Global markets have retreated from the highs reached yesterday, which can largely be attributed to the desire of some players to lock in some gains after the big moves earlier this week. The main culprit for the market movements was the weakening of the US currency, which caused a rush in demand for several assets.

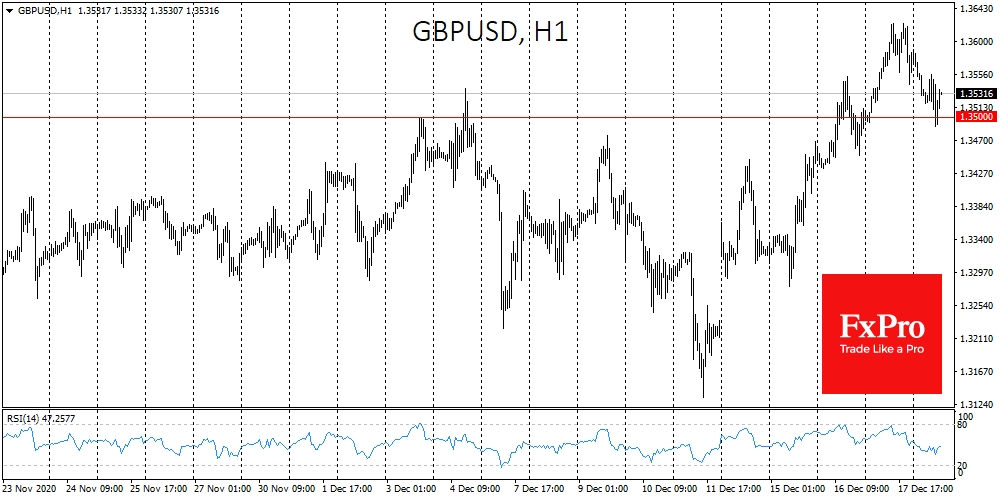

Quickly brushing off the problems surrounding Brexit, GBP/USD jumped 2.5% in less than three days up to Thursday. With a sharp outbreak, the pair overcame resistance in the 1.3500 area, at one point rising above 1.3620. On Friday, the former resistance is now being tested as support. Keeping the pair above 1.3500 by the end of the week will increase the bulls' confidence for the remaining days of the year.

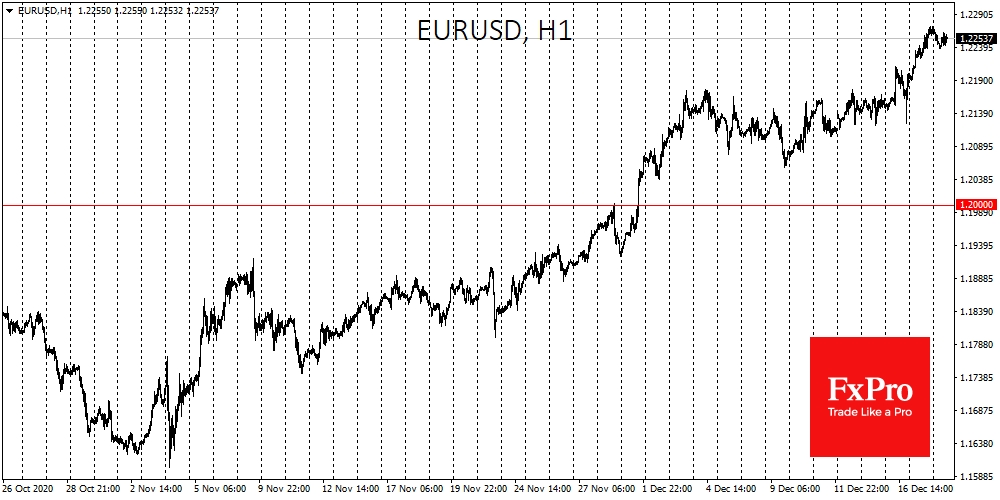

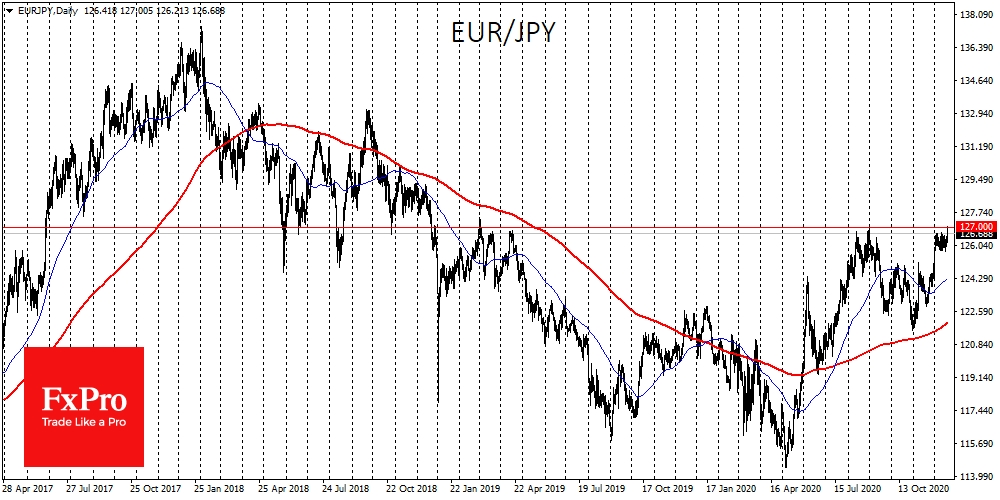

An even better technical picture works in favour of the euro. Right now, the EUR/USD is trading at 1.2260, quickly shaking off the sentiment of a correction earlier in the day. Despite the rise in the pound, the euro managed to stay above the 50- and 200-day averages, reflecting the prevailing bullish sentiment. EUR/JPY rose above 127, finding itself in the area of the highs of the last two years.

The gains of EUR against USD and JPY could be an important signal that the markets remain optimistic and that the current drawdown on several markets and instruments may be just a short-term shake-up of portfolios, but with a bullish view still in sight.

However, traders should also consider another option. Macroeconomic reports of the last few days have shown time and again that Europe is doing relatively well despite the second wave of the pandemic. The German Ifo released just a few minutes ago beat expectations by showing an increase of the Business Climate Index in December to 92.1, contrary to an expected drop from 90.9 to 90.2.

Rising producer prices beyond expectations and a higher current account surplus are further signs of a eurozone that may today boost interest in the single currency as well as underlining a robust demand for the region's goods abroad.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Stronger Euro Is A Sign Of A Healthier World Economy

Published 12/18/2020, 08:05 AM

Updated 03/21/2024, 07:45 AM

Stronger Euro Is A Sign Of A Healthier World Economy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.