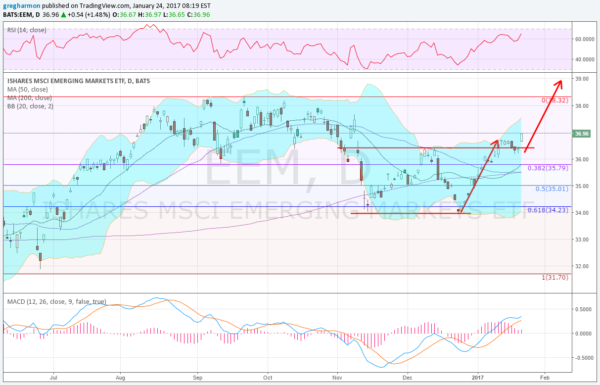

Two weeks ago iShares MSCI Emerging Markets (NYSE:EEM) confirmed a break out of a double bottom. You can read about that here. Since then not much has happened though. All the hype two weeks ago was followed by a sideways motion, until Monday. That is when Emerging Markets started to show some strength. Take a look.

The chart below has 4 indications of strengthening. The first is the price action. That sideways motion, or consolidation, was just a bull flag. The move out of the bull flag Monday gives a target up to 39 on the next leg. The second is that move Monday itself. A bullish Marubozu candle, opening at the low and closing at the high of the day, it is a show of strong intraday price action.

The next is the RSI. This momentum indicator has been trending higher. It pulled back with the bull flag in price and held at 60 before reversing higher. It is firmly in the bullish zone. Finally the MACD is trending higher and positive. it also has turned up slightly after a sideways action where it looked as if it might give a negative cross. All of these combine to show building strength in Emerging markets.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.