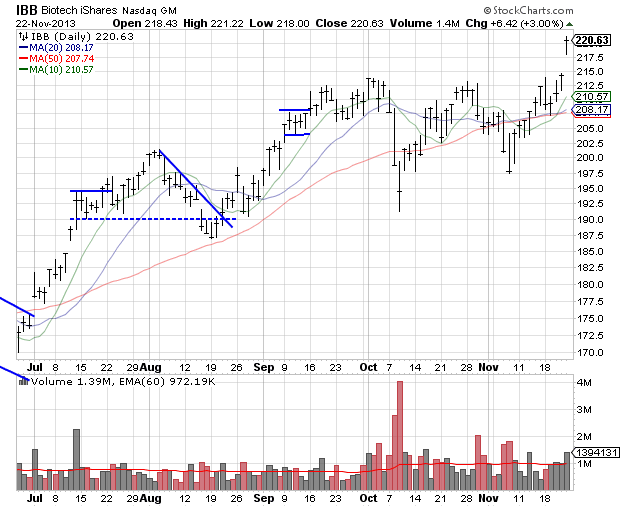

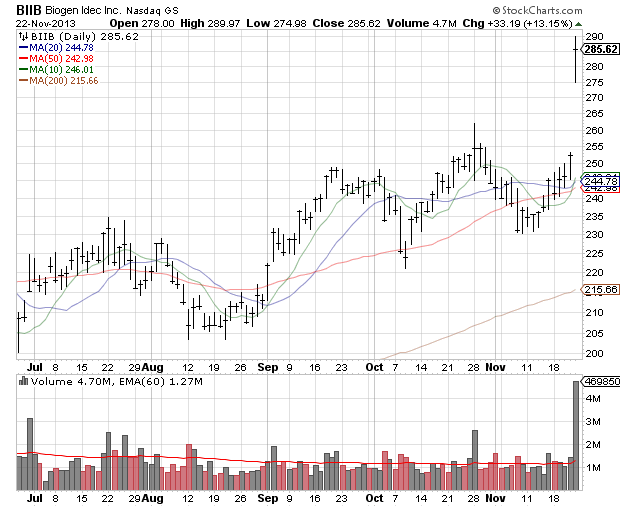

Biotech

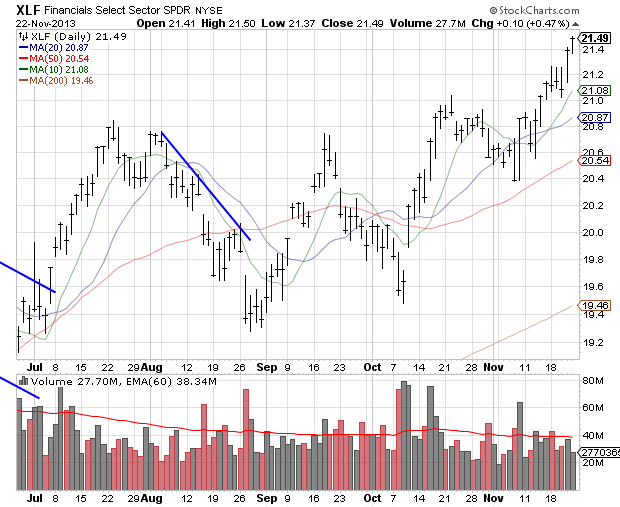

Financials

Biotechs were led by large cap company Biotech (BIIB) which jumped 13% after the company won 10 years of exclusivity protection for its multiple sclerosis drug, Tecfidera, from regulators in Europe. This sector has been the leader of 2013.

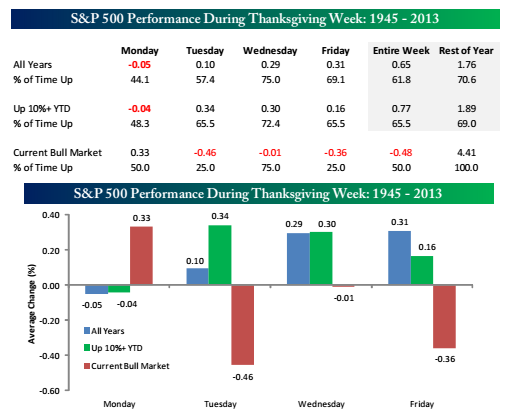

Next week is Thanksgiving and is traditionally is a very bullish week for the market, as volume is very light. Especially the two days that bracket Thanksgiving itself (Wed/Fri), and even more so in years when the market is up 10% year to date. It also marks the beginning of a very bullish period for the market aka "the Santa Claus rally" through the end of the year. Bespoke Investment Premium has details on this.

As shown towards the left side of the table below, the S&P 500 has historically performed well during Thanksgiving week. Since 1945, it has averaged a gain of 0.65% with positive returns 62% of the time. In years where the S&P 500 was already up 10%+ heading into the week, the index has done even better, averaging a gain of 0.77% with positive returns 65.5% of the time. One area where there has been consistency is in the returns from the end of Thanksgiving week through year end. Since 1945, the S&P 500 has averaged a gain of 1.76% with positive returns 71% of the time. In years where the S&P 500 was already up 10%, the average return is a similarly impressive 1.89%.

Have a good weekend, and we'll see you back here next week.

Original post