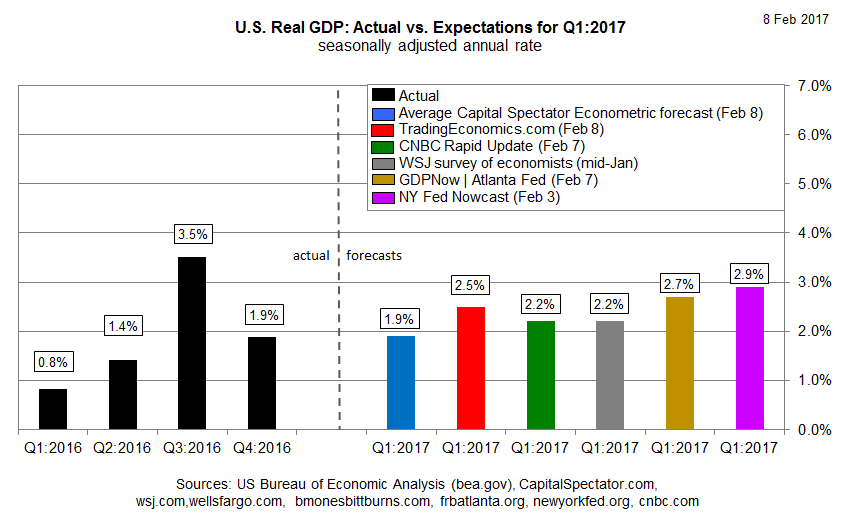

First-quarter GDP growth for the US is expected to pick up after a sluggish Q4, according to forecasts from several sources. It’s still early in the quarter, but the preliminary estimates for the kickoff to 2017 anticipate a firmer trend.

The New York Fed’s model offers one of the more optimistic predictions, forecasting a 2.9% rise in GDP in the first three months of this year (as of February 3). That’s a solid improvement over the 1.9% increase in last year’s Q4, although it’s below the recent peak of 3.5% for 2016’s third quarter. (Growth rates quoted as seasonally adjusted annual rates.)

Meanwhile, the mood in the business community has perked up lately. A survey of businesses published yesterday via the YPO Global Pulse report shows that US economic confidence in last year’s fourth quarter posted its biggest quarterly gain in five years. The increase represents the highest ranking for the regions surveyed on a global basis.

But potential trouble spots could be lurking due to policy changes brewing in Washington. “We must protect our borders from the ravages of other countries making our products, stealing our companies and destroying our jobs,” President Trump said in his inaugural address. “Protection will lead to great prosperity and strength.”

A new report from Goldman Sachs begs to differ. The bank advises that the economic price tag will be costly if a trade war unfolds between the US and China as the result of “America First” policies implemented by the Trump administration. The investment bank estimates that US growth could be pinched by up to a quarter percentage point if trade relations sour between the two largest economies on the planet.

For the moment, however, the near-term view for the US macro trend is expected to improve. The Markit Flash US Composite PMI Output Index ticked higher in January, “thereby signaling a robust and accelerated expansion of US private sector output,” according to IHS Markit’s January 26 report. The implied GDP growth rate for January is currently 2.5%.

The question is whether political risk threatens the modest acceleration in growth that appears to be unfolding in the new year vs. 2016’s fourth quarter? Opinions generally fall into two opposing camps. On one side are the optimists, who assert that Trump’s plans to cut taxes and regulations and roll out infrastructure spending programs will lead to higher economic output. The alternative view is that the White House seems intent on unleashing a trade war with China, Mexico and other countries.

“I’m incredibly concerned that the Trump people mean what they say,”

Chad Bown, a trade expert at the Peterson Institute for International Economics, told The New York Times last week.

“One would hope that they are using this as a negotiating tactic. But even if you are, that’s an extraordinarily dangerous game to play, because, right now, the communication to the world is not flowing clearly.”