Forex News and Events

RBNZ likely to stay sidelined

The New Zealand dollar was on fire during the Asian session as the employment report surprised massively to the upside. In the 4th quarter, the unemployment rate eased to 5.3%, beating market expectations of 6.1%, as fewer people looked for work leading to a decline in the size of the labour force. The participation rate fell to 68.4% from an upwardly revised figure of 68.7% in the previous quarter.

From our standpoint, even though this good news should be welcomed by the RBNZ, the effects of a tighter job market will take time to translate into wage growth. It therefore raises the question of further support from the Reserve Bank as inflation fell to 0.1% y/y in the 4th quarter.

According to Governor Wheeler, the current weak level of headline inflation is mostly due to negative inflation in the tradables sector as well as the sharp decline in oil prices, adding that core inflation is well within the target band and that the central bank’s main objective is to anchor inflation expectations. In light of this morning speech, we believe that the RBNZ will likely wait a little bit longer before cutting rate again, most likely later this summer.

On the currency side the New Zealand dollar got another boost from the strong performance of crude oil this morning. NZD/USD continues its bull run and is now trading at around 0.6590, testing the resistance implied by the 0.66 psychological level.

U.S: Hoping for a strong jobs report

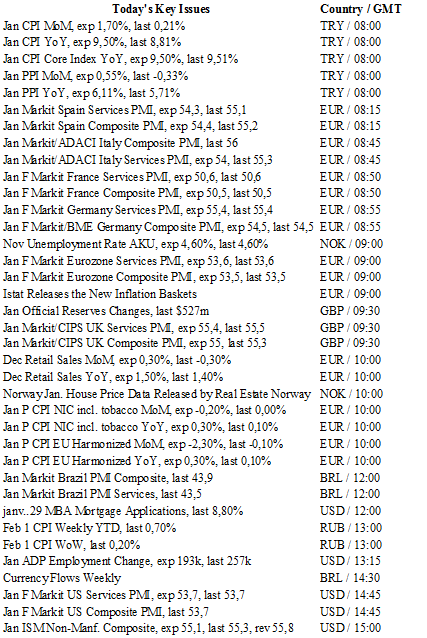

A week after the FOMC decision where no surprise has been made as rates have been kept unchanged, markets are now focusing again on economic fundamentals, in particular to jobs data. ADP private payrolls will then be well scrutinized today. Consensus are betting on 193k jobs added in January but down from the 257k creation in December. Indeed, it is likely that we will not see the exaggerated figure of December where the holiday hiring was important and exceptional.

Fed's baseline forecast calls for 4 rate hikes this year and markets are pricing in that a continued strong trend of jobs creation this year should normally be sufficient to trigger those 4 raises. Yet, there are more than a hundred million Americans without a job, so it leaves us some year before this reserved army may relieve labour shortages.

Consequently we believe that there are too many workers on the sidelines which adds downside pressures on wages. Despite official lower unemployment data and important jobs creation, wages growth remains somewhat sluggish. We are highly sceptical on the inflation to pick up towards Fed's target of 2%.

Fed's dual mandate is far from being achieved despite massive intervention over the past decade. Weak data are the new normal for the U.S economy. First estimate of the Q4 GDP has been released later last week at 0.7% y/y, the weakest one since winter 2015.

Chinese economic slowdown and collapsing oil prices should lead to less investment and more jobs cut. Fed is definitely over optimistic. Why would the institution succeed where it has failed over the last 10 years?

Crude Oil: Back to bearish

The Risk Today

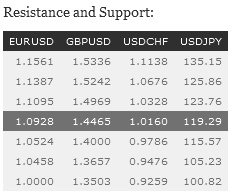

EUR/USD EUR/USD bullish momentum has stalled ahead of key trend-line resistance. Hourly resistance may be found at 1.1070 (28/10/2015 low) while hourly support can be found at 1.0524(03/12/2015). The medium-term technical structure is clearly negative. Yet, expected to show further very short-term increase. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD GBP/USD has failed to build on patterns of higher highs indicating potential short-term reversal. Hourly resistance at 1.4413 (26/01/2016 high) has been broken. Stronger resistance can be found at 1.4969 (27/12/2015 high). Hourly support can be found at 1.4081 (21/01/2015 low). Expected to show further decrease inside the channel before bouncing back. The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY USD/JPY has further weakened, suggesting some exhaustion in buying interest. Hourly support lies can be found at 119.45 (03/02/2016 low). Hourly resistance lies at 121.60 (29/01/2016 high). Expected to show further increase toward resistance a 123.76. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF USD/CHF is trying to bounce near the base support at 1.0171 (02/02/2016). Another hourly support is located at 0.9876 (14/12/2015 low) and hourly resistance can be found at 1.0328 (27/11/2015 high). Expected to show continued strength. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.