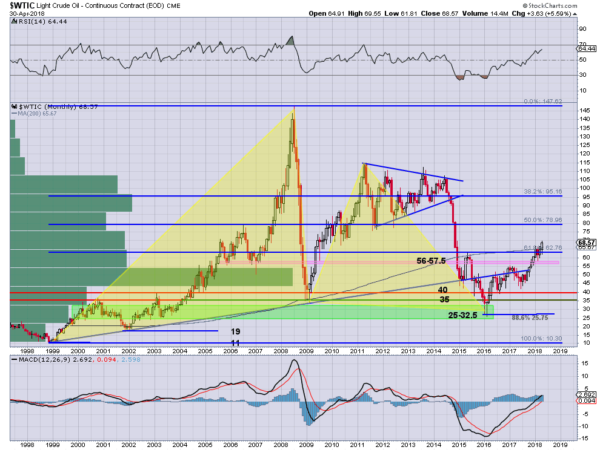

Crude Oil is shifting into beast mode. After a fast plunge from over $100 in 2014 it found some support when it hit the rising 16 year trend line in early 2015. It bounced but the bounce was short lived and only 4 months later it was back at that trend line. It stayed in a tight range for a few months then broke down at the end of 2015. All told a drop of over 75%. You would think this is a good thing, and it was for consumers, but not for oil related stocks.

That bottom at the end of 2015 was significant for many reasons. It completed a bullish Bat harmonic with the drive down to a Tweezers Bottom in January and February. This gives a reversal target of 38.2% of the pattern and then 61.8% as a second target. You can see the first target slowed Oil’s ascent but it is now moving higher again with the second target at 95. This has also pushed the price above the 200 month SMA again for the first time since the 2014 drop.

There is also an Inverse Head and Shoulders pattern (not drawn) with the right shoulder completing and the price moving through the neckline in October 2017. This gives a price objective of at least 87. Momentum supports a continued move higher. The RSI is rising in the bullish zone with the MACD moving up and positive. The volume profile shows lighter resistance all the way to the prior top as well. This gusher may just be getting started.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.