America continues to release strong macro data, with a fresh batch of GDP and New Home Sales figures coming above expectations, supporting dollar-buying interest late in the day.

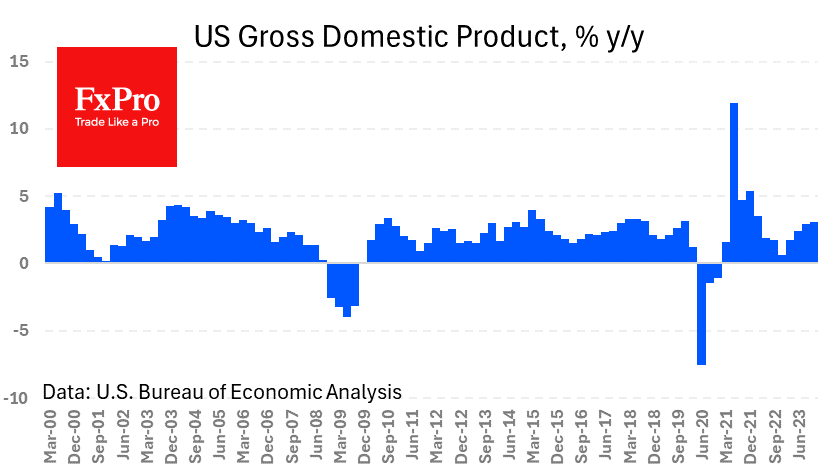

The US economy grew at an annualized rate of 3.3% in the 4th quarter of 2023.

Analysts, on average, had forecast a slowdown to 2.0% from 4.9% earlier. The economy added 3.1% to the same quarter last year. That's a healthy growth, one that the economy has seen in the second half of 2019 and before that during periods of robust expansion. With this kind of performance, the voices of those predicting an imminent recession are getting quieter.

At the same time, this rate of growth is not pushing up inflation, as has been the case in previous episodes. The GDP price index rose at a rate of 1.5%, much weaker than the 2.3% and 3.3% previously expected.

These data suggest that the economy is managing to combine the tightest monetary conditions in decades, healthy economic growth, and a downward trend in inflation.

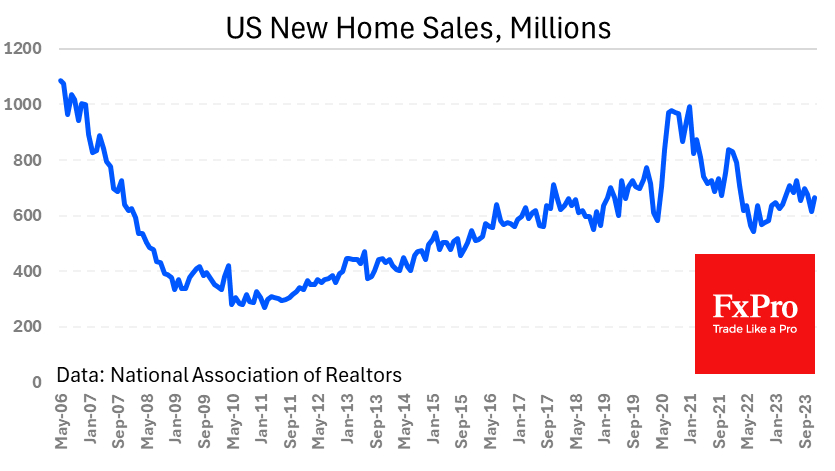

As if that weren't enough, the New Home Sales showed an 8% m/m increase, largely reversing the previous month's 9% drop. The current pace of new home sales (664K annualized rate) is within the normal range for the three years since the start of 2017. Thus, the housing market does not appear to be a victim of decades high mortgage rates.

Ultimately, the data did not affect expectations for a rate change in March, with the probability of a cut still close to 50%. The market will have to wait for more clarity from the Fed, which may not come until 31 January in the form of Powell's post-FOMC comments and press conference.

Such statistics could also have a positive impact on the equity market, pointing to strong domestic demand. However, the indices, which are close to historic highs, have come under investor scrutiny amid the corporate reporting season.

The FxPro Analyst Team