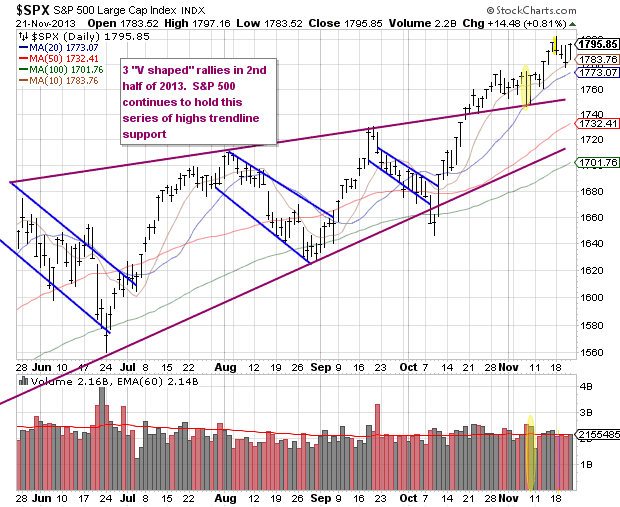

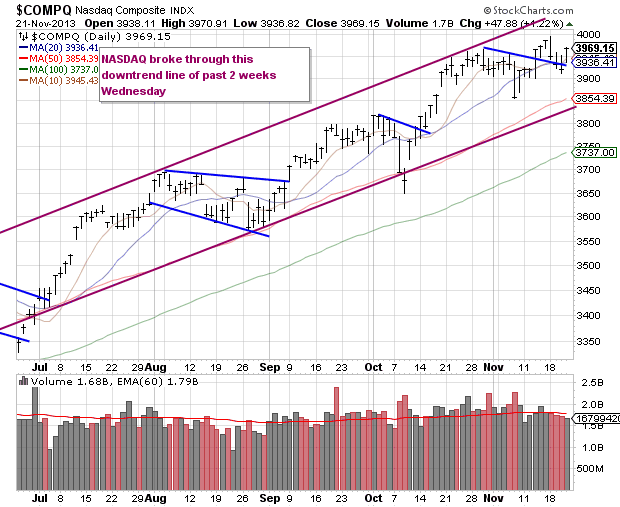

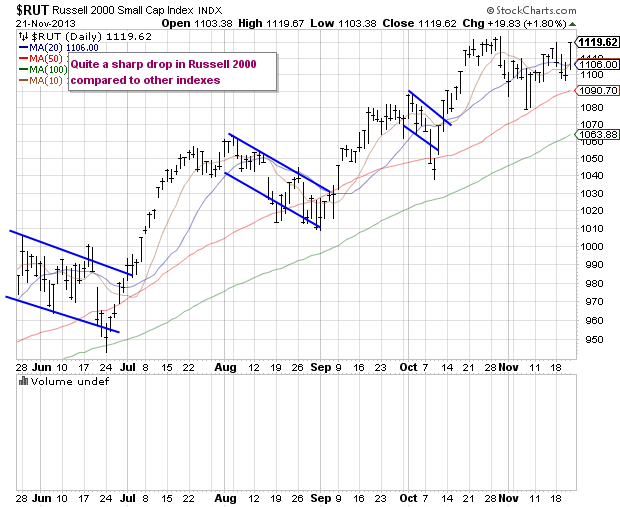

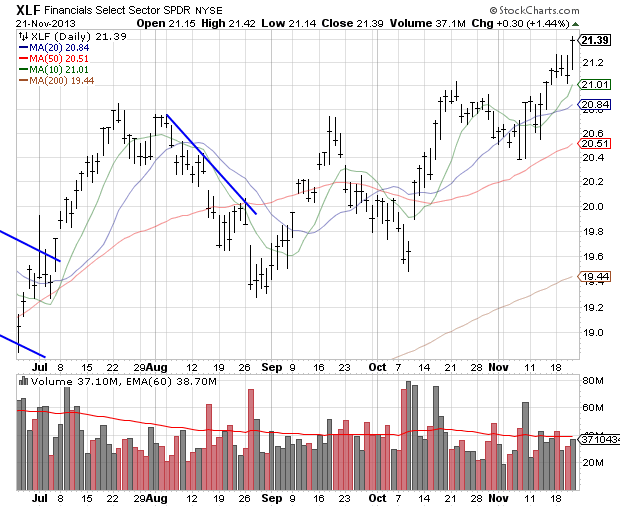

Markets bounced convincingly after the first 3-day losing streak in quite a while. The S&P 500 added 0.81% and the NASDAQ 1.22%. We saw very good level of strength in the small caps today as the Russell 2000 jumped 1.80%. Financials led the way today which was a good sign for overall strength. Ironically economic news was bad this morning but we know what that means by now - bad news = more Federal Reserve.

The Philadelphia Federal Reserve Bank said its business activity index dropped to 6.5 in the latest month, from 19.8 in October. This month's figure was well below economist expectations for a reading of 15.0.

In the indexes we again had a bearish outside day Monday but it appears in the QE markets, this marker is going to become increasingly useless, especially if today's move leads to new highs shortly. That will be 2 outside days in a week that would be rendered useless. For now all the S&P 500 did is pull back to its 10 day moving average and bounced. The NASDAQ had a bit of a sharper pullback.

We'll add the Russell 2000 index today...

Here is the ETF for the financial sector (XLF) - a very nice move...

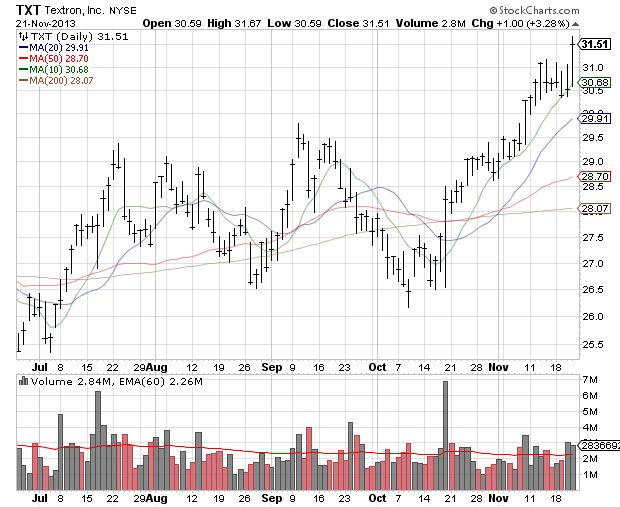

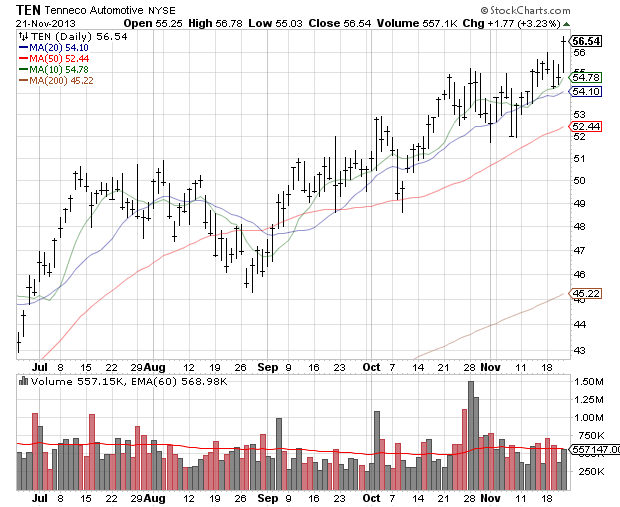

The industrials also did well today - here are charts for Textron (TXT) and auto supplier Tenneco (TEN).

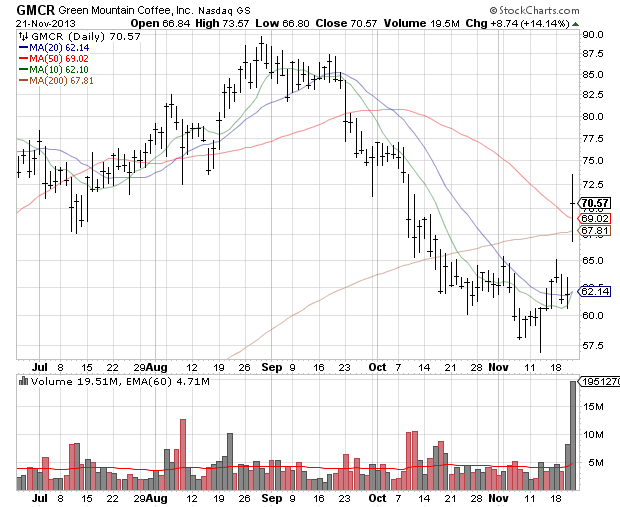

Green Mountain Roasters (GMCR), a former momentum stock and highly shorted issue, popped 14% today as the single-serve coffee brewing company late Wednesday reported adjusted per share earnings of 89 cents in the fourth quarter, beating estimates of 75 cents. Obviously an awful chart, but you can see the risk of betting one way or the other into earnings...

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Thursday's U.S. Markets In Review

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.