Another robust GDP report will leave the US firmly on track to hit 3% growth for 2018, but will it be enough to help the Republicans retain control of Congress?

This week’s data highlight is Friday’s US third-quarter GDP growth, and President Donald Trump will be hoping that another strong figure can give the Republican party a last-minute boost ahead of the 6 November mid-term elections. The Republicans continue to lag behind the Democrats in generic polling while President Trump’s personal approval rating still languishes at around 44%, although this is up from 38% six weeks ago. As such it is no surprise that analysts continue to expect the Democrats to win control of the House of Representatives, but probably fall just short of winning the Senate too – see our note here for a full preview.

Still, there are a lot of undecided voters, and a strong GDP figure could sway people at the margin as President Trump continues to play up his and his party’s economic credentials. Moreover, Republican strategists will also be hoping that complacency amongst Democrat supporters could yet help spring a surprise in two weeks.

In terms of expectations for the GDP report, the consensus amongst economists is that we will see a slowdown from the 4.2% annualised rate seen in 2Q18 to 3.3% for Q3. However, the range of forecasts is rather broad with a low of 2.4% and a high of 4.2%. The Atlanta Federal Reserve Bank’s GDP Now model suggests growth should be even better at 3.9% annualised. We are relatively upbeat, forecasting growth of 3.6%.

Consumer spending will be the main driver, supported by massive tax cuts, a strong jobs market and rising wage growth. Investment spending should also be firm given the healthy economy while core durable goods orders suggest we could see an acceleration in growth in this key component. We also expect to see inventories rebound, having been run down at the fastest rate in nine years in 2Q. The counterweight to this will be that net exports will be a major drag on growth after having made a surprisingly large contribution in 2Q.

In terms of expectations for the GDP report, we are relatively upbeat, forecasting growth of 3.6%

Overall though this is set to be a very solid GDP report and will leave the US well on course to record 3% growth for the year as a whole, which would be the strongest outcome since 2005. We see no real reason to expect a collapse in growth anytime soon with 4Q GDP supported additionally by the rebuild/clean-up operations following the recent Hurricanes Florence and Michael.

As we move into 2019, we are likely to see some moderation in growth. The support from the fiscal stimulus will gradually fade while the lagged effects of rising interest rates and a stronger dollar will feel more of a headwind.

We see no real reason to expect a collapse in growth anytime soon with 4Q GDP supported by the rebuild/clean-up operations following the recent Hurricanes Florence and Michael

Escalating trade protectionism could also become more disruptive for the economy as weaker global growth and supply chain tensions lead to softer business sentiment and higher prices through tariff hikes. Nonetheless, the tight jobs market and the prospect of stronger rates of pay growth will provide a solid base, and we still think the economy can expand at a very respectable 2.4% rate for the full year 2019.

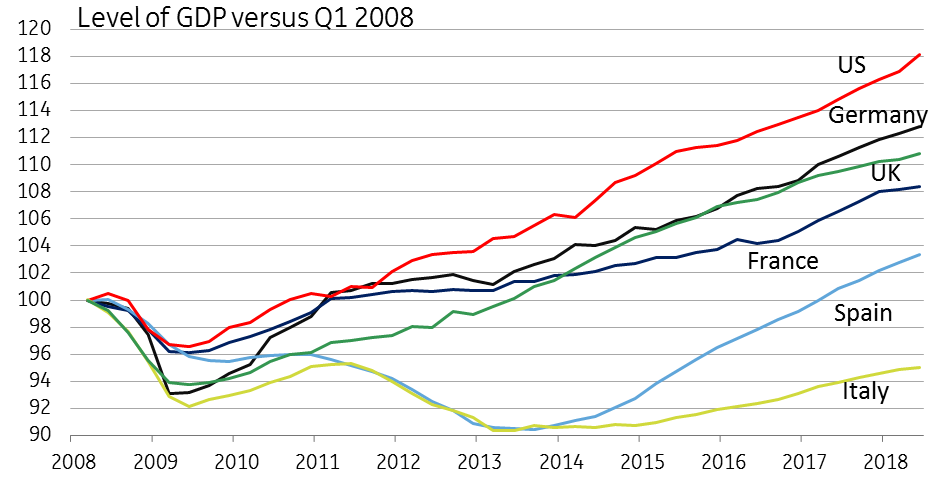

This remains a decent story, and when compared with other economies, the US is the best performing developed market economy. As the chart below shows, the US-Europe divergence in terms of both growth and the level of economic activity remains as wide as ever. We will soon see if this is recognised by the electorate.

Outlook for monetary policy

While President Trump may apparently have some regrets over hiring Jerome Powell as the Federal Reserve chair (stating that Fed interest rate hikes are the “biggest risk” to the economy in his view), criticism of the central bank will fall on deaf ears.

Inflation is already at or above the Fed’s 2% target on all of the key inflation measures, so while the Fed is right to say monetary policy is no longer “accommodative”, we are still some way from it being considered “restrictive”. As such we forecast the Fed will continue raising interest rates, starting with another hike in December with three more 25bp moves in 2019.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”