The past two years have been an ideal period to test the risk-management techniques of tactical portfolio strategies, courtesy of high volatility and sudden shifts in global market trends. But as many investors have discovered, translating what looks promising on paper into real-world results is as challenging as ever.

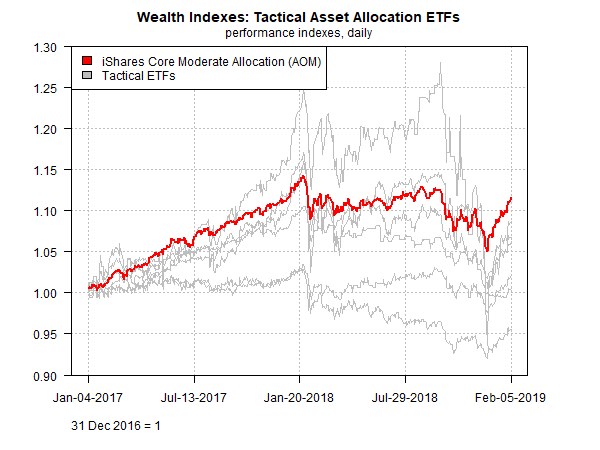

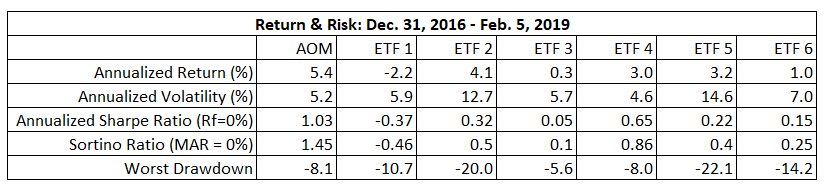

As an example, let’s review recent history for six ETFs that attempt to navigate global markets with a variety of tactical asset allocation strategies. As we’ll see, the results are mediocre at best. Measured against the benchmark of iShares Core Moderate Allocation (AOM) — a relatively plain-vanilla, low-cost multi-asset class ETF — the six tactical funds reviewed were unable to add value over the past two years-plus. (The six tactical ETFs remain anonymous for this analysis; interested readers can contact The Capital Spectator for funds’ identities.)

To be sure, there were some high points, albeit fleeting. In particular, one of the tactical ETFs managed to soar over the rest of the field in two separate occasions. But the strong outperformance arrived when markets generally were rising sharply. By contrast, when the corrections hit, this high-flying tactical portfolio fell sharply, particularly in the latest bout of selling in late-2018.

As the chart below indicates, the main takeaway is that a standard asset allocation strategy via AOM (red line) outperformed the six tactical strategies over the past two-years plus.

Does the analysis change after factoring in risk? Not really. AOM has a clear edge in terms of Sharp and Sortino ratios for the sample period. Note, too, that AOM’s deepest drawdown was near the softest of the bunch.

To be fair, the six portfolios represent a small minority of the funds available in the broad universe of tactical strategies. But the advantage of testing ETFs (representatives of a new breed of applying risk management techniques via publicly traded portfolios) is that the results (or lack thereof) are verifiable via public data. By contrast, most of the tactical realm is run privately, with varying degrees of transparency to the outside world. No doubt there are successes, perhaps many, but it’s hard to know if you’re an outsider.

In any case, the recent track records for the six tactical ETFs suggest that generating alpha over and above conventional asset allocation beta on consistent basis has been tough lately.

Surprising? Not really. Adding value over a relevant benchmark has always been difficult and that’s never going to change. After all, there’s a finite amount of alpha available. As Professor Bill Sharpe persuasively outlined in “The Arithmetic of Active Management,”

Properly measured, the average actively managed dollar must underperform the average passively managed dollar, net of costs.

True for picking stocks, true for managing asset allocation.

That doesn’t mean you should be completely passive and forgo any hope of boosting return, reducing risk or a bit of both. But the slow grind of uncertainty in markets, combined with taxes and trading costs, implies that remaining above average for any length of time is difficult. Fortunately, there’s room for improvement, if only on the margins. As AQR Capital Management’s Cliff Asness advises, there’s a case to “‘sin a little’ (perhaps very little) with tactical strategies linked to value and momentum.”

We find that, consistent with the gigantic amount of evidence across a diverse set of markets and asset classes, value and momentum have something to add in timing, too. But, consistent with the intuition of many, we still find that market timing of one or two asset classes is very hard.

Presumably, the management teams overseeing the six tactical funds analyzed above are somewhat more inclined to agree these days.