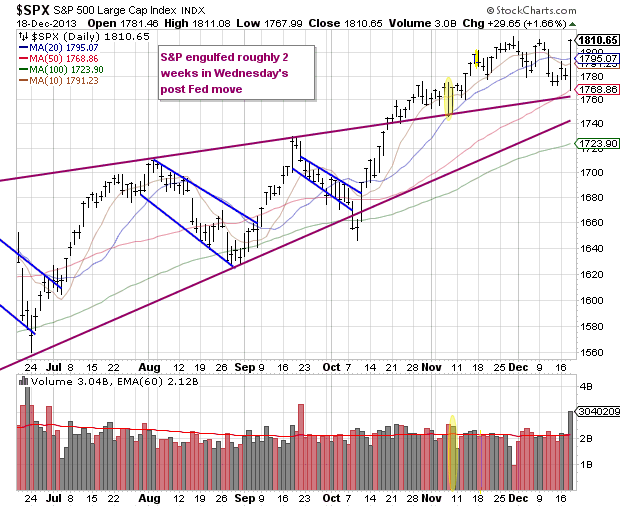

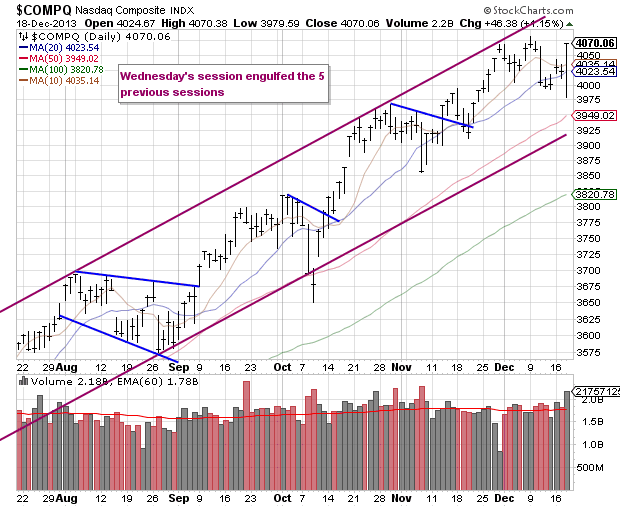

Surprise, surprise. Ben Bernanke had one last trick up his sleeve as he exits state right and that was to do the opposite of what happened in September. Back at that Federal Reserve meeting all the smoke signals had indicated the Fed would reduce its quantitative easing program to a small degree - but they did not. Today, the majority expected no action and instead we got the small reduction. After a knee jerk reaction downward the market made a stupendous move the following 2 hours, posting a rare bullish engulfing pattern on the S&P 500; not just of the previous day but of the previous few weeks. The S&P 500 gained 1.66 and the NASDAQ 1.15%; all of that plus more in the final 2 hours as the indexes were negative pre Fed. That said today's action by the Fed was perceived by many to be dovish because while they reduced QE by $10B per month they put in more dovish language in terms of interest rates:

The central bank said it would reduce its monthly asset purchases by $10 billion to $75 billion, while it also indicated that its key interest rate would stay at rock bottom even longer than previously promised. It said it "likely will be appropriate" to keep overnight rates near zero "well past the time" that the U.S. jobless rate falls below 6.5 percent. Regardless of the Fed's decision, "the overriding theme is that rates are going to stay low for several more years," said Dan Greenhaus, chief global strategist at BTIG LLC,.

Both indexes staged an engulfing pattern where the previous day's low was breached along with the previous day's highs, but it was even more extreme than that as the NASDAQ engulfed a week and S&P 500 two weeks....all in 2 hours.

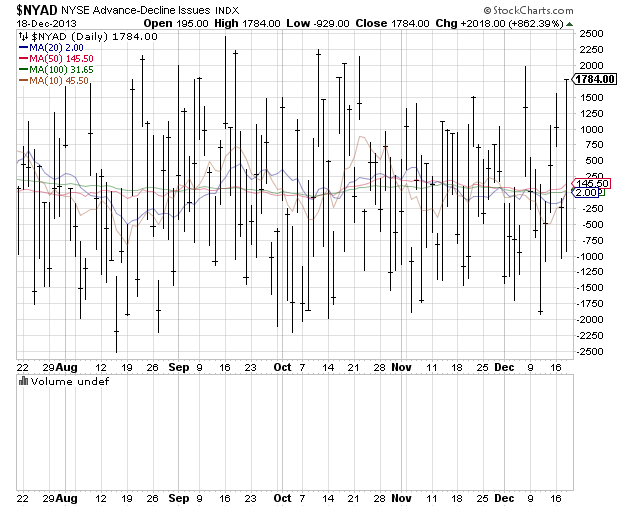

Breadth had been lacking the past month but as you can see today's session was the best in that regard since mid October.

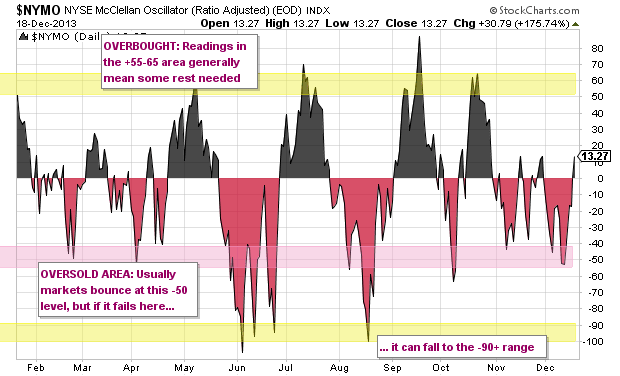

Finally the NYSE McClellan Oscillator is back in the green; hopefully for bulls it stays that way for a while.

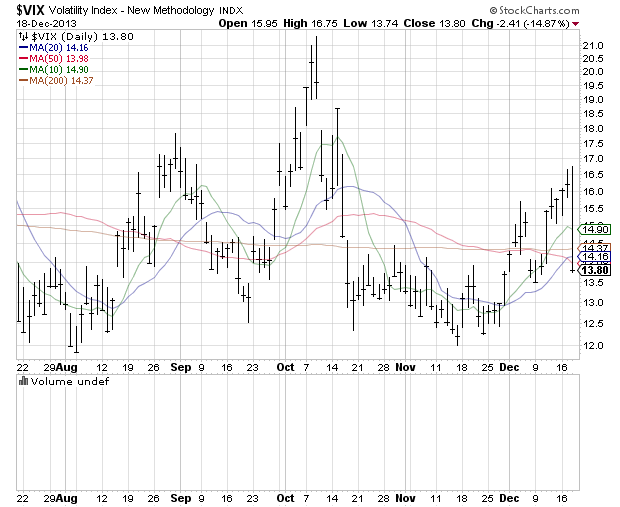

As for volatility we saw the exact opposite situation; after hitting a 2 month high we have a bearish engulfing candle today.

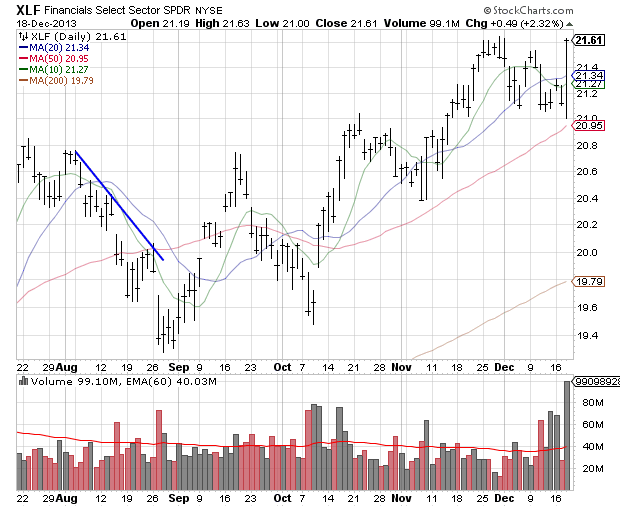

Financials were a key tell they reversed hard mid afternoon to the upside - keeping this as a leadership group would be a positive. This was another massive bullish engulfing session which engulfed 2 prior weeks.

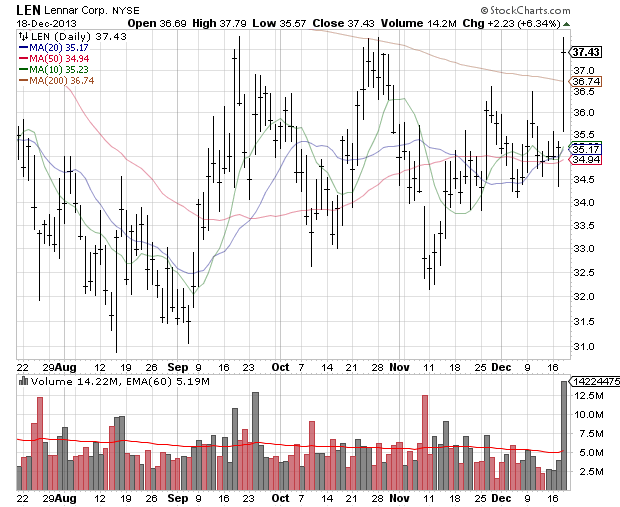

Housing was also another strong sector as shares of Lennar Corp jumped after the No. 3 U.S. homebuilder reported a 32 percent jump in fourth-quarter profit. Data on Wednesday showed that U.S. housing starts surged to the highest in nearly six years in November, a sign of strength in the housing market.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

STTG Market Recap: Bernanke's Last Trick

Published 12/19/2013, 04:55 AM

Updated 07/09/2023, 06:31 AM

STTG Market Recap: Bernanke's Last Trick

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.