Advanced Micro Devices, Inc. (NASDAQ:AMD) justreleased its second-quarter 2017 financial results, posting a GAAP loss of $0.02 per share and revenues of $1.22 billion. Currently, AMD is a Zacks Rank #3 (Hold) and is up 8.08% to $15.25 per share in after-hours trading shortly after its earnings report was released.

AMD:

Beat earnings estimates. Adjusting for stock option expenses, the company posted a loss of one cent per share, beating the Zacks Consensus Estimate of a loss of one cent per share. On a GAAP basis, AMD reported a loss of two cents per share, and on a non-GAAP basis, the chipmaker posted a profit of two cents per share.

Beat revenue estimates. The company saw revenue figures of $1.22 billion, topping our consensus estimate of $1.15 billion.

The chipmaker’s quarterly revenue jumped 19% year-over-year and 24% sequentially, spurred by higher revenue figures from its computing and graphics sector. AMD reported operating income of $25 million, but a net loss of $16 million.

AMD’s computing and graphics segment revenue jumped 51% year-over-year to $659 million, which was helped demand for its Ryzen desktop processors.

AMD projects revenues to increase roughly 23% sequentially (plus or minus 3%) for the third-quarter. The company expects full-year revenue to jump “by a mid to high-teens %,” which is up from the company’s last guidance projections of low double-digit revenue growth.

“Our second quarter results demonstrate strong growth driven by leadership products and focused execution," AMD president and CEO Dr. Lisa Su said in a statement.

"Our Ryzen desktop processors, Vega GPUs, and EPYC datacenter products have received tremendous industry recognition. We are very pleased with our improved financial performance, including double digit revenue growth and year-over-year gross margin expansion on the strength of our new products.”

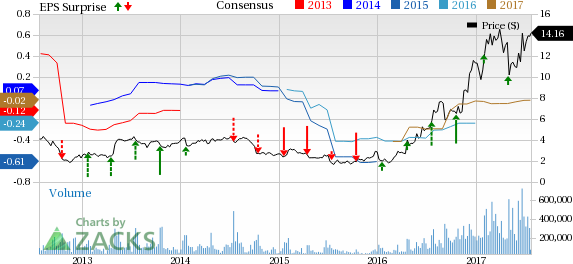

Here’s a graph that looks at AMD’s Price, Consensus and EPS Surprise history:

Check back later for our full analysis on AMD’s earnings report!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Original post

Zacks Investment Research