JPMorgan (NYSE:JPM) Global Growth & Income (JPGI) is a 50-90 stock portfolio of global equities, chosen by manager Jeroen Huysinga from the output of a rigorous, valuation-based investment process developed by J.P. Morgan Asset Management (JPMAM). After a long period where investors were focused on defensive growth stocks, a recovery in the appetite for cyclical companies since mid-2016 has favoured JPGI’s approach.

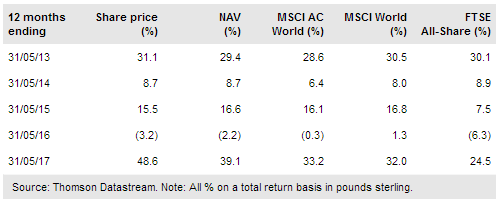

The resulting resurgence in performance has seen the trust’s NAV total return outperform both its MSCI AC World benchmark and all of its peers in the AIC Global Equity Income sector over one, three and five years and since 1 October 2008 (when it adopted its current strategy). Recent share price performance has been even stronger, arguably boosted by greater investor appetite for the trust since announcing a 4% annual distribution policy in July 2016.

Investment strategy: Valuation-focused global process

JPGI is managed using JPMAM’s global focus investment process, and is the only UK retail investment product to offer access to this strategy. The process is based on JPMAM’s dividend discount model, which assesses global stock valuations and allows them to be ranked into quintiles by sector. By focusing only on the cheapest two quintiles, and applying tests for significant profit potential and the presence and timing of catalysts for a market reappraisal, the manager is able to build a portfolio of growth companies at attractive valuations.

To read the entire report please click on the pdf file below: