After an early swoon, gold miners (Market Vectors Gold Miners (ARCA:GDX)) closed at session highs as they continue to form a formidable looking bullish flag pattern:

One might have thought that a blowout jobs report would have dealt a severe blow to gold and gold mining stocks. However, after an early sell-off both recovered impressively with gold ending at the ‘magical’ $1321 level yet again:

The daily chart of gold illustrates that gold continues to form a healthy consolidation pattern after the big move higher two weeks ago:

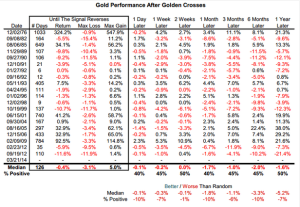

There was even a so-called ‘golden cross’ Wednesday as the 50-day simple moving average crossed above the 200-day moving average. However, gold bulls shouldn’t get too excited about this technical development – golden crosses have not proven to be bullish for gold historically:

From my vantage point, much more significant than the placement of two moving averages has been the continued resilience in gold's price despite a string of upbeat economic data. The underlying bid in gold in the face of historically bearish macro factors (improving economic data, ultra-low volatility equity market uptrend, stable & low levels of inflation in developed markets, etc.) speaks to a robust resilience that could quite likely give way to the next wave higher in the long term secular gold bull market.

Meanwhile, for the foreseeable future, market participants will focus on the large head & shoulders bottom which has formed during the past year:

Resistance near $1400 will be the nut to crack with a breakout above this neckline area targeting a measured move to $1600+.