The Chinese data once again helped to boost buying on the financial markets, noting that the economy is roaring ahead after the coronavirus crisis. The optimism around economic recovery has also led to a sharp increase in interest in the Chinese yuan.

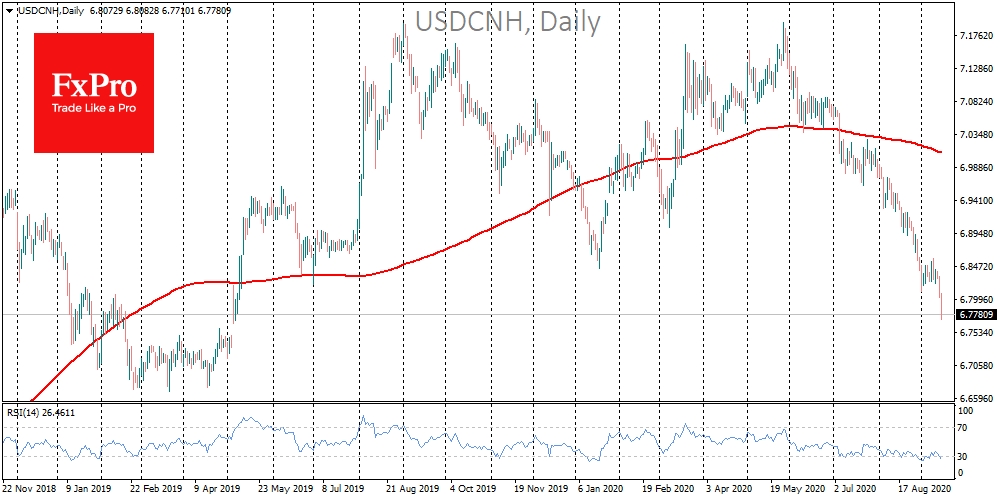

The decline of USD/CNH to 6.80 overnight, triggered a wave of stop orders that led to further deterioration of the pair. At the time of writing, the dollar stands at 6.78 yuans. Thus, the USD/CNH lost 14% from the peak levels in June, a huge move for this pair.

From the technical analysis perspective, the double top formation near 7.19 area was confirmed, which shows the potential for a decline to 6.50. However, the next important stop could be 6.70, where the pair spent two and a half months in early 2019.

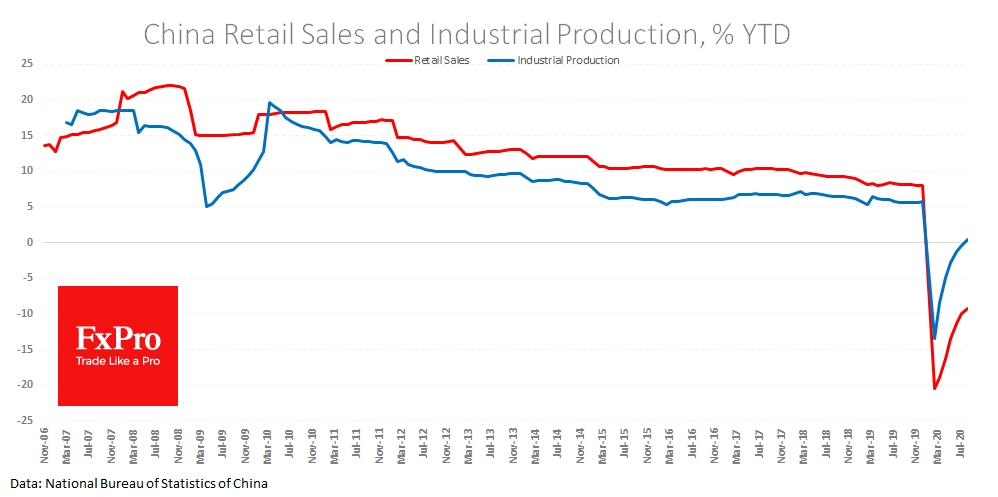

The data released in the morning showed industrial production recovering to 5.6% YoY, the fastest pace since December, reaching a symbolic plus (+0.4%) year-to-date compared to the same period last year.

Retail sales in China lagged behind the recovery, losing 9.2% in the first eight months compared to the same period a year earlier. However, here too, the figures were noticeably above expectations, adding 0.5% YoY vs the 0.0% forecasted.

China is the second world economy. Its development through stimulus programs in 2009 significantly accelerated the recovery of global demand and supported stock and commodity markets. A similar scenario seems to be happening this time. China is recovering rapidly, giving back confidence and increasing global demand, which is spreading positive vibes across all markets.

What remains now is to ensure that Europe and the US do not falter. ZEW’s estimates of business sentiment in Germany are being released later today. By the start of the US session, the US Industrial Production Indexes are set to publish. All of this will make it possible to compare the recovery of the largest economic regions by maintaining or questioning the overall positive trend.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Strong Chinese Data Lifts Yuan And Financial Markets

Published 09/15/2020, 04:59 AM

Updated 03/21/2024, 07:45 AM

Strong Chinese Data Lifts Yuan And Financial Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.