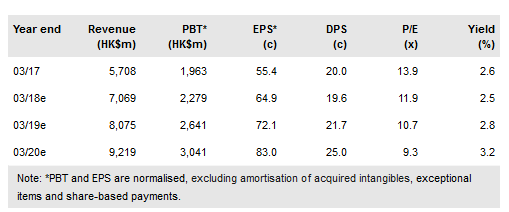

The H118 results and publication of the full interim report confirmed China Water Affairs Group's (HK:0855) strong growth trajectory. In our view the outlook for the company remains positive. We have increased our EPS and DPS forecasts for CWA and raised our fair value from HK$6.7/share to HK$8.0/share.

Continuing growth evident at the H118 results

Interim figures from CWA demonstrated a continuation of the strong growth trajectory that has been evident in recent years. Group revenue rose by 16.3% to HK$3,514m, while operating profits (excluding FV movements in derivatives and investment properties) rose by 40.7% to HK$1,344m. EPS (basic) increased by 22.9% to HK28.43 cents. Driving overall growth was the rise (+10.4%) in revenue and segmental profits (+22.8%) at the key water supply and construction business (c 94% of group revenues). The water business continues to benefit from the widespread adoption of the public-private partnership (PPP) model and the integration of urban and rural water systems. A turnaround in the performance of the associate business and tight control of costs, which fell by 6.2% to HK$287m despite the top line growth, also helped boost profitability.

To read the entire report Please click on the pdf File Below: