The Consumer Staples, tracked by the Select Sector ETF, $XLP, have been a benefactor of the appetite for stocks since late December. The sector has seen a nearly 18% move higher. And unlike the broader indexes it has held steady over the past 3 weeks. To some that is probably not a revelation, as the staples are a place to hide in times of trouble. But they has already moved to new all-time highs and are holding their.

The fact that the staples have not retrenched seems to point to strength more broadly with the broader indexes just resetting momentum as they react to headlines. A drop in the staples, even to just below the 50 day SMA might change that thinking. But that does not appear to be in the cards as of now.

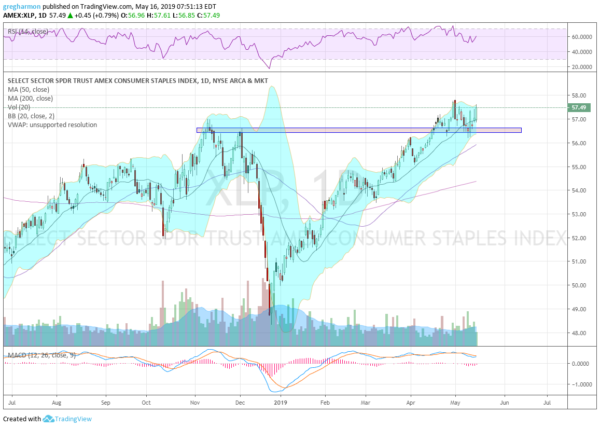

The chart above shows that the staples forged to all-time highs in mid-April. They retested the November highs and then made a higher high. And the ‘pullback’ in May held on a second retest. As I write it is moving higher in the pre-market and trading pennies away from the intraday all-time high from May 1st.

Momentum has reset and remained bullish. The RSI is turning back up after making a lower low, giving a Positive RSI Reversal signal and a target to 59. The MACD eased lower and is now about to cross up. With the Bollinger Bands® tight and price pressing on the upper limit, the move could be beginning right now.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.